Ally Financial: "Moving Pieces"

From “A Clearer Roadmap”:

“While Ally is far from being out of the woods, we now have some clarity on what a difficult 2023 might look like for the company. Despite the rally on the print (the stock went up ~20%), it’s clear Mr. Market still has some worries… We’ve seen endless headlines about falling used car prices, which brings up the fear that they’re ‘doing dumb things on the asset side’ (the abrupt resignation of the CFO certainly didn’t help). As we look to the next few quarters, I’d expect these concerns to keep lingering over Ally Financial.”

The first quarter was a mixed bag for Ally. I’ll get into those puts and takes below, but here’s my headline summary: the storm clouds have not passed. The combination of normalized credit losses and NIM pressures (along with broader concerns in the banking industry following the events of March 2023) has clearly led to a more defensive tone / posture from management than a few quarters ago. That response seems reasonable, but it also speaks to the natural difficulties and execution risk inherent in this business (which raises the bar in terms of required confidence / trust in management for long-term investors). While I believe Ally Financial is positioned to navigate through the present storm, the next 12-18 months are unlikely to be a walk in the park.

Deposits and Lending

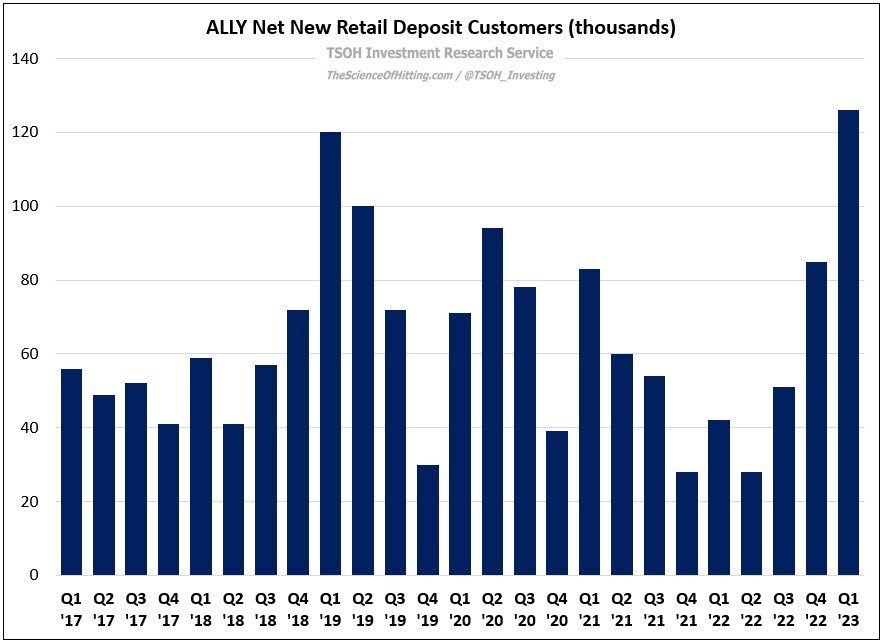

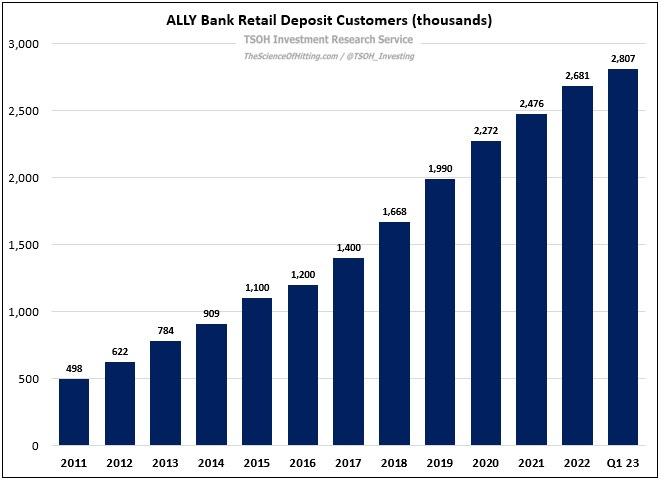

With respect to the fear and uncertainty created by the events of the past few weeks, Ally’s retail deposit base produced some impressive results in the first quarter. As shown below, the company added ~126,000 net new deposit customers in Q1 FY23, its largest quarter of customer growth in more than ten years. Ally Bank ended Q1 FY23 with ~2.8 million retail deposit customers, a >2x increase from YE FY17. (The average customer deposit balance is roughly $50,000, with >90% of retail deposits FDIC insured.)

As a reminder, most of Ally’s retail deposits are attributable to online savings accounts (OSA’s) and CD’s; as I wrote in October, Ally naturally attracts a customer that is more rate sensitive (in a way that I don’t believe applies to your average Bank of America or Wells Fargo customer). That said, while prices (savings account / CD rates) are a relevant consideration for Ally Bank customers, they aren’t the only factor (their strong customer retention rates, which have held at ~96% in recent years, speak to that reality). Ally’s cost structure affords them the ability to pay OSA / CD rates within spitting distance of very aggressive rate payers, but they also compete on other attributes - for example, consistently being top rated by publications like MONEY magazine and Kiplinger’s. (Importantly, Ally also differentiates itself through multi-product relationships, with roughly 10% of deposit customers having an Ally Invest, Home, or Credit Card relationship as of Q1 FY23.)

Over time, the attractiveness of Ally’s offerings to retail bank customers has led to significant changes in their funding mix: deposits accounted for nearly 90% of Ally’s funding sources at the end of 2022, compared to less than 40% a decade earlier (retail deposits went from ~$35 billion to ~$139 billion).

The cost of these funding sources – and how quickly those costs can change - is an important consideration: as noted on the Q1 call, the recent growth in CD volumes has been “concentrated in 11-month and 18-month products” (as of yearend 2022, ~90% of Ally’s CD balances were set to mature within 24 months). On OSA’s, the rate paid to depositors is subject to adjustment at a moment’s notice (competitive dynamics, changes in interest rates, etc.). That has been evident in the recent results: as shown on page 21 of the Q1 FY23 slide deck, Ally’s average interest rate on retail deposits was 3.16% in Q1 FY23, up from 0.59% in the year ago period (the end of period OSA yield was 3.8% - up more than 7x from 0.5% in Q1 FY22).

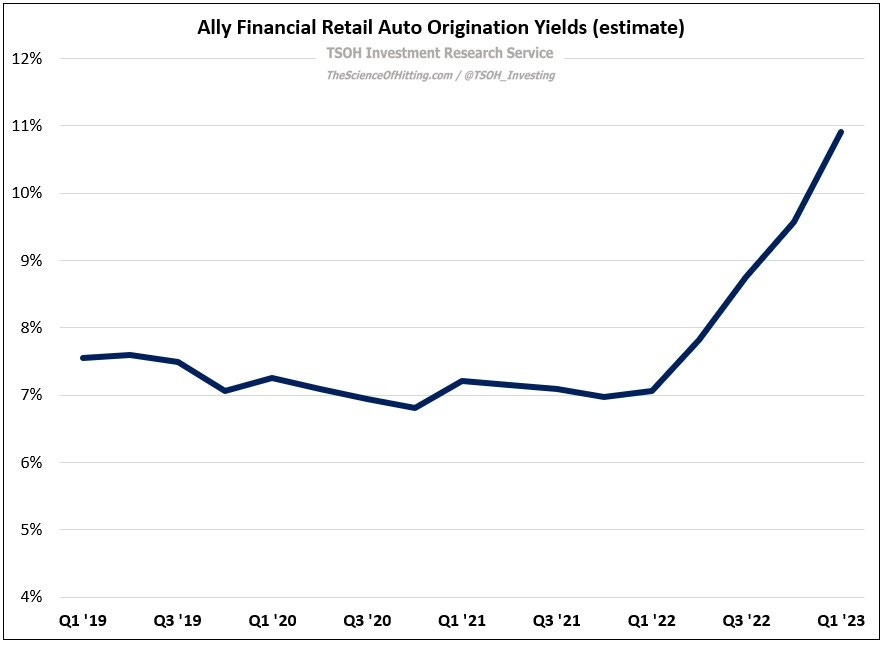

Said differently, Ally’s balance sheet is liability-sensitive; in a rising rate environment, with the cost of funding shifting higher more quickly than the yield on earning assets, net interest margins (NIM) compress. The good news, as noted at a January 2023 conference, is that some key components of earning assets also reprice relatively quickly (“the weighted average life of our auto book is 22 months or so”). In addition, the company is writing new loans at much higher origination yields than a few quarters ago: as shown below, the company’s estimated origination yield on its new auto loans in Q1 FY23 was 10.9% - up nearly 400 basis points from 7.1% in Q1 FY22.