“Moving Forward, Or Moving On”

Disney, Charter, and the future of the U.S. pay-TV business

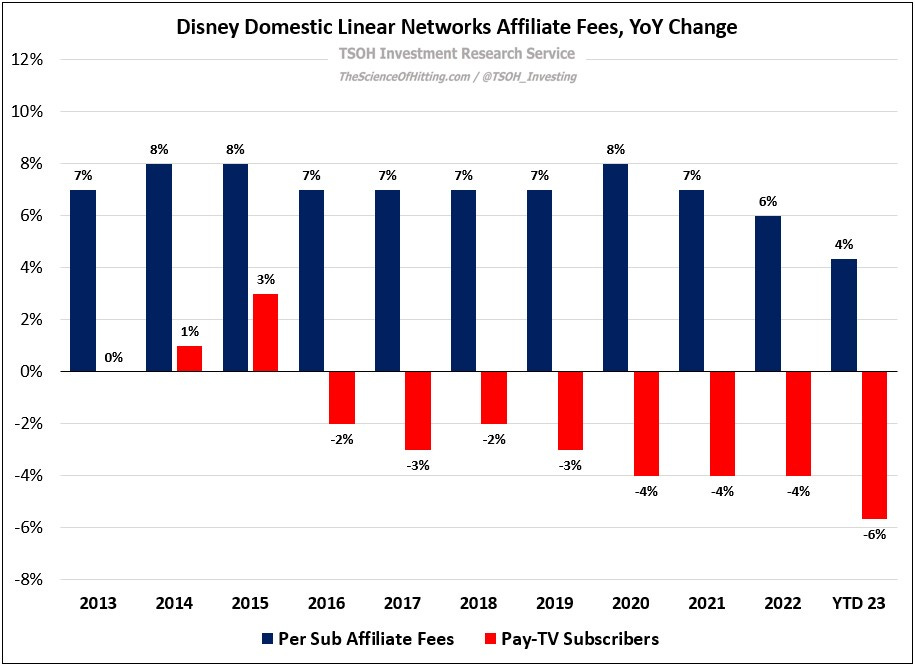

There’s a straightforward explanation for what happened in the U.S. pay-TV business over the past decade: prices went up a lot and (relative) value went down a lot. A breakdown of Disney’s Domestic Linear Networks Affiliate Fees between volumes and pricing does a good job of framing the discussion.

The subscriber trend won’t surprise anyone; the consumer value proposition for pay-TV, particularly for entertainment programming, is inferior to OTT DTC services. As a result, the number of U.S. households subscribing to pay-TV has dwindled from ~100 million to ~75 million over the past seven years.

For the tens of millions who still pay, the growing per sub affiliates fees reflect how much more Disney is charging MVPD’s like Comcast and vMVPD’s like YouTube TV to carry its channels. (We can roughly guesstimate that the total is ~$16 per subscriber per month.) As you can see, per sub affiliate fees increased at a high-single digit rate for many years (up 7% - 8% in each year from FY13 to FY21). By contrast, that growth rate has fallen to 3% - 4% in each of the past two quarters. If Disney holds the stronger hand in its renewal negotiations with the MVPD’s and the vMVPD’s, why isn’t that growth rate (meaningfully) higher? One plausible answer is due to the timing of the most recent renewals with Charter (2019), DirecTV (2019), Comcast (2021), YouTube TV (2021), and Dish (2022). Said differently, we may be in the middle of a temporary lull; if so, it should reaccelerate in the near future.

That conclusion has now been thrown into doubt with a big development: as of August 31st, Charter’s ~14.7 million pay-TV customers cannot access Disney’s TV channels. (It hasn’t been resolved in the past ten days.) On Monday, Charter pay-TV customers will not be able to watch the Bills / Jets game on ESPN (that said, it will also be on ABC and ESPN+); those TV customers have already missed some high profile college football games, as well as the final rounds of the U.S. Open tennis tournament. This is a critical moment for the pay-TV ecosystem; the endgame of the Charter / Disney carriage battle will reverberate through the media industry in a major way.

Charter’s Perspective

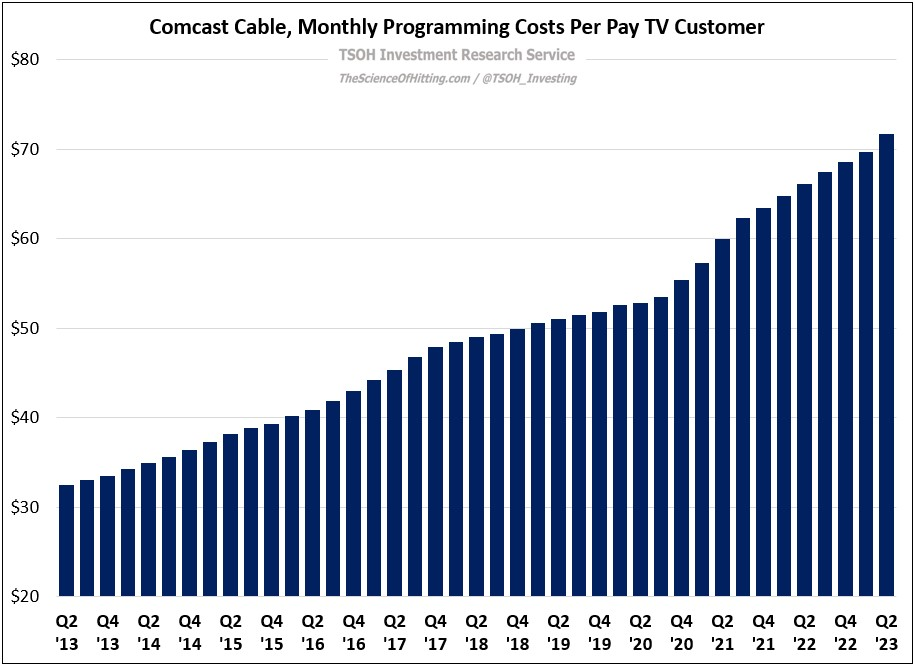

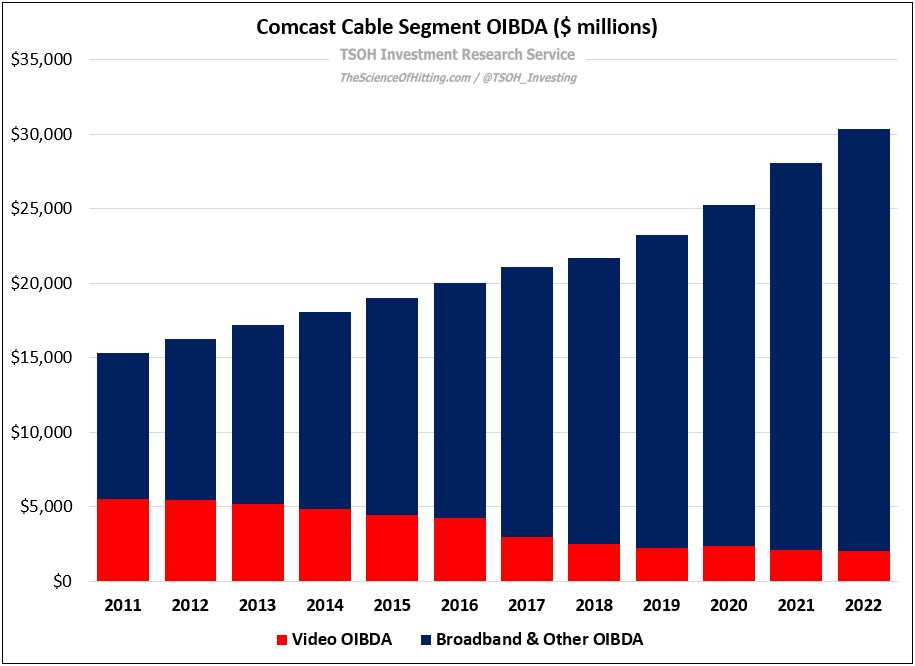

While carriage disputes have been a common occurrence over the years, Charter CEO Chris Winfrey has made it abundantly clear that they view this one differently: “We're at the edge of a precipice, which Disney itself forecasted; this is not a classic carriage dispute.” On September 1st, the company held a conference call that included a slide deck titled “The Future of Multichannel Video: Moving Forward, Or Moving On”. The presentation focused on the key changes that took place in the U.S. pay-TV and broader video ecosystem over the past 10+ years. From the perspective of customers and MVPD’s, there have been two main (unwelcome) developments over the years: (1) pay-TV has become much more expensive (>2x over the past decade); and (2) MVPD profits from distributing pay-TV have shrunk significantly (the figures in the second chart are very rough guesstimates; what’s relevant to note is that the MVPD profits declined significantly in absolute dollars and relative to the contribution from the Internet business).