Disney: Iger's Strategy Shift?

“You might not feel like you can do much now, but that's just because you're not a tree yet. You just have to give yourself some time. You're still a seed.”

- “A Bug’s Life”

With Bob Iger’s return, this was a highly anticipated call for The Walt Disney Company. Meaningful changes were expected, and it didn’t disappoint (of course, the implementation of those changes will take time). This section of the call, when Iger discussed the plan to drive growth and profitability in streaming / DTC, was the most noteworthy part of his opening remarks:

“With that goal in mind, we will focus even more on our core brands and franchises... We will aggressively curate our general entertainment content. We will reassess all markets we have launched in and also determine the right balance between global and local content. We'll adjust our pricing strategy, including a full examination of our promotional strategies. We will fine-tune our advertising initiatives on all streaming platforms. We will improve our marketing, better balancing platform and program marketing, while also leveraging our legacy distribution platforms for marketing and programming. This may include greater use of legacy distribution to increase revenue and more effectively amortize our content investments.”

That covers a lot of ground. And while Iger’s remarks are presented as the answer to the streaming problem, I think it also requires us to reconsider the question. To return to what I discussed in “It’s All About Scale”, each streamer has an important decision to make: go wide or go deep. The acquisition of the 21CF assets, by far the largest deal in Disney’s history (and which was completed during Iger’s prior tenure), suggested they intended to go wide.

The strategy over the next few years aligned with that posture, with the company delivering very impressive subscriber growth along the way.

But that seems a bit up in the air now.

The decision to “aggressively curate our general entertainment content” is noteworthy, as is the decision to separate ESPN and ESPN+ into its own segment. These actions indicate that Iger is reconsidering some aspects of the strategic direction of The Walt Disney Company. If I’m correct, it will have implications for the company, as well as for the media industry.

DPEP (Disney Parks, Experiences, and Products)

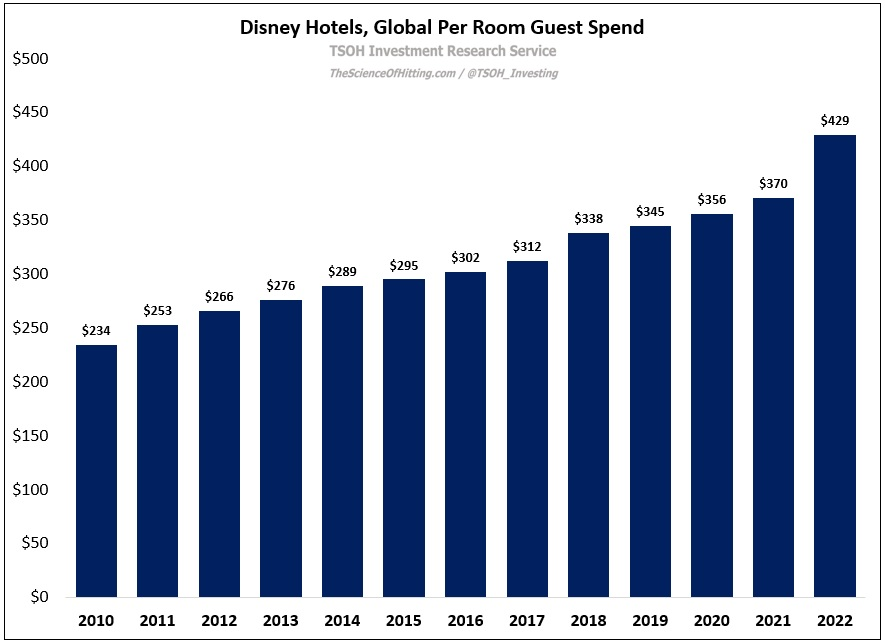

Before we dive in on the content / video businesses, let’s take a second to look at DPEP. Long story short, the segment continues to generate strong results for Disney, while simultaneously making some necessary adjustments to the aggressive actions taken under former CEO Bob Chapek. This is most evident at the domestic parks, which reported 30%+ EBIT margins in Q1 FY23 on the back of strong attendance and per capita guest spending, as well as the first full quarter of results for their newest cruise ship, the Disney Wish. The company is (rightly) pulling back on some of the nickel-and-diming implemented under Chapek’s leadership – for example, adding ~$20 parking fees for a guest who’s already paying hundreds of dollars a night to stay at a Disney hotel. The company may not sustain record high profit margins, but that’s okay; this is, and will continue to be, a very strong business. As long as they truly prioritize the guest experience and leverage their IP, “the most magical place on earth” can charge enough to earn attractive returns.

The strength of DPEP also speaks to the advantage of Disney’s business model; as Iger noted on the call, “Virtually every dollar we earn, every transaction, every interaction with our consumers, emanates from something creative.” The company’s strength in DMED and DPEP is inextricably tied to its brands / IP. (The turnaround underway at Disneyland Paris is a great example of this strategy in action). By extension, given the outsized impact of its best-in-class IP and effective monetization through multiple channels, Disney has the ability to spend – either organically or inorganically – at a higher level than its peers (or, at the same level, with better returns).

DMED (Disney Media and Entertainment Division)

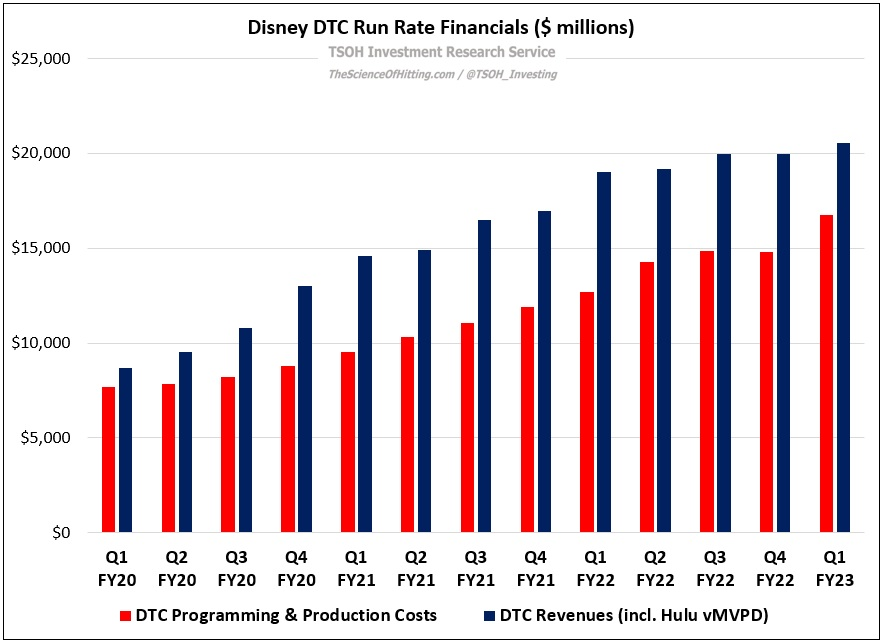

In its two primary video distribution buckets – linear and DTC – the DMED segment financials struggled in Q1 FY23 (a continuation of the longer term trends I discussed last quarter). In combination, Linear Networks and DTC reported $12.6 billion in revenues, up 2% from the year ago period; in terms of profitability, Linear and DTC collectively earned just $200 million in Q1, compared to $900 million in Q1 FY22. The fact that these combined businesses are facing short-term headwinds isn’t surprising; that said, the lingering question for Disney is how they will address that problem.

This brings us back to the Iger quote at the outset of the article, which I’d broadly summarize in three key points: (1) Refocus the portfolio in terms of content spend and marketing spend; (2) Shift the focus of the business from customer acquisition to driving ARPU’s; and (3) Effectively use the collection of distribution channels available to maximize the value of Disney’s content.

(1) On the first point, marketing spend is self-explanatory; on content spend, this is primarily focused on “aggressively curating” the general entertainment budget. As we think about general entertainment, we can broadly define this as anything that isn’t Marvel, Lucasfilm, Pixar, Disney Animation, or the top-tier / standout content from FX, National Geographic, etc. (The Simpsons and the Avatar franchise are two prominent examples that belong in that bucket).

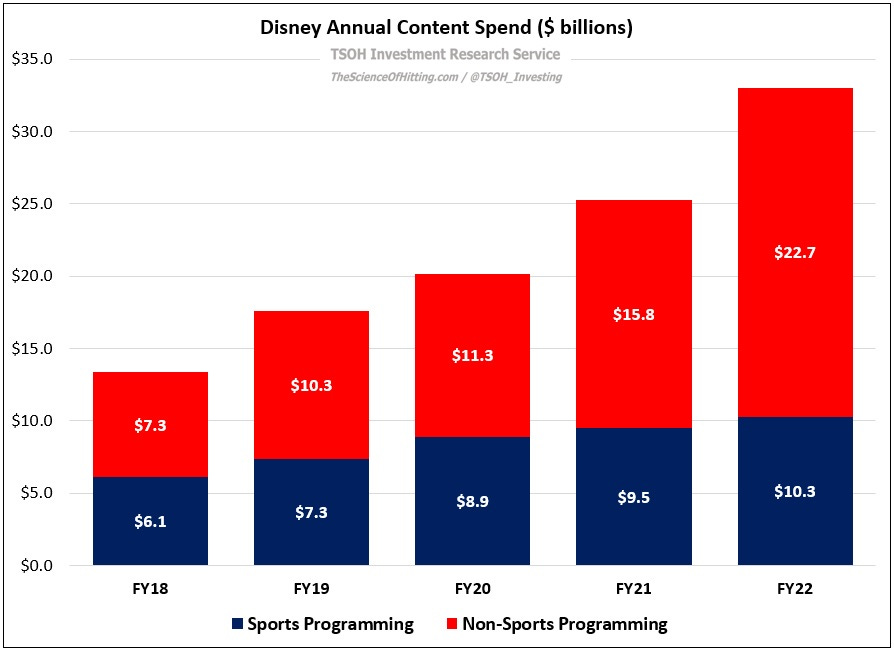

Over the next few years, Disney plans to cut its general entertainment content spend by ~$3 billion. On a total FY22 non-sports content budget of ~$22.7 billion, that implies a ~15% reduction (and a larger number if measured only on the non-Marvel / Lucasfilm / Pixar content spend).

In my mind, the most obvious bucket of what Iger’s focused on here is Hulu Originals / Disney+ Originals, meaning content that was created for first run distribution on these platforms (from there, we have to split the hairs further: The Mandalorian is clearly different from something like Pam & Tommy).

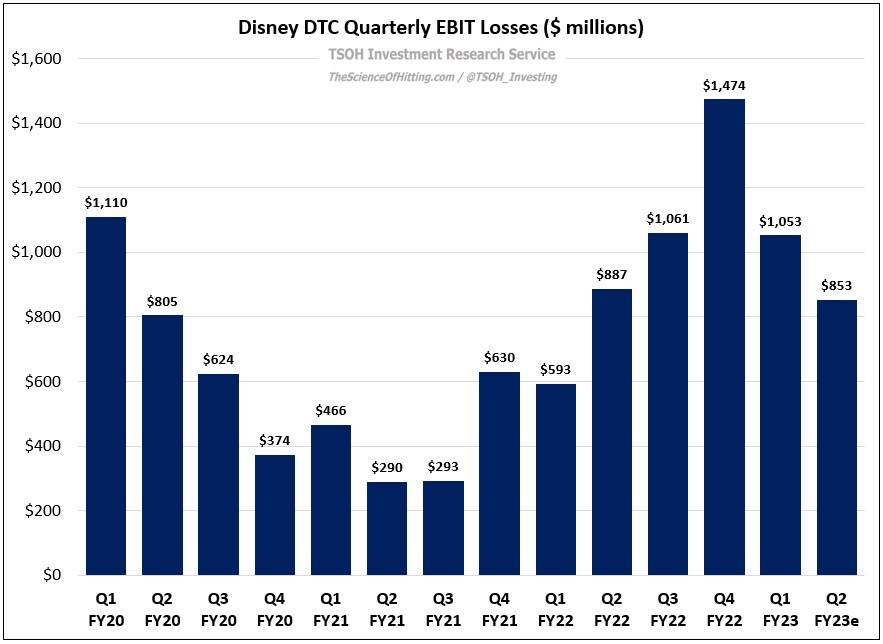

I see two different ways to think about this announcement: One is a major strategic shift back to a model that’s truly focused on the core IP (meaning Hulu Originals are out in the cold - but the same goes for ABC content, other Fox / FX content, etc.). In that scenario, you’d need to address the Hulu situation - more on this in a moment - in addition to their increasingly popular U.S. DTC bundle (how do you unwind it?). The other way to read it is this simply reflects rationalization following a peak for the industry capital cycle; that suggests an adjustment, as opposed to a major pullback from general entertainment. We don’t have a definitive answer, but my sense is Iger’s goal is closer to the second option. (And in his defense, Disney clearly needs to get its DTC businesses back on the right track: as shown below, the gap between run rate DTC revenues and run rate DTC content costs narrowed to ~$3.8 billion in Q1 FY23 - the lowest total reported since Q3 FY20.)

(2) On the second point (higher ARPU’s), this is aligned with the current trajectory; Disney spent the first few years of its DTC expansion focused on subscriber acquisition, and the shift to a focus on pricing is already underway. (That said, as Iger noted on the call, “I think we might have gotten a bit too aggressive in terms of our promotions [to attract new DTC subscribers].”)

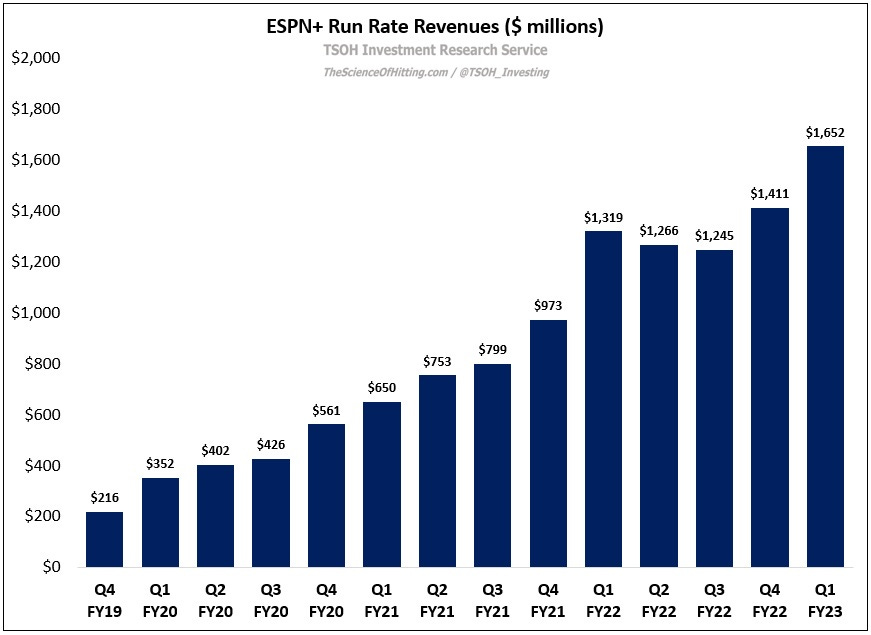

A good example is ESPN+, where the sub count and ARPU’s increased 17% and 7%, respectively, in Q1 FY23 (despite the ARPU headwind from rising penetration for the U.S. DTC bundle). The question here is unchanged: is the price charged for Disney’s DTC services / bundle outweighed by the value delivered? If so, there’s room to take pricing in the years ahead.

Importantly, we have some supporting evidence on the ARPU question: the company has taken meaningful pricing on each of its U.S. DTC services in the past six months, and it has not seen a notable impact on subscriber activity / churn. (Iger on CNBC: “The pricing was taken up by $3, from $7.99 per month to $10.99 per month… We had de minimis churn in subs.”)

I want to be perfectly clear (this is something I’ve discussed in the past): the long-term pricing of these DTC services is a massively important variable for the economics. Can Disney, a company that used to sell a single DVD for $15 or $20, convince tens of millions of U.S. households to pay $10 - $15 per month for access to its DTC services, and well north of $20 for its DTC bundle? (For context, current Disney+ ARPU’s in the U.S. are only ~$6.)

If you believe the answer is “yes”, as I do, the long-term economics in this business should be quite compelling. (The same idea applies around the world, but I focused on the U.S. business here for the sake of clarity.)

(3) On the final point, Disney’s distribution strategy has changed. This was exacerbated by the pandemic (when movie theaters were closed), but it also speaks to the question / role of content licensing. As I’ve argued on WBD, I think this is an approach that may make sense in theory, but which faces real issues in practice. (To be clear, I don’t mean this in terms of the theatrical window or their linear channels; I’m talking about licensing to other streamers.) In my view, this really gets back to the first point: if Iger is of the belief that they’re producing content that does not belong on its DTC services, it should be licensed – but that would also suggest that they need to rethink whether they want to own a general entertainment service (Hulu). On the other hand, I believe anything core to the platform(s) shouldn’t be available on other streaming services; over the long-term, that action dilutes the brand(s), customer experience, and their pricing power.

This isn’t a black or white decision, but it speaks to what I wrote in the most recent Netflix update: as others in the industry are forced to address the realities that surfaced over the past year, Netflix stands alone in its ability to remain 100% committed to the long-term opportunity in streaming. Whereas I once thought that Disney could largely avoid the trade-offs that PARA, WBD, and NBCU would be forced to address, that is somewhat less clear now.

In some ways, I think there are parallels between the discussions on licensing content / the general entertainment pullback and management’s hope of reinstating a “modest” dividend in 2024; both strike me as a bit misguided (albeit not the biggest deal in the world) if Iger truly believes in the long-term global opportunity in streaming. At the same time, large DTC losses are a key reason why Chapek lost his job. With Peltz backing down after Iger announced his plans, this reveals something that I don’t think I give enough consideration to at times: Iger clearly understands what it takes to survive as a public company CEO (it demands the ability to make difficult trade-offs).

For Disney, DTC’s time as a seed has passed; now it must become a tree.

Hulu’s Future

In April 2019, when Disney announced the launch of its namesake DTC service (Disney+), Iger sat down for an interview with CNBC’s David Faber. When asked for his thoughts on the long-term opportunity in streaming, along with the economic rationale for pursuing DTC, Iger said the following: