The Turning Point, Revisited

An update on The Walt Disney Company (DIS)

From “Disney: The Turning Point” (August 2023):

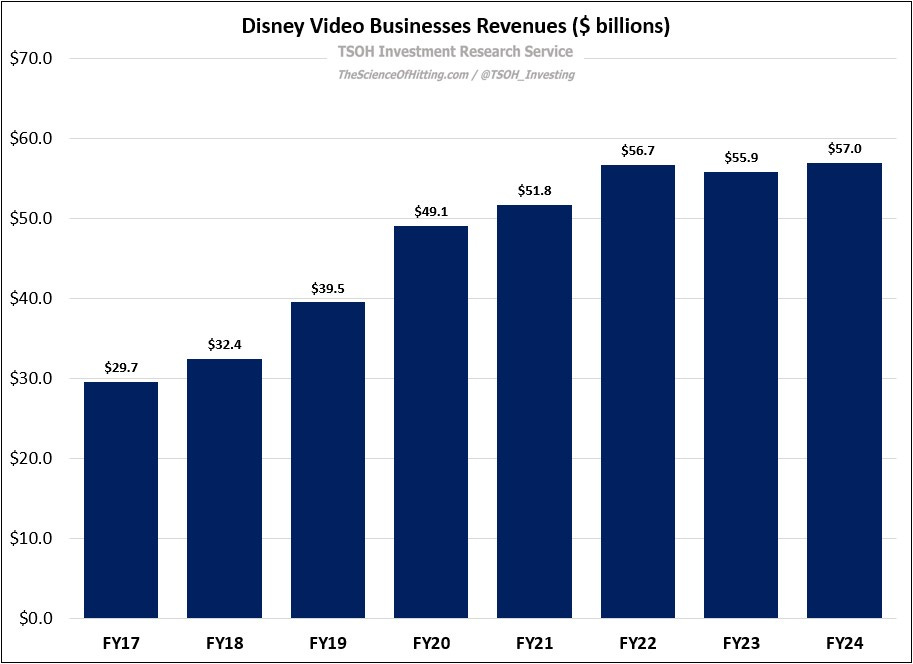

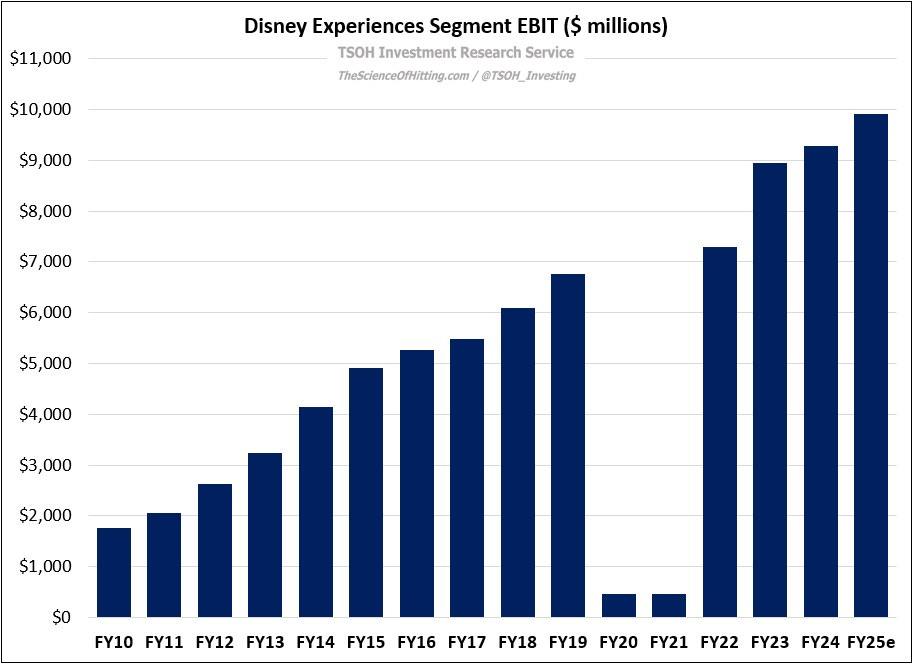

“At ~$89 per share, Disney has an enterprise value of ~$195 billion. For that price tag, you receive (1) the DPEP segment, with TTM operating income of ~$9.2 billion; and (2) the video businesses, with annual revenues of ~$55 billion. The big question is the future profitability of that second bucket. That’s a difficult question to answer – but these DTC pricing action, if well received, will go a long way towards paving the path to resurging profitability in the video businesses. I want to make sure I’m 100% clear on that point: in my view, that outcome is critically important for the future of Disney.”

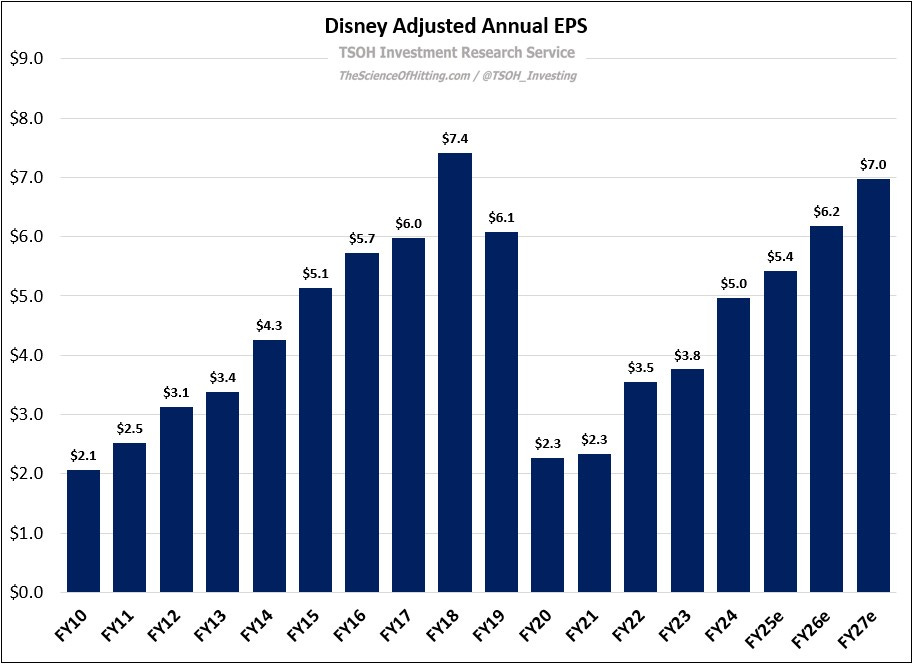

When Disney reported its Q4 FY24 results on Thursday, management put forward the following adjusted EPS guidance for the next three years: up high-single digits in FY25, up double digits in FY26, and up double digits in FY27. As you can see below, the net result on my estimates is FY27e EPS of ~$7 per share, close to the peak result reported in FY18 ($7.4 per share).

The two key variables that will drive this outcome are continued strength at Experiences, along with the turning point on profitability in Disney’s video businesses (linear, theatrical, content licensing, and DTC). I’ve written in detail about my long-term confidence on Experiences, most recently in “Turbocharged”, so I will focus today on the turn in the video businesses.

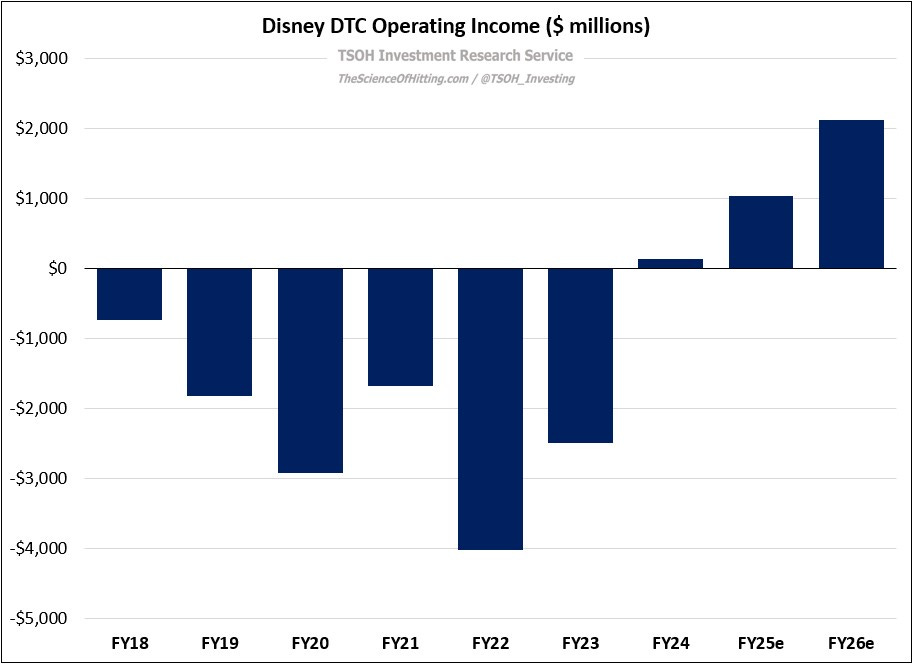

On the aforementioned financial guidance, management also provided some granularity on the segment contributions. Let’s start with Entertainment DTC (everything except for ESPN+, which is generating ~$2 billion in annual revenues and is roughly breakeven). In FY25, management expects that Entertainment DTC operating income will improve by roughly $900 million. Then, in FY26, they expect that Entertainment DTC will generate ~10% operating margins (excluding Hulu Live vMVPD). The following chart is a rough approximation of what that looks like in terms of Disney’s annual DTC profitability. As you can see, the FY26 guidance implies ~$2 billion in DTC segment EBIT, or an improvement of ~$6 billion relative to the ~$4 billion of DTC losses reported in FY22. Given that Disney generated less than $10 billion in FY22 pre-tax income, you can see why the maturation of the DTC business is, and will be, a substantial tailwind to their income statement.

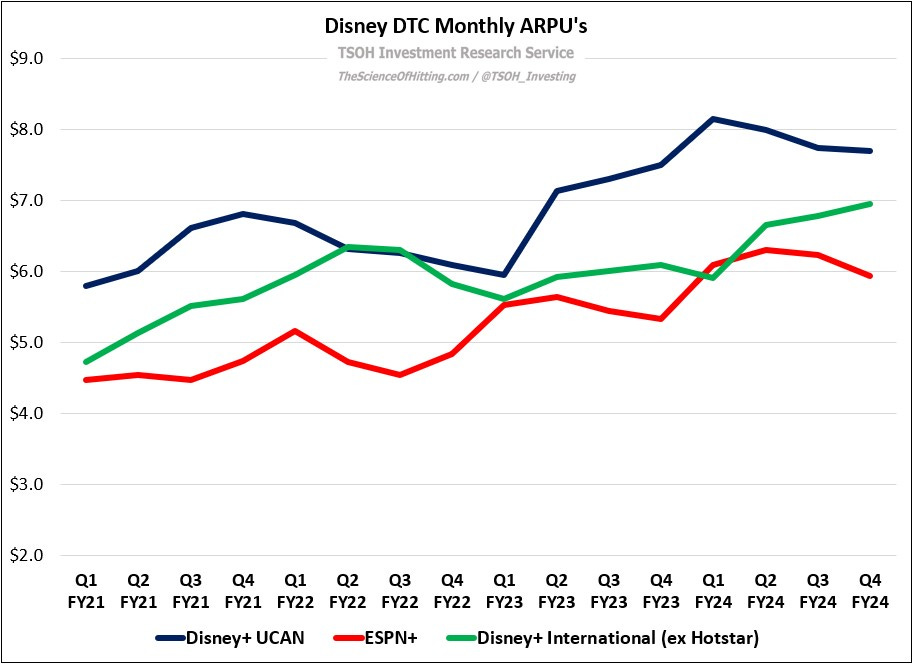

The variables that drove this improvement were paid subscriber growth, net pricing actions / higher ARPU’s, and cost efficiencies: compared to mid-teens DTC revenue growth, total segment expenses declined slightly in FY24.

I’ve talked about these factors on numerous occasions, and they remain paramount for the next leg of improvement in Disney’s DTC financials. (One of my ongoing concerns is the long-term trajectory at International, which exited FY24 with ~$5.5 billion in run rate revenues; they have tough decisions on sizing the “right” level of local content investments in certain regions.)

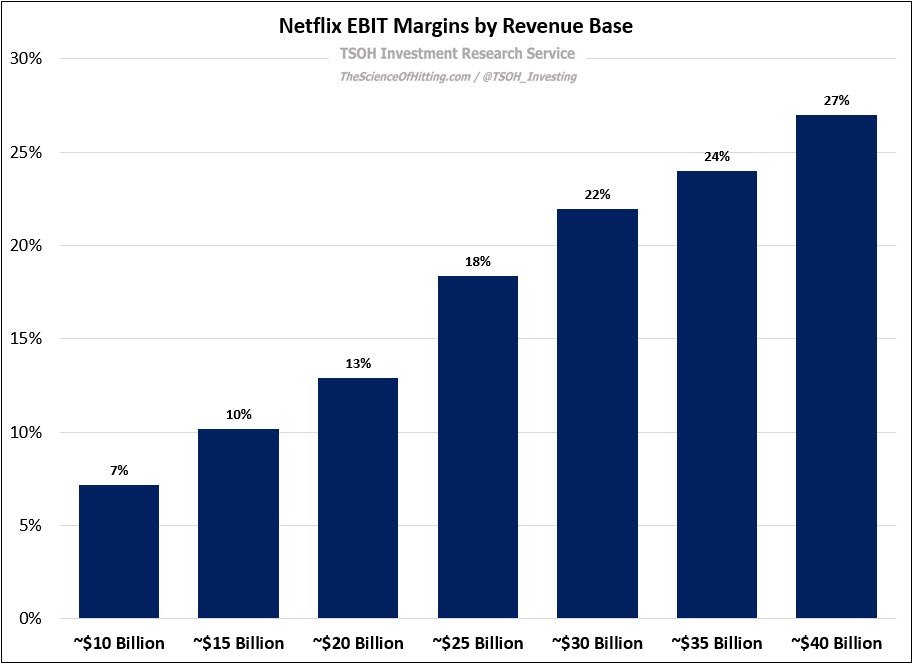

Note that the FY26 results above assume ~10% EBIT margins for Disney DTC; by comparison, Netflix’s EBIT margins in FY26 are likely to be ~30%. With Disney at roughly $22 billion in FY26e DTC revenues (ex Hulu vMVPD), their margins at that revenue scale are likely to be a few hundred basis points below where Netflix stood at a comparable size. While I suspect we may see some sustained gap between the two (call it ~500 basis points), I also think the following graphic offers a reasonable trajectory for Disney’s DTC margins as the business scales. Long story short, with successful execution against the long-term DTC opportunity, I believe that the ~$2 billion of DTC segment EBIT expected in FY26e could triple to ~$6 billion by the end of the decade. (In rough numbers, ~$35 billion in revenues with high-teens EBIT margins.)

The story gets trickier when we move to the legacy businesses, most notably U.S. linear pay-TV. As a jumping off point, let’s think about something that Disney CFO Hugh Johnston said on CNBC when he was asked about Comcast’s announcement that they may spin / sell their linear TV business: