Ally: Past The Peak

On the list of things you really don’t want to see the day before a company reports earnings, the abrupt resignation of a key executive would be near the top. Unfortunately, that’s what happened last week at Ally, with the company disclosing on October 18th - the day before reporting its Q3 FY22 results - that Jen LaClair, its CFO since March 2018, had “departed from her position”, effective immediately. (She’ll stay in an advisory role in the short-term.)

LaClair was present on the Q3 call for a brief moment; it was nice to hear CEO Jeff Brown (JB) pay the proper respects for her accomplishments over the past 4+ years, in addition to hearing LaClair discuss her time at Ally.

That said, the way this played out leaves a sour taste in my mouth. It’s not something that you can quantify in a financial model, but it’s an adverse development that paints my overall view of the company. (For what it’s worth, JB suggested LaClair was interested in a larger opportunity, which apparently wasn’t in the cards at Ally: “Jenn is excited to pursue her next chapter of opportunities - and candidly, that's hard to do while serving as the CFO. So, we mutually determined that now was the best time for a change...”)

One final point before we jump into the Q3 results: while management filed an 8-K - as they’re required to do - there was no press release discussing the C-suite change (the screen shot below was taken on October 20th). As a shareholder, and someone who truly hopes to be a long-term partner with the management teams that I’ve invested behind, I don’t expect or demand perfection; I recognize occasional mistakes and miscues are a reality of life.

At the same time, I’m also of the view that the shareholder / manager relationship demands open and honest communication, especially when something big happens (the bad stuff). As Buffett and Munger have discussed in the past, their test for proper communication is to ensure that they clearly tell shareholders key information that they’d like to know about if they were on the other side of the table. In this instance, I’d argue Ally didn’t live up to that standard. (Or at least not to a level that I think this development deserved.)

Past The Peak

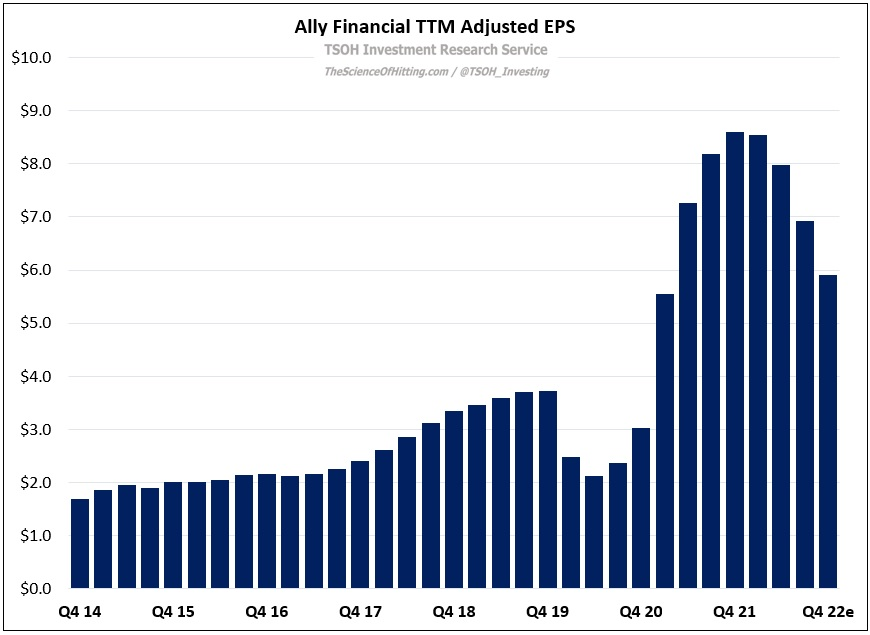

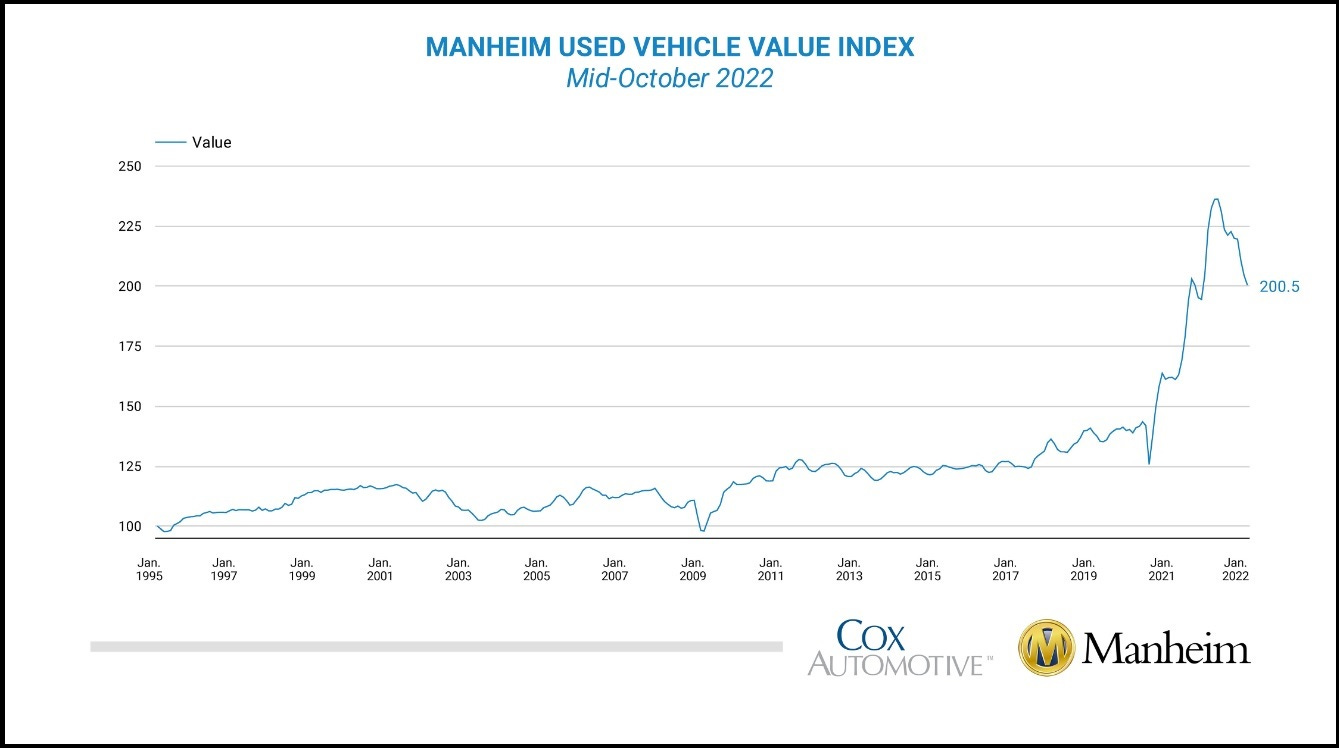

As I discussed in “More Banks Than Bankers”, I think a reasonable estimate of normalized earnings power at Ally is $4 - $5 per share. But as you can see below, the company has been running well above those levels over the past two years, with adjusted TTM EPS reaching a high of ~$8.6 per share in Q4 FY21. That outcome was reflective of a number of short-term tailwinds at Ally, most notably a significant increase in used car prices (net charge-off’s in Q2 FY21 were at the lowest level in the company’s 102-year history).

That fortuitous environment was bound to pass eventually, and that day has come. For one, U.S. used car prices have declined by about 15% since the start of the year, which comes with concerns of heightened credit risk for Ally. In addition, given the ~300 basis point increase in the Fed Funds rate since early 2022 - and with more expected ahead - Ally is seeing a significant increase in deposit costs (interest paid on deposits increased ~130% YoY in Q3); that will be addressed on the asset side of the ledger (higher origination rates) over time, but liabilities reprice more quickly, pressuring net interest margin (NIM’s) in the interim (NIM’s declined by 23 basis points QoQ in Q3, with another ~30 basis points of NIM contraction expected in Q4 FY22).

The net result – higher net charge-offs (NCO’s) and a tighter spread between asset yields and funding costs (NIM) – is a significant headwind to short-term profitability. For Q4, management expects ~$1 per share of EPS – down ~50% from the year ago period. We are past the peak - and Ally likely faces a much tougher environment in the quarters ahead. (Maybe this conclusion informed LaClair’s decision to seek greener pastures sooner than later.)