"It's About Returns, Not Growth"

Update on Ally Financial

From “Ally Financial: Moving Pieces” (April 2023):

“The storm clouds have not passed. The combination of normalized credit losses and net interest margin (NIM) pressures, along with broader concerns in the banking industry following the events of March 2023, has clearly led to a more defensive tone / posture from management than a few quarters ago. That response seems reasonable, but it also speaks to the natural difficulties and execution risk inherent in this business (which raises the bar in terms of required confidence / trust in management for long-term investors). While I believe Ally Financial is positioned to navigate through the present storm, the next 12 - 18 months are unlikely to be a walk in the park.”

Ally’s recent results have lived up to that gloomy prediction; while the deposit gathering franchise remains strong (retail deposits crossed $140 billion in Q3 FY23), lingering pressures and concerns around NIM’s, used car prices, and NCO’s continue to be in the spotlight (and rightly so). When I mentioned the higher bar on trusting management in “Moving Pieces”, it was in reference to the abrupt resignation of CFO Jen LaClair in October 2022. Last week, we received yet another unwelcome surprise from Ally: on October 11th, CEO Jeff Brown (“JB”) announced he will step down by the end of January 2024 (he has already accepted a position at Hendrick Automotive Group).

While JB has been Ally’s CEO since 2015, he’s still only 50 years old. Given the difficult results as of late, in combination with management’s persistent optimism about the opportunities ahead, this announcement is surprising and disappointing. (For what it’s worth, here’s what JB had to say on his decision: “I think it's very important to state there was no disagreement with our Board, or regulatory, financial, or operational concerns. This was really the only call that could have pulled me away… Frankly, I think the next Ally CEO is going to have a financial profile that's pretty damn attractive going forward.”)

Deposits & NIM’s

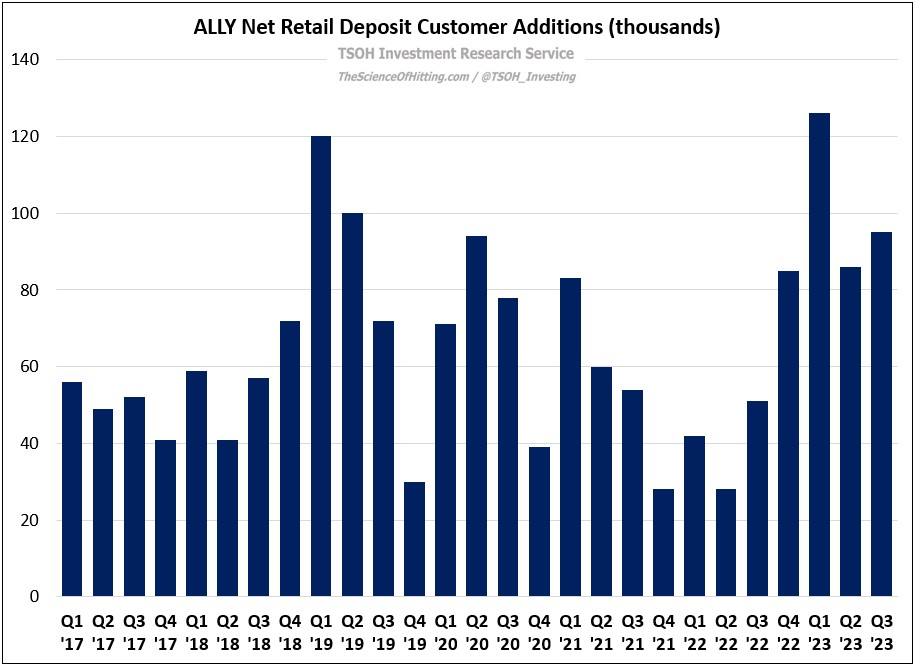

Despite the industry concerns that arose earlier this year, Ally’s deposit gathering franchise has continued to gain ground. The company has added more than 300,000 net new retail deposit (Ally Bank) customers through the first nine months of the year, bringing the total tally to three million customers.

In my mind, Ally’s success throughout this period reflects a fundamental difference between itself and some of the banks that stumbled in early 2023: their value proposition is largely tied to competitive deposit (OSA) pricing. Through that lens, you might compare Ally to a company like GEICO; both are likely beneficiaries when notable changes in industry pricing provide a reason for customer activity. (As discussed in the deep dive, Ally also differentiates itself from competitors on other factors beyond pricing.)

In the short-term, the interest rate environment has led to a meaningful change in Ally’s funding, which has pressured NIM’s. In Q3 FY23, deposit costs were roughly 4.0% - an increase of nearly 250 basis points from the year ago period (as you can see on the company’s website, they are currently offering 4.25% on OSA’s). While the yield on earning assets has also moved higher, it adjusts more slowly than funding costs given that the auto portfolio has a weighted average life of roughly two years (in Q3 FY23, the yield on earning assets was ~7.1%, up ~150 basis points versus Q2 FY23). After accounting for both sides of the equation and other funding sources, net interest margin (NIM) contracted by more than 50 basis points YoY. This is a large headwind to short-term earnings, with management estimating on the Q1 call that each ~10 basis point (~0.1%) NIM move is equal to ~$0.50 of EPS. The good news is that earning assets continue to reprice; as shown below, retail auto origination yields remained above 10% in Q3 FY23.

With the portfolio yield below 9%, we will see continued upward pressure on asset yields as the book matures (assumes origination yields do not materially change, which seems like a reasonable bet for now given the actions being taken by others in auto finance – more on that in a moment).

As it relates to the FY23 results, management tweaked NIM guidance to ~3.35%. To put that in context, management said on the Q4 FY22 call that NIM’s would likely trough at ~3.5% in FY23 before climbing to >4% “over time”. (CFO Russell Hutchinson: “We expect NIM to trough a couple of quarters after rates stabilize, followed by gradual expansion each quarter, even without the benefit of rate cuts… You could see us [at 4% NIM’s] entering 2025.”) As always, these comments come with the caveat that Ally is largely subject to market conditions on OSA prices, origination yields, etc.; on that point, Hutchinson’s comment at the end of the Q3 call on competitive responses to the current environment was noteworthy (“some players haven't just dialed back their originations; they’ve exited the market altogether”).

Credit Performance

As expected, Ally’s retail auto net charge-off’s (NCO’s) increased to 1.85% in the third quarter, which is higher than the loss rates reported at any point since the beginning of the pandemic. As shown below, that is directionally in-line with the results reported at both Wells Fargo and J.P. Morgan (I typically include Capital One in these charts, but they do not report until next week).