Disney: "Improve The Bottom Line"

Note: Here’s the link to all prior Disney posts on the TSOH website

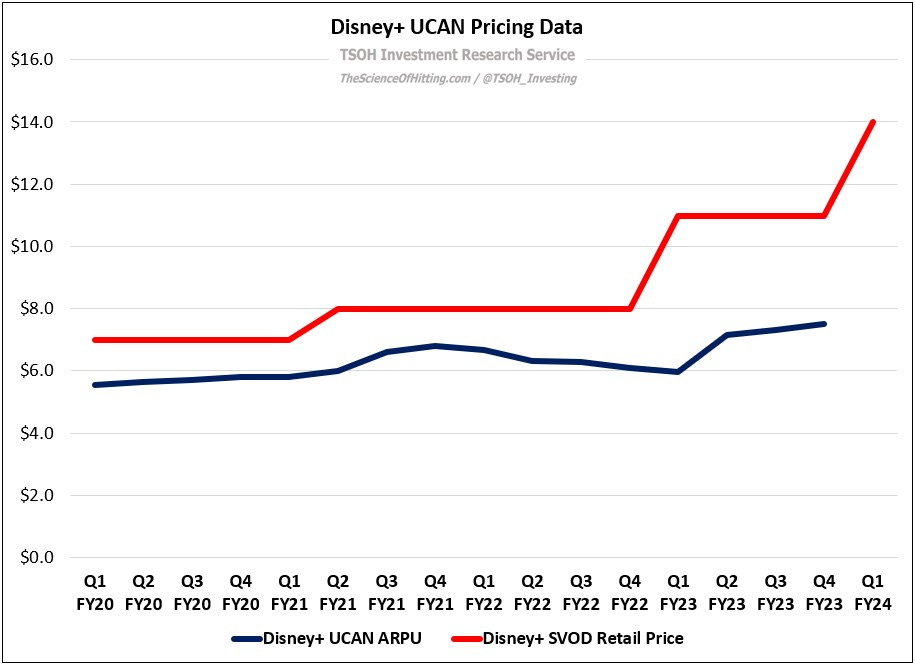

Disney ended Q4 FY23 with 46.5 million domestic Disney+ subscribers, which was only ~100k higher than in the year ago period (it was up ~500k sequentially). Against a roughly unchanged sub base, the namesake DTC service reported domestic ARPU’s of $7.5 per month – up >20% versus Q4 FY22 (and despite an increased mix of two-service and three-service U.S. bundle subscribers). With Q4 ending on September 30th, there’s more to come: the U.S. DTC price increases detailed in last quarter’s update went into effect five weeks ago (after quarter end). The actions of the past 12 months reflect a very significant shift to phase two; the events of the next 12 to 18 months will greatly influence the future of The Walt Disney Company.

The Video Business

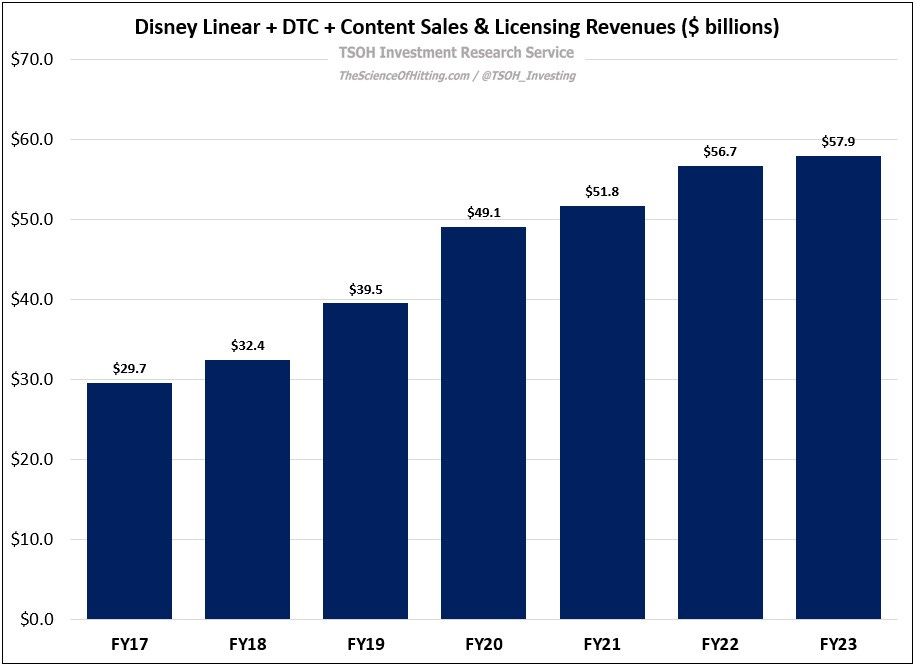

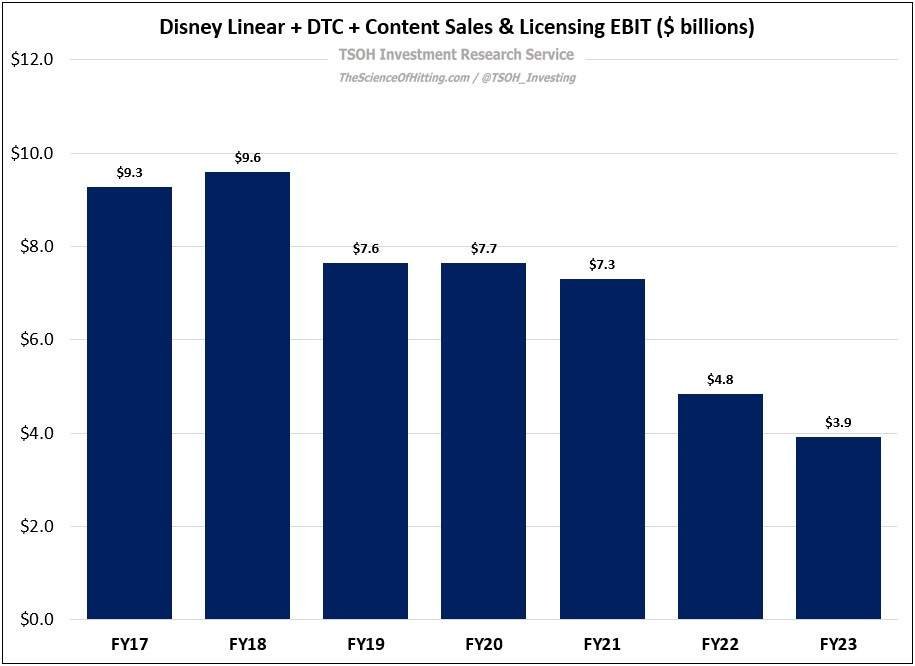

Two seemingly incongruous facts about Disney’s video businesses offer a good overview of their current predicament: despite the fact that video revenues reached a record high in FY23 (~$58 billion), video profitability is nearly 60% lower than at the peak. (Given that these businesses accounted for >60% of the company’s segment EBIT in FY18, the ~$6 billion cumulative decline in profitability has been a huge headwind over the past five years.)

As we look to FY24 and beyond, the key financial question to answer is if we’ve turned a corner: will FY24 reveal the long awaited turnaround in the profitability of the Video businesses, which, in combination with growth at Experiences, sets the foundation for attractive EPS / FCF growth?

That will be the focus of today’s update.