Disney: The ESPN Solution

On February 7th, The Walt Disney Company reported its Q1 FY24 results.

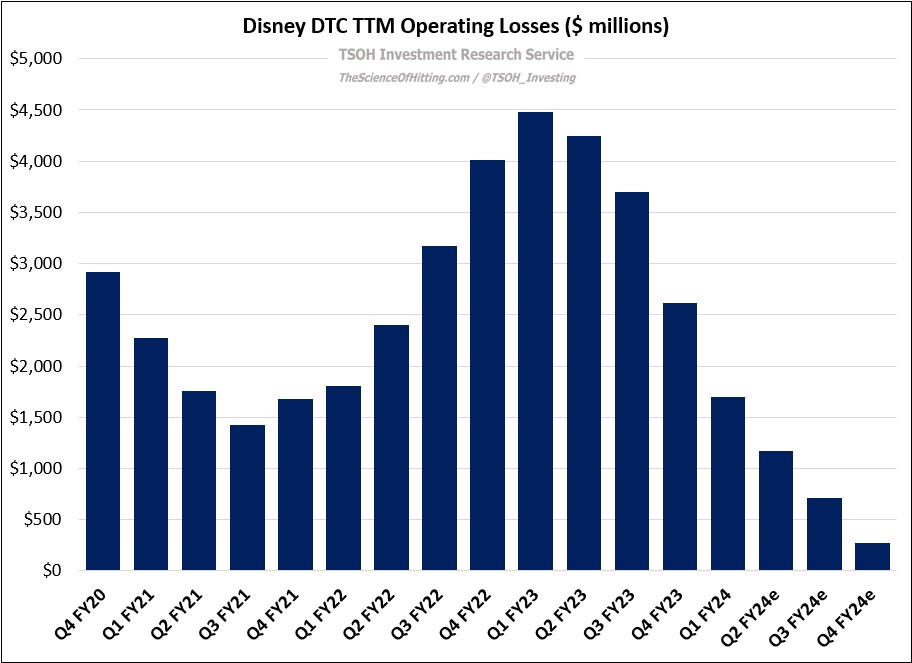

It was a solid start to the year, with continued strength at Experiences and an ~$850 million reduction in DTC losses leading to >20% YoY earnings growth. A similar outcome is expected to hold for the remainder of the year, with FY24e EPS of ~$4.6 per share (up ~22%). In addition, Disney is on track for ~$8 billion of FY24e free cash flow, with management looking to ramp capital returns (including repurchases, which have been paused since late FY18).

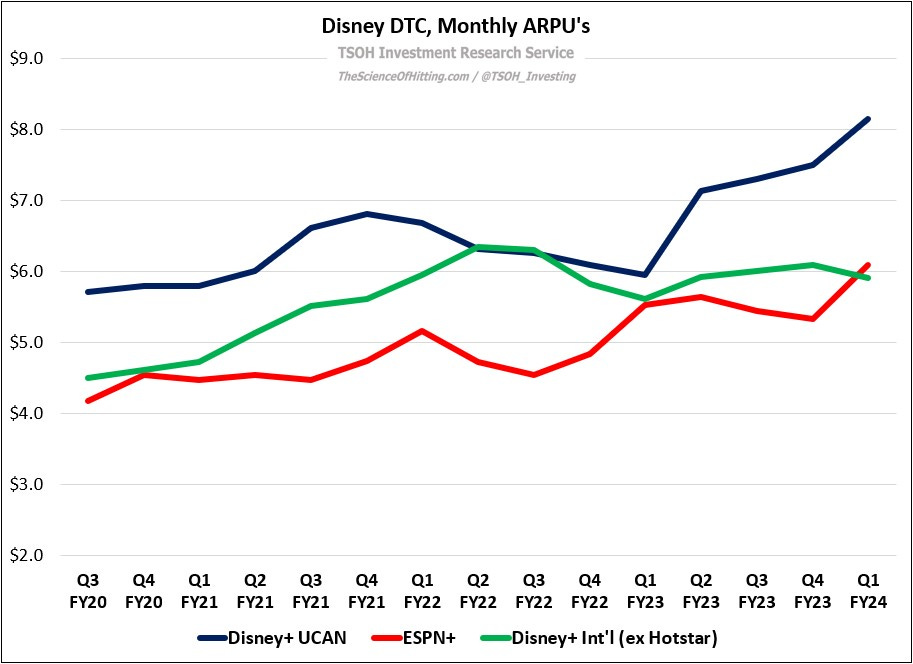

Overall, I think thesis laid out in “The Turning Point” (August 2023) is coming to fruition. In particular, I was encouraged by the results at Disney+ UCAN in the quarter, with paid subscribers down ~1% YoY on ~37% ARPU growth. (“These DTC pricing actions, if well received, will go a long way towards paving the path to resurging profitability within the video businesses… That outcome would be a critically important signal for the future of Disney.”)

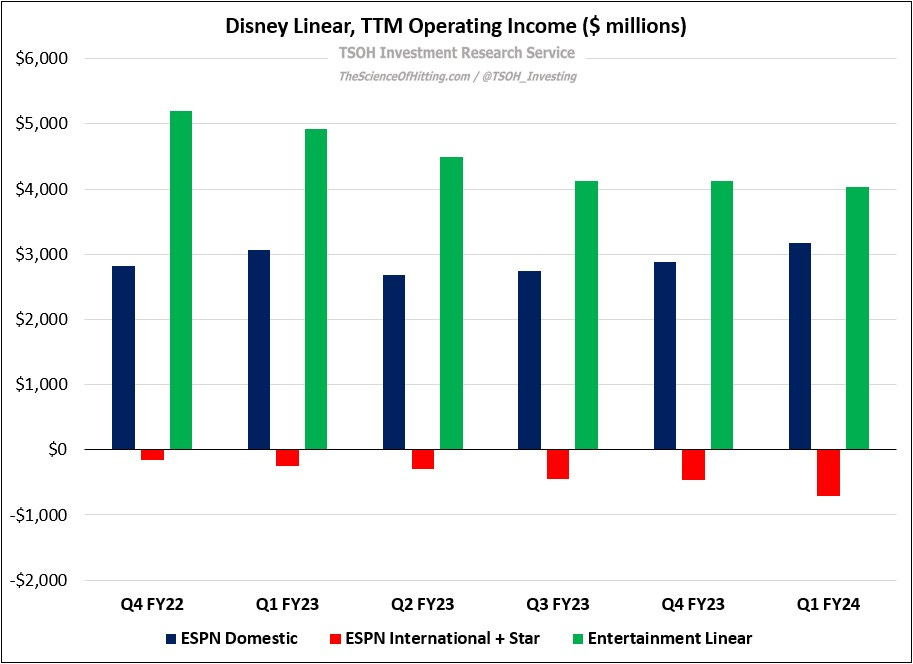

But the road ahead still looks bumpy. In my opinion, that is most evident when analyzing the company’s strategy for live video, and particularly U.S. sports rights. The latest examples are the new sports bundle with Warner Bros. Discovery and Fox, launching fall 2024, as well as the ESPN DTC offering, launching fall 2025. These actions are another step in the direction of revealing the accounting mirage that I wrote about in “Improve The Bottom Line” (November 2023). Said differently, the company’s P&L remains heavily exposed to the distribution of live sports rights; sitting idly by in the face of sustained pressure on U.S. linear pay-TV volumes isn’t a sufficient answer.

That brings us to the focus of today’s post: as CEO Bob Iger noted on the Q1 call, Disney wants to transition ESPN “into the preeminent digital sports platform, reaching as many sports fans as possible and giving them more ways to access the programming they love in whatever way best suits their needs”. What does that mean for Disney’s long-term DTC strategy, as well as its future earnings power? And as it relates to the business and the stock, is this a sign that The Walt Disney Company is finally rounding the corner?

Disney+: Growing Up

As noted in the introduction, Disney+ UCAN ARPU’s were +37% YoY, which came with a 1% hit to the sub count (the latter figure will rise by ~7.5 million in Q2 to account for Charter MVPD customers who will now have access to Disney+, net of cannibalized DTC subs). On both of those items - aggressive UCAN DTC pricing actions and newly structured agreements with MVPD’s (pay-TV distributors) - Disney’s approach to the DTC business is maturing.

Given the company’s late entrance in the streaming business (Disney+ launched in November 2019), the first few years were primarily focused on adding subscribers and driving engagement. Today, they are pulling the necessary levers to build a profitable long-term business, while also thinking about how to intelligently marry streaming services with legacy distribution channels. (It helps to have best-in-class IP: Disney had six of the top ten movies across all U.S. streaming platforms in 2023, including the top spot with “Moana” – which has a sequel coming to movie theaters in November.)