Disney: The Turning Point

From “A Worrisome Circumstance” (May 2023): “As I think about the ‘logical progression’ for Disney DTC, a single platform strikes me as a superior strategy for driving discovery and engagement… The way to incentivize subscription and usage of a bundle / consolidated app that has high-value content for everybody in the family is pricing; super fans with a narrow interest in sports, Marvel or Star Wars, etc., should be paying a significant premium for the a la carte offering - in my mind, much more than they’re being charged currently. This is a long-term journey for Disney, particularly as it relates to marquee sports rights. They’ve already started down this road, but it’s now clear they will need to move more quickly - particularly given the accelerated pace of pay-TV subscriber losses. (They have 20.0 million three service / trio subs, up from 16.8 million a year ago; that number should be, and really needs to be, much higher over time.)”

Two things have now become clear: (1) Management has come around on the logic of the single platform product strategy; and (2) their DTC pricing architecture is undergoing a meaningful evolution. On the first point, consider this comment from the Q3 call: “We're moving closer to a more unified one app experience domestically to pair high-quality general entertainment [Hulu] with content from our popular brands and franchises [Disney+] for bundle subscribers. It's a formula for success that we have already proven in our international markets… We see a future where consumers can access even more of Disney's streaming content all in one place, resulting in higher engagement, lower churn, and greater opportunities for advertisers.”

While it wasn’t 100% clear how sports / ESPN fit into that discussion, this comment from CEO Bob Iger was noteworthy: “Overall, we're considering potential strategic partnerships for ESPN around distribution, technology, marketing, and content opportunities where we retain control.”

With discussions about “strategic partners” and the sports betting deal with PENN Entertainment, it’s evident that Disney is rethinking its hand at ESPN. While ESPN+ was an early entrant in OTT / DTC sports, there hasn’t been enough financial progress over the past 5+ years to make it anywhere close to a swap for linear. These recent developments, along with the DTC pricing announcements discussed below, give some reason to for optimism; I think ESPN is getting back on the front foot. (As it relates to sports and the TV business, note that advertising revenues at Linear Networks declined 14% YoY in Q3, inclusive of 4% YoY growth at ESPN; amidst the implosion of entertainment programming on U.S. linear TV, live sports are a bright spot.)

That brings us to the second major development: on Wednesday, Disney announced another round of significant price increases for its DTC services. As I (most recently) argued in May, while the late 2022 price increases were a big step in the right direction, the price point for the standalone apps needed to keep moving much higher over time. As you can see below, that’s what will happen in October: prices for the ad-free tiers of Disney+ and Hulu will be increased by 27% and 20%, respectively, with ESPN+ hiked by another 10% (at $10.99 per month, it’s ~120% higher than the price at launch in 2018).

The price of the ad-free trio bundle (Disney+, Hulu, and ESPN+) was also increased significantly – up 25% to $24.99 per month - with the discount remaining unchanged relative to the group of individual services (~40% cheaper through the bundle). Given that 20.1 million U.S. customers are on the trio bundle, which is equal to roughly 80% of the subscriber base for ESPN+, I think that this was a pretty surprising move (in a good way). It suggests that management has a high level of confidence in customer’s perception of the bundle value proposition; said differently, they believe the DTC services have untapped pricing power. (“We took a pretty significant price increase in late 2022 - and we didn't see significant churn [from] it.”)

In contrast to the aggressive price hikes on the ad-free tiers, management has been conservative on the ad-supported DTC pricing. Given Disney’s long history in TV / video advertising, including the learnings from majority control of Hulu (where ~70% of subs are on the ad-tier), I’m confident they have a good understanding of how to think about the relative pricing of their offerings (the company is introducing an ad-supported Disney+ tier in Canada and in some European countries in November). With ~40% of new Disney+ subscribers now choosing the ad-supported service, my guess is that this penetration rate will move even higher following the October 2023 pricing changes. (“We're keeping the advertiser-supported product flat in terms of prices. That's being done for a reason… The advertising marketplace for streaming is picking up; it's healthier than the marketplace for linear TV.”)

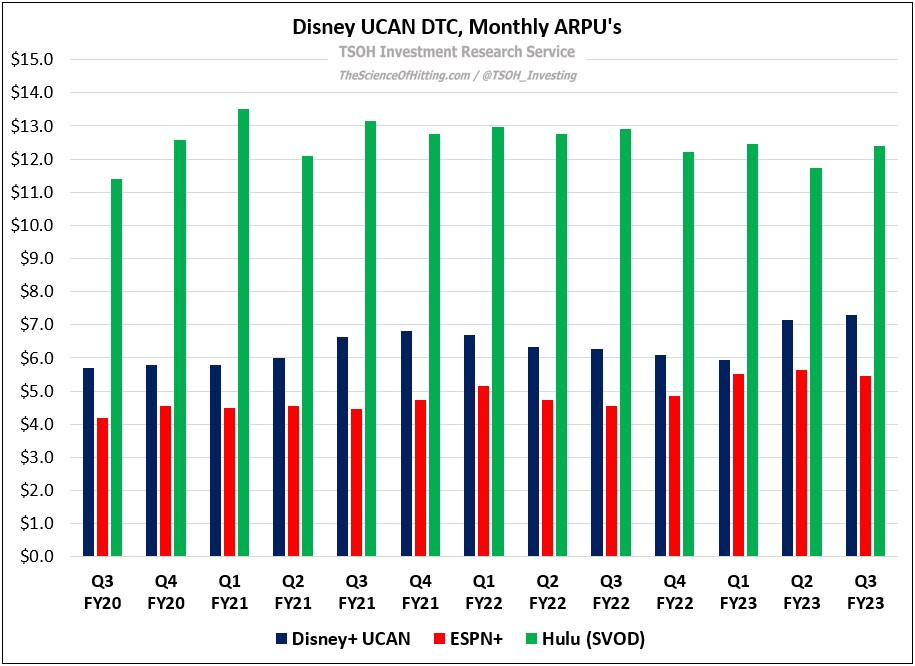

As we think about the impact of these changes, consider the data in the following chart; as you can see, monthly ARPU’s for Hulu SVOD, Disney+ UCAN, and ESPN+ were $12.4 per month, $7.3 per month, and $5.5 per month, respectively, in Q3 FY23. For Disney+ and ESPN+, the ARPU’ s are ~50% below the list prices for the ad-free tier (after the October 2023 hikes). That outcome is largely a desirable one, i.e. it reflects significant adoption of the multi-product bundles. Over the coming months, if those bundled subs react as management expects them to, the resulting impact will be a $1.5 - $2.0 increase in ARPU across each of the DTC services (again, that’s for the trio subscribers, which covers over 20 million U.S. customers).

Long story short, this is a very big decision. I commend management for taking meaningful action, which will be critical to building a large and profitable DTC business. While we probably won’t know the answer for a few months - the pricing changes go into effect after the end of Q4 FY23 – I’ll be very interested to see what impact it has on customer behavior (all else equal, the DTC business would be profitable with a global ARPU lift of ~10%).

Disney (DTC) Financials

On the Q3 call, management reiterated its FY23 guidance: “Putting this all together, excluding the impact of accelerated depreciation for the Starcruiser [~$300 million in FY23], we still expect total company revenues and segment operating income to grow high single-digits versus FY22.”

In FY22, Disney’s segment operating income totaled ~$12.1 billion; assuming high-single digits implies ~7% growth, that would put FY23e at ~$13.0 billion. With year to date FY23 segment operating income of ~$9.9 billion, the company will need to generate roughly $2.8 billion in Q4 FY23 segment operating income to hit the target (adjusted for Starcruiser) – significantly higher than the $1.6 billion of segment operating income generated in Q4 FY22. The primary sources of improvement are DTC, where I suspect quarterly profitability will swing by ~$1 billion YoY, along with the tailwind from a resurgence at the International Parks. The bigger point is we’re likely past the bottom for Disney’s consolidated profitability; the company expects DTC to be profitable by the end of FY24, a big change from the ~$4.5 billion in TTM operating losses generated back in Q1 FY23 (said differently, improvements at DTC will more than offset linear pressures).

On that point, I think this comment from Iger was an important one:

“Our streaming business is still very young; it's not even four years old… We would love to have the margins Netflix has – but they’ve accomplished that over a substantially longer period of time, and they've done so because they figured out how to really carefully balance their investment in programming with their pricing strategy and what they spend in marketing. Because we're new at all of this, we have not really achieved the balance we know we need in terms of cost savings, pricing, and money spent on marketing… I can't emphasize enough the time and the effort that we’ve spent on managing costs. We've done a tremendous job in a very, very short period of time of exceeding the cost reductions we said we were going to achieve, and that's obviously a major step in the direction of improving our margins. Pricing, password sharing, and advertising are other ways to do that. So, I'm reasonably optimistic and hopeful that we will be improving our margins in this business significantly over the next few years… We know how much work we have to do; we know the work we have to do as well.”

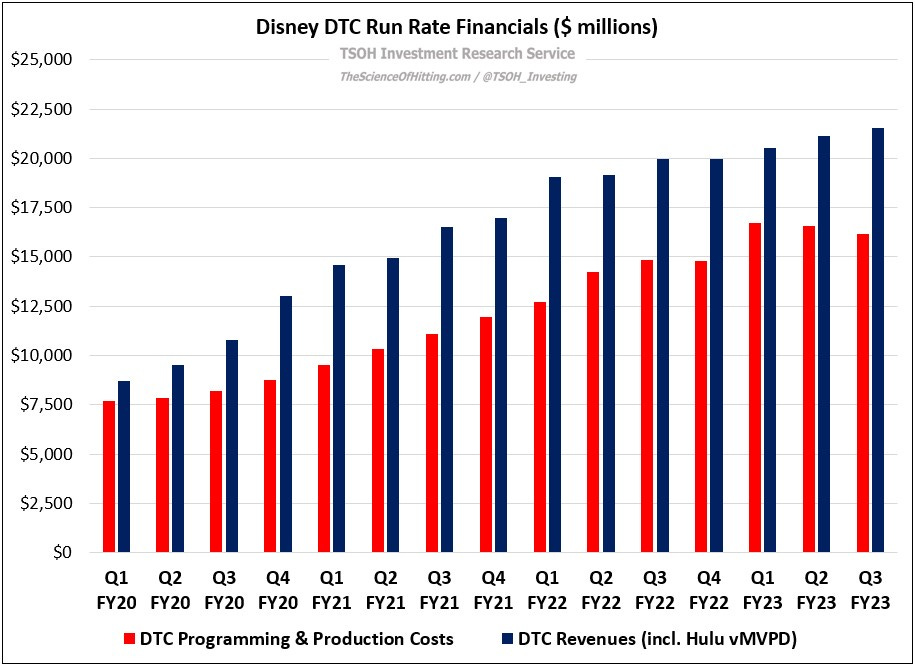

I think that is a fair and honest assessment of what happened, as is evident in the financials. At Disney’s DTC business, which is currently at ~$22 billion in run rate revenues, ~75% of sales is spent on programming & production costs and ~42% of sales on OpEx and SG&A (-17% TTM EBIT margins). By comparison, when Netflix reached $20 billion in revenues in 2019, it spent ~62% of sales on programming & production costs and ~25% of sales on OpEx and SG&A (12% TTM EBIT margins). While Netflix did a great job over time of balancing its spend against subscriber growth and revenue growth, it’s worth noting they were in the DTC business for a decade before consistently reporting double digit EBIT margins. Disney went through the early stages of its DTC subscriber / revenue growth at hyper speed, but that also led to the significant growing pains experienced over the past 12 - 18 months. Whether or not you believe that is fixable is a critical question for the investment thesis; personally, I continue to believe that Disney can build a sizable and highly profitable DTC business over the coming years.

Conclusion

In the earlier days of Disney’s foray into the streaming (DTC) business, the company’s subscriber count greatly benefited from the growth of Disney+ Hotstar - but as I cautioned in August 2021, adding a lot of subs was just one component of what would be necessary to build a sustainable business:

“At a similar point in Netflix’s history – the company crossed 170 million global paid members in early fiscal 2020 – it was generating nearly $6 billion in quarterly streaming revenues (run rate of roughly $24 billion). This stark difference reflects a meaningfully higher blended ARPU at Netflix; it should serve as an important reminder that all paid subs are not created equal.”

Fast forward to Q3 FY23, and we’ve reached the other end of the spectrum: the company has lost ~17 million Disney+ Hotstar paid subs in six months, yet management seems accepting of that outcome; given that these subs would’ve generated ~$125 million in annual sales, or ~0.5% of Disney’s run rate revenues in DTC, I think you can appreciate why. This example speaks to the trade-offs that Disney will need to address as they look to turn DTC into a profitable business (that conversation gets messier as we think about the path to global scale; that said, Hotstar markets are the low hanging fruit).

Above all else, I think management’s decision to aggressively raise (U.S.) DTC prices for the second time in ~10 months is an encouraging sign. In my mind, success here - meaning limited churn - would lead to more than just solidifying the base for the DTC business (clearly that’s very important too); it would also provide line of sight for the future of ESPN (if they keep growing bundle subs while pushing ESPN+ ARPU’s north of $10, they’ll be in position to be more aggressive with the DTC transition for marquee sports rights).

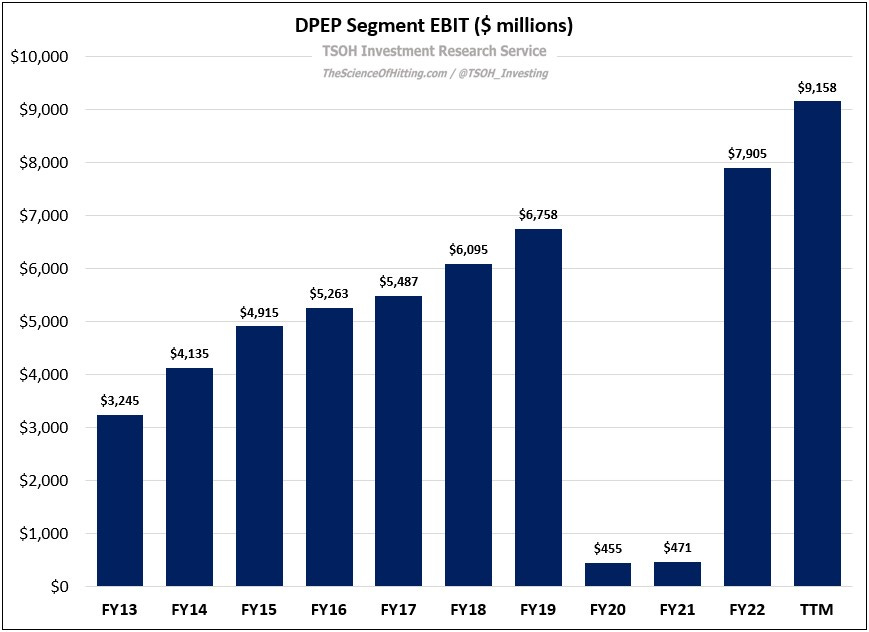

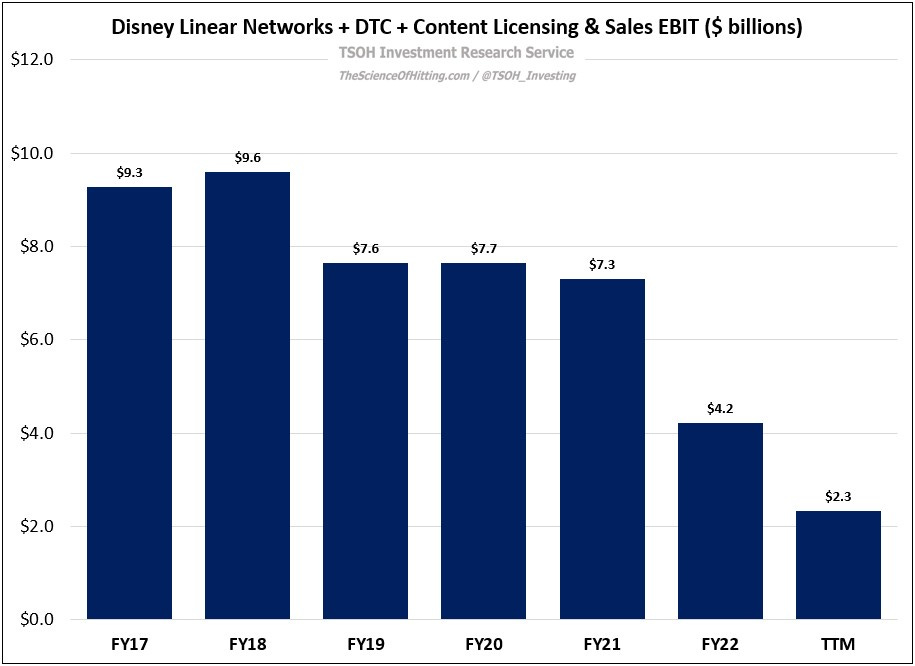

At ~$89 per share, Disney has an enterprise value of ~$195 billion. For that price tag, you receive (1) the DPEP segment, with TTM operating income of ~$9.2 billion; and (2) the video businesses, with annual revenues of ~$55 billion. The big question is the future profitability of that second bucket (as you can see below, the trend has been painful). That’s a difficult question to answer – but these DTC pricing action, if well received, will go a long way towards paving the path to resurging profitability within the company’s video businesses. I want to make sure I’m 100% clear on that point: in my view, that outcome is critically important for the future of Disney.

With all that said, my decision for now is to leave the position as is. If the DTC price increases are well received by customers, alongside growing confidence that management is willing to make the difficult decisions required to position the company with a clear long-term strategic vision, it would have a significant impact on my views. If those stars align, I’d likely conclude that it is time to starting buying additional shares of The Walt Disney Company.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

Thanks as always here, Alex. I'm curious if, historically, management has been transparent about churn rates?

Hopefully so, as that seems like a very important metric to watch in the coming quarter(s).