Disney: Rewiring The Earnings Engine

Happy Thanksgiving! TSOH Investment Research will be off on Thursday for the holiday, but I’ll be back Monday, December 1st, with an update on Airbnb.

From “The Turning Point, Revisited” (November 2024): “With the launch of ESPN DTC flagship, and with proper alignment of the strategy across the DTC apps / the U.S. Disney bundle and more aggressive negotiations with (v)MVPD’s that reflect the essential content that Disney supplies, I think they will start to do a better job at fending off the pressure from more expensive sports rights. After six-plus years of a largely defensive strategy that did not address the core ESPN issue, Disney is shifting to an offensive posture...”

At the stroke of midnight on October 30th, Disney’s U.S. TV channels went dark on YouTube TV, the leading vMVPD with a subscriber base estimated at roughly 10 million households (not accounting for what I suspect is millions of users who are taking advantage of loose password sharing restrictions). The stalemate lasted more than two weeks, with a resolution on November 14th.

This is the second Disney carriage dispute I’ve covered at TSOH, with the first being the Charter blackout in late 2023. I won’t rehash that discussion, but it’s important to note that Charter was primarily focused on packaging flexibility, including customer access to Disney’s DTC apps; the dispute wasn’t centered on a disagreement about affiliate fees / pricing (Charter CEO Chris Winfrey: “we agreed to Disney’s supposed market rate increases”).

Based on WSJ reporting, the YouTube TV negotiations primarily stalled on pricing - “the fees Disney was seeking to carry ESPN and other networks”. If so, I think Disney’s negotiating position was clear: hold firm (I think that’s the right answer even before considering MFN clauses with other distributors).

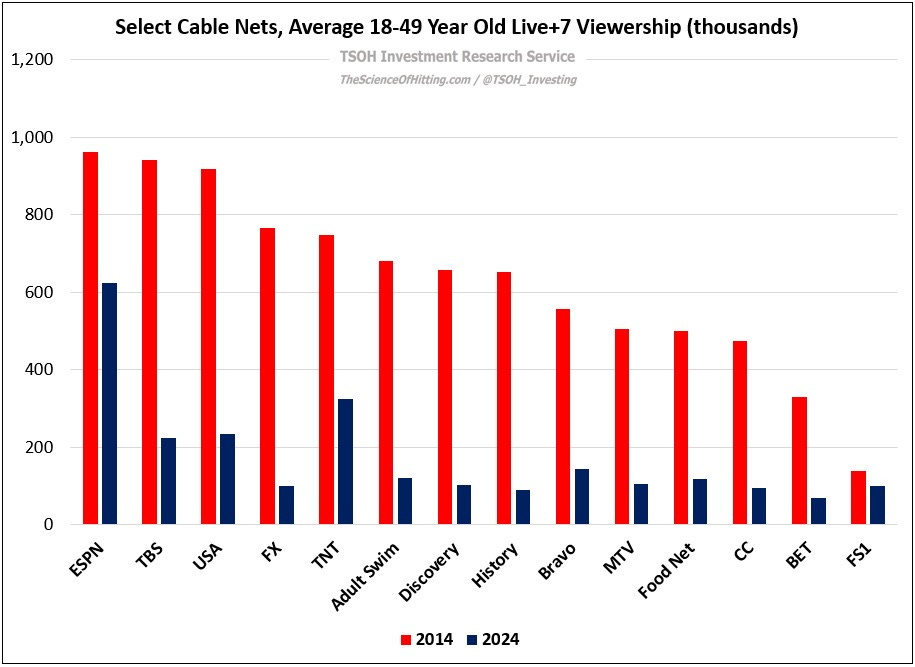

My view is Disney’s position as the leading supplier of marquee U.S. sports rights has greatly improved its relative importance as the U.S. pay-TV audience shrank from ~85 million households five years ago to ~60 million today; they are the most important content provider, and they need to aggressively defend their economics (as shown on page 44 of the 10-K, ESPN’s domestic programming and production costs were up 8% in FY25).

While this wasn’t true for many years - the ESPN+ diversion - Disney is now in a position where their business can be truly indifferent to the distribution channel that a customer chooses (that said, given some considerations on advertising pricing, different churn dynamics, etc., that doesn’t necessarily mean they will be indifferent to those various channels at the same price).

There’s an alternative way to frame the negotiation: as opposed to “YouTube TV vs. Disney”, it’s really “YouTube TV vs. The NFL, the SEC, NCAA Basketball”, and a long list of other premium sports rights. If these blackouts are needed to secure the necessary pricing, and to remind distributors like YouTube TV that their business would be bleed away without Disney, so be it.

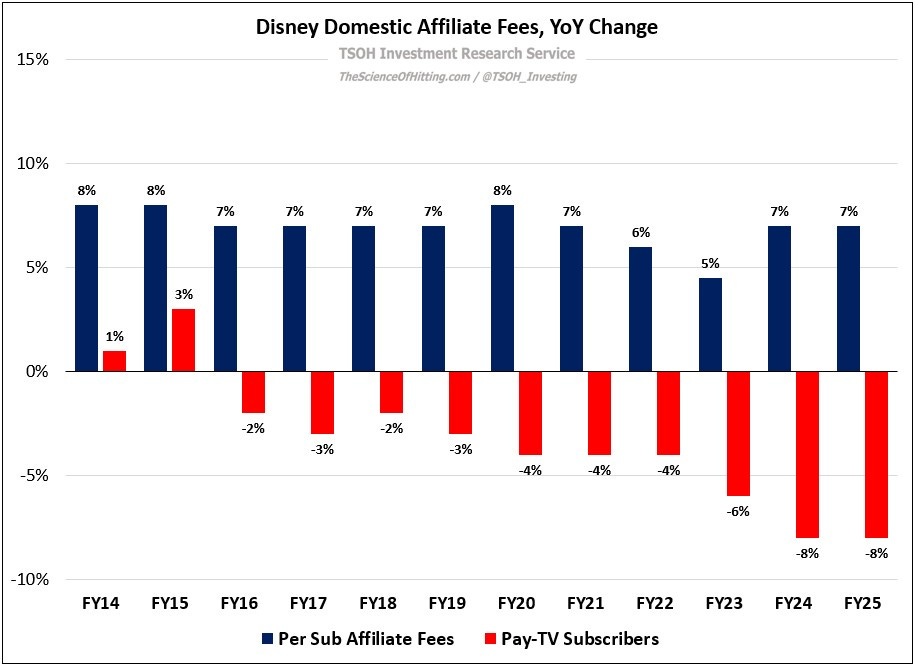

Ultimately, the resolution appears to have landed close to Disney’s initial terms – an understandable outcome given Disney’s negotiating leverage, but also necessary given the rising costs associated with the source of that leverage. It’s a position that Disney should express forcefully, and even more so now with the launch of ESPN flagship. (The ~7% per sub affiliate fee increases are artificially constrained by the accounting mirage created by defending its other U.S. linear channels; in a vacuum, it should be higher.)

Financials