The Next Platform

"It’s a risky game. But the payoff can be large.”

For the kind of companies that I own, quarterly reports are typically fairly uneventful. Growth may come in a few hundred basis points higher or lower than anticipated, but the business drivers and the long-term strategic vision are rarely subject to meaningful change. But every once in a while, as happened when Meta (née Facebook) reported their Q3 FY21 results on October 28th, our prior beliefs about a company are subject to a drastic change in circumstances – and when that happens, it demands an unbiased reassessment of the investment thesis.

As noted in the Q3 press release, Facebook will introduce a new segment reporting structure in Q4, with the business split into two components: Family of Apps (FoA), which includes Facebook, Instagram, Messenger, and WhatsApp (the core business); and Facebook Reality Labs (FRL), which includes AR / VR consumer hardware, software and content (most notably Oculus, which Meta acquired in 2014 for ~$2 billion). We won’t receive clarity on the segment financials until we get closer to the Q4 print, but I think it makes sense to split today’s discussion to reflect this new structure (we can guesstimate based on disclosures reported in Q3 FY21).

FoA: Users

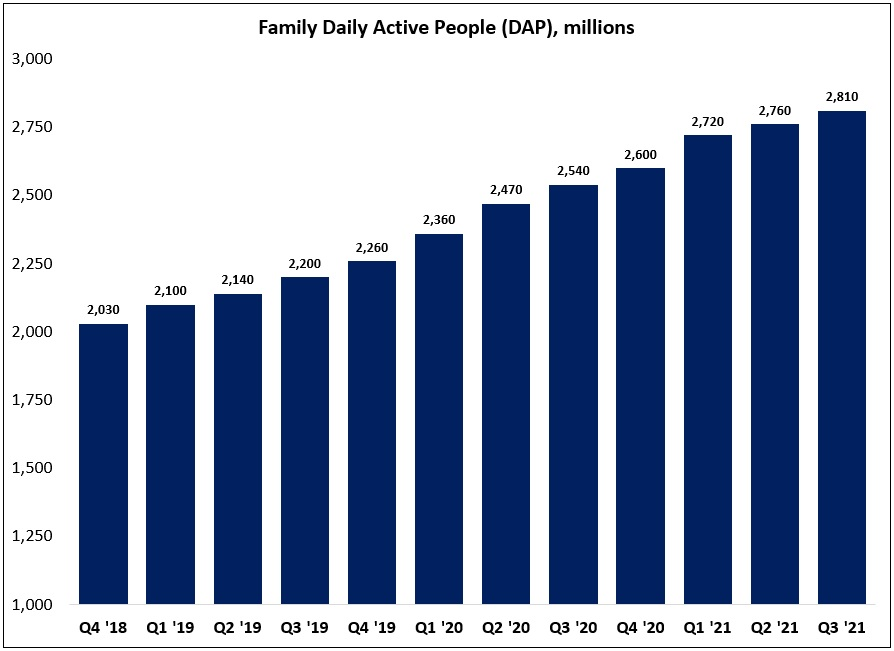

Let’s start with what hasn’t changed: for the 8th consecutive quarter – an unbroken record since FB first disclosed the Family Daily Active People (DAP) metric - the (deduplicated) number of users across Facebook (blue app), Messenger, Instagram, and WhatsApp increased at a double digit rate (+11%). Over the past 12 months, these services added 270 million (net) DAP’s – a number that exceeds the population of every country in the world except for China, India, the U.S., and Indonesia. Simply put, Facebook’s services have collectively achieved unparalleled scale among its social media peers (ex China). The number of DAP’s added in the past year (270 million) is nearly 30% larger than Twitter’s total user base (211 million mDAU’s).

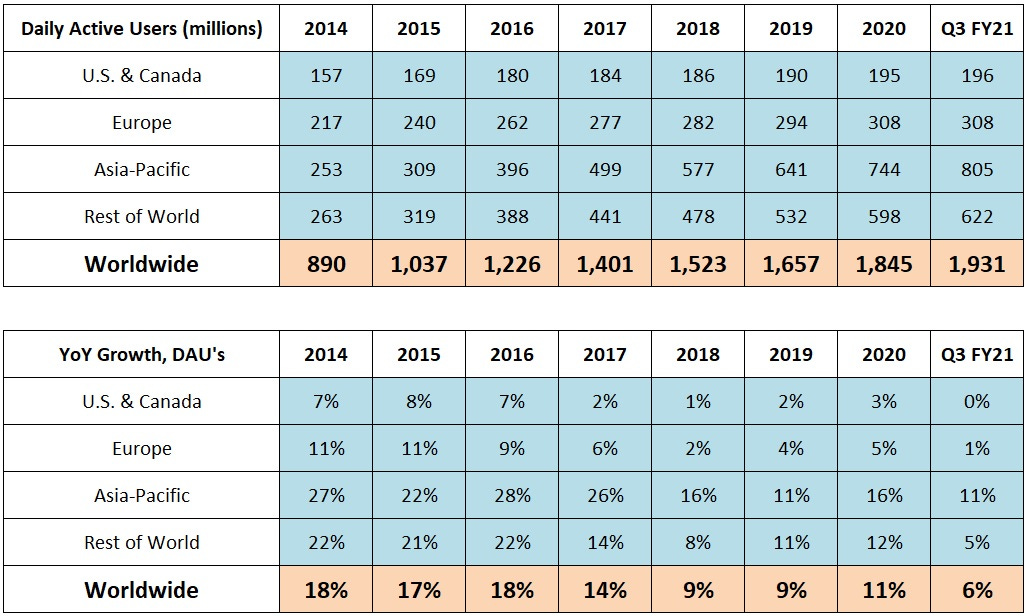

While the Family DAP metrics remain strong, we’ve seen a deceleration in the Facebook DAU metric (which only includes users of the blue app and Messenger). As shown below, Facebook DAU growth in Q3 was in the mid-single digits, with DAU’s in Europe and in the U.S. & Canada effectively unchanged from the year ago period (note that the Q3 FY21 growth rates shown at the bottom are correctly compared to Q3 FY20, not YE FY20).

This is the flip side of the “unparalleled scale” mentioned earlier: with nearly 200 million DAU’s in the U.S. and Canada and more than 300 million DAU’s in Europe, the reality is that Facebook (blue app) user growth has effectively been tapped in these markets (especially if the company struggles to attract younger users to the service). Notably, as CFO Dave Wehner discussed on the follow-up call, this problem is showing up in other markets as well:

“On overall MAU growth for Facebook, it’s a mixed story across the globe… growth has slowed as we've reached saturation of Internet users in some markets; for instance, what we’ve seen in markets like Brazil [population of 215 million] is similar to what we’ve seen previously in the U.S. and Canada.”

2020 is admittedly a tough comparison (the COVID tailwind pushed Facebook DAU growth up to +11%, following +9% growth in 2018 and 2019), but we’re starting to see global DAU growth taper off. Personally, given the fact that we’re starting from a base of nearly 2 billion daily active users, I’d be surprised if mid-single digit Facebook DAU growth is sustainable over the next 2-3 years (at +6% p.a., that would imply 2.3 billion DAU’s by Q3 FY24, or another 370 million net users). This is less important than Family DAP growth, but it’s still a notable development (that said, as long as user retention / engagement remains strong, this slowdown is manageable).

FoA: Financials

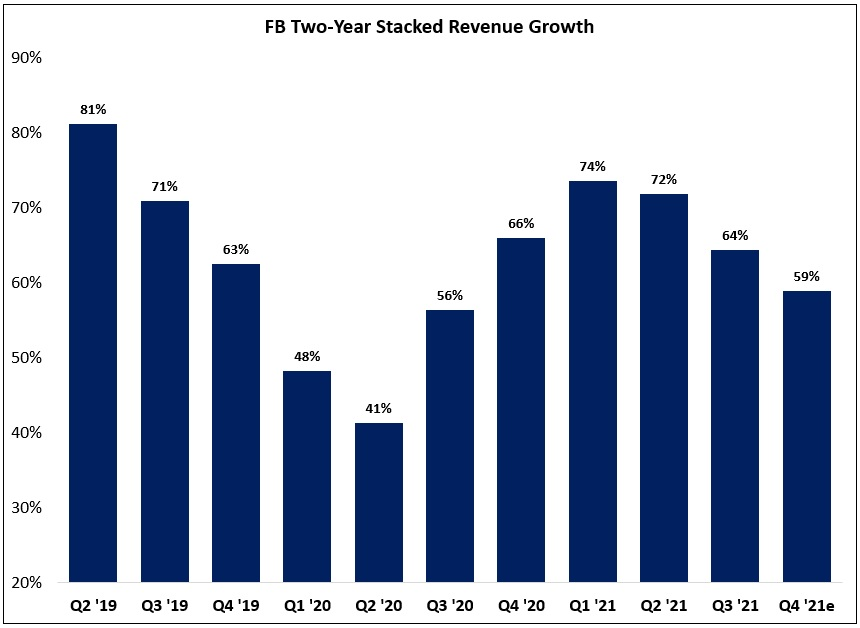

As a result of double digit Family DAP growth, which led to a 9% increase in ad impressions and a 22% increase in average ad prices, Q3 revenues increased 35% to $29.0 billion (advertising, which accounted for 98% of FB’s revenues in Q3, was +33% YoY). On a trailing two-year stacked basis (for the purpose of reducing pandemic-related noise), Facebook’s revenues in Q3 FY21 were +64% compared to Q3 FY19 – a deceleration of 800 basis points from Q2 FY21, but in-line with the company’s pre-pandemic result (+63% in Q4 FY19). As you can see below, the company’s Q4 guidance implies a further deceleration of roughly 500 basis points in the two-year stack, with growth of +59% versus Q4 FY19 (two-year CAGR of +26%).

For the company as a whole, Q4 guidance implies 2021e revenues of ~$118 billion, with FoA accounting for ~$114 billion and “Other Revenues” (FRL) accounting for ~$4 billion. New FRL disclosures (more on this in a moment) suggest FoA has ~50% operating margins, which translates to ~$57 billion in FY21e EBIT (for what it’s worth, that’s comparable to the peak EBIT margins that FB reported in FY17). To put that number into context, Facebook’s total revenues in FY18 were $55.8 billion. Despite the significant incremental spend in areas like platform safety and security over the past few years (“more than $5 billion on safety and security in 2021”), Facebook’s core business remains incredibly profitable. (Note: After appropriately accounting for the 2022e CapEx increase, assuming the vast majority of that spend should be allocated to FoA, my “real” run rate EBIT estimate for FoA is ~$50 billion in FY22e; this assumes high-teens sales growth next year.)

FRL: The Next Platform

On Facebook’s Q2 FY21, management was asked to quantify their investments at FRL. In response to the question, Wehner said the following: “We have mentioned that we're investing billions of dollars annually, and we expect to invest in this area for the foreseeable future.”

Many analysts, myself included, assumed this meant Facebook was investing $2 billion, $3 billion, or maybe $5 billion a year into FRL – which is surely a big number by most standards, but a digestible figure given Facebook was on pace for 2021e EBIT of $45 - $50 billion.

But with the Q3 FY21 press release, we learned that “billions of dollars annually” was a larger number than we suspected: “We expect our investment in FRL to reduce our overall operating profit in 2021 by ~$10 billion. We are committed to bringing this long-term vision to life and we expect to increase our investments for the next several years.”

Note that $10 billion is a net number; if FRL generates ~$4 billion in 2021 revenues, the gross investment is closer to ~$14 billion this year. That’s a staggering sum; even Andrew Bosworth, who has ran Facebook’s AR and VR efforts since 2017, had to admit “that amount of money is hard to fathom”. In addition, this isn’t the end of the line (“increase our investments for the next several years”); personally, I wouldn’t be surprised if Meta’s gross investment into FRL was $20 billion a year by 2023 or 2024.

Following the release of the Q3 results, Zuckerberg and the FRL team put their metaverse vision on display at Facebook Connect. In addition, Zuckerberg participated in multiple interviews to discuss Meta’s role in the development of the metaverse, including conversations with Ben Thompson, Matt Ball, and Casey Newton. After reviewing these interviews, here’s my high level thoughts on what investors currently need to know about FRL: