Disney: Commence Phase Two

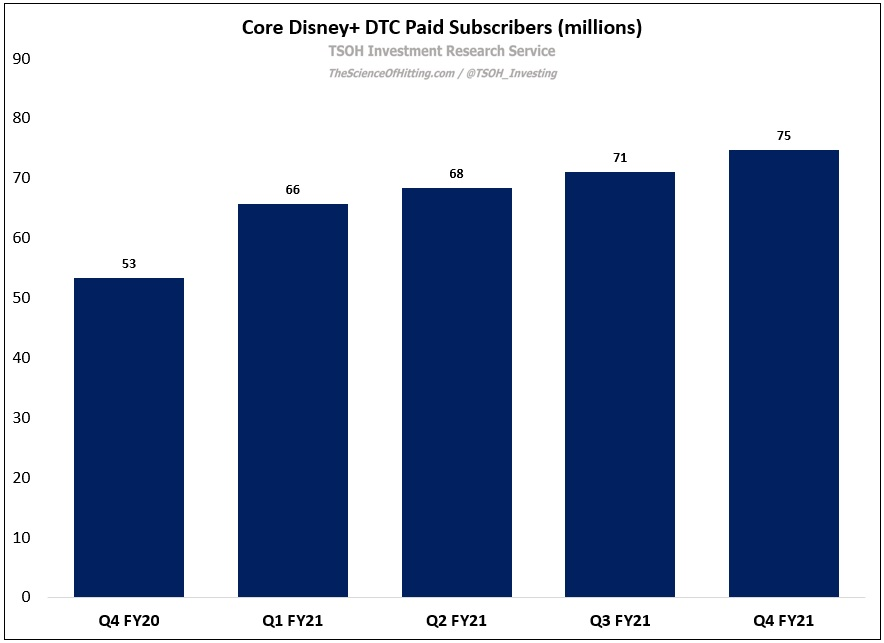

In November 2021, following Disney’s Q4 FY21 results, I wrote “Breaking The Dam”. That article was published at a difficult time for Disney; over the prior three quarters, the company had added less than ten million cumulative core subscribers for its namesake DTC service, a pace that fell well short of what would be necessary for the company to reach its long-term DTC subscriber targets. In that write-up, I examined the company’s broader DTC strategy, along with some thoughts on where I believed an alternative approach and thought process was likely warranted (particularly in the U.S.).

Fast forward to today, and the picture has changed pretty significantly. As shown below, the core Disney+ DTC offering now has 103 million paid subscribers, up 37% from the year ago period (+28 million core Disney+ subscribers). On the other hand, the DTC business continues to incur significant losses, with a TTM operating loss of more than $4 billion.

In addition, the U.S. pay-TV business is seeing accelerated subscriber losses, which presents a tricky situation for Disney. While Disney’s Linear Networks reported record revenues in FY22, along with $8.5 billion in operating income, management’s FY23 guidance suggests that they expect material incremental headwinds over the coming year. As I did following the Q4 FY21 results, I think recent events present a timely opportunity to take a step back and focus on one big question: is Disney’s strategy for the future of its video businesses - in DTC and linear - positioning the company to be a larger and more profitable enterprise over the long run? (If not, that would suggest it’s time consider an alternative course, most notably at ESPN.)

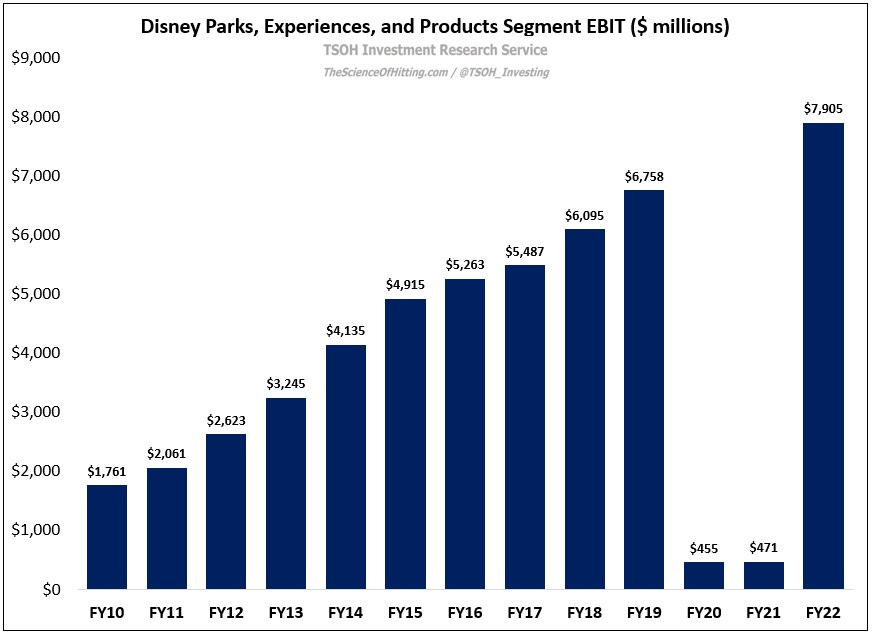

Parks, Experiences, & Products

Before we jump into the meat of the conversation, let’s take a quick moment to appreciate the strength in the DPEP segment (Parks, Experiences, and Products). This segment was directly impacted by the pandemic, which has resulted in major operational issues that continue to this day (at the end of October 2022, Shanghai Disney Resort was shutdown yet again). Despite these ongoing pressures, the segment generated $7.9 billion in FY22 EBIT, up 17% versus FY19. These results speak to the unique assets housed within this segment, as well as the changes that have been implemented at the Parks over the past few years. At a time when Disney’s core video business is navigating through significant change, DPEP has served as a much needed ballast. While DPEP isn’t immune to short-term macro headwinds, I believe this business remains well positioned for long-term success (with higher segment operating profits materializing over time).

Linear and DTC

Let’s look at two charts as a jumping off point for this conversation.

The first chart shows Disney’s linear networks, DTC, and content licensing / sales revenues from FY17 to FY22 (the third bucket includes the theatrical / movie theater business, as well as third-party licensing and DVD / Blu-ray sales). As you can see, reported revenues for these combined businesses reached $56.1 billion in FY22 – up nearly 100% from FY17. That result – a trailing five-year revenue CAGR in the mid-teens – provides compelling evidence that DTC, at least so far, has been materially incremental for Disney (even after accounting for the inclusion of the assets acquired from 21CF).