"It's All About Scale"

In “The Pickle Out Of The Jar”, which I wrote shortly after the WarnerMedia / Discovery deal was announced in May 2021, I quoted John Malone on the rationale for the combination: “You may remember you asked [a few years ago] about HBO Max, and I said I thought they were going to struggle with getting the kind of subscriber growth in the U.S. that they were hoping for. I think, in fact, that’s true… It’s an excellent service, but it’s a premium service at a fairly high price point… For me, the problem with HBO Max is that it had no ability to go international at the time. The combination with Discovery, given its existing, large presence in 200 countries, with a great brand and an administrative organization that kind of knows the ropes (an ability to localize services that may be created by Time Warner). To me that’s the big upside… Discovery already has a massive video presence around the world. So, the ability to promote, advertise, and introduce a new product or service from Time Warner, internationally, is going to get a huge leg up by the cross-promotion capabilities that exist in this combination.”

While I have great respect for Malone, I discussed in that write-up why I had continued doubts about the combined company’s ability to truly achieve international success – and as a result, global scale. As we fast forward to the present, I think this recent reporting from Variety is a timely reminder of the challenges that Warner Bros. Discovery faces in the global DTC business:

“As [WBD] looks to recalibrate its streaming priorities, it will no longer produce originals for HBO Max in the Nordics, Central Europe, the Netherlands and Turkey, and will also remove some content from its platform in order to free up licensing deals elsewhere… Variety understands similar decision-making is taking place in all territories where HBO Max operates, which spans the U.S., Latin America, and parts of Europe.”

I don’t want to overstate the conclusions drawn from a single article, but I’d note that this fact pattern (decision-making) aligns with what management has said as of late. For example, consider this comment from CEO David Zaslav (Q1 FY22 call): “We have no religion about any one platform or window versus another, and we intend to approach each and every decision through a lens of enhancing asset value against a set of financial returns. Our goal is to maximize long-term shareholder value and asset value, not just [DTC] subscribers. We will not overspend to drive sub growth.”

Whether WBD is pursuing this approach by choice or by necessity (a leverage ratio around 4.5x) is a moot point. Management has clearly communicated its views to the investment community: they’re not trying to win “the DTC spending war”. They might quibble with this next point, but I think it’s a fair one given their proposed course of action, as well as their asset base and current financial position: unlike Disney and Netflix, WBD does not have the ability and willingness to commit to the sizable long-term investments that will be necessary to achieve global scale in DTC.

(“HBO is a bit late on local originals. They’ve produced a few, and they are now [or were?] stating that local production will be more and more important, to be closer to the local audience and culture. HBO has been more focused on big American or English-speaking shows and films.”)

Of course, given that Mr. Market’s perceptions of these businesses has flipped over the past 6-12 months, you might argue that’s a good thing. Said differently, global DTC VOD is unlikely to be a good business for anybody.

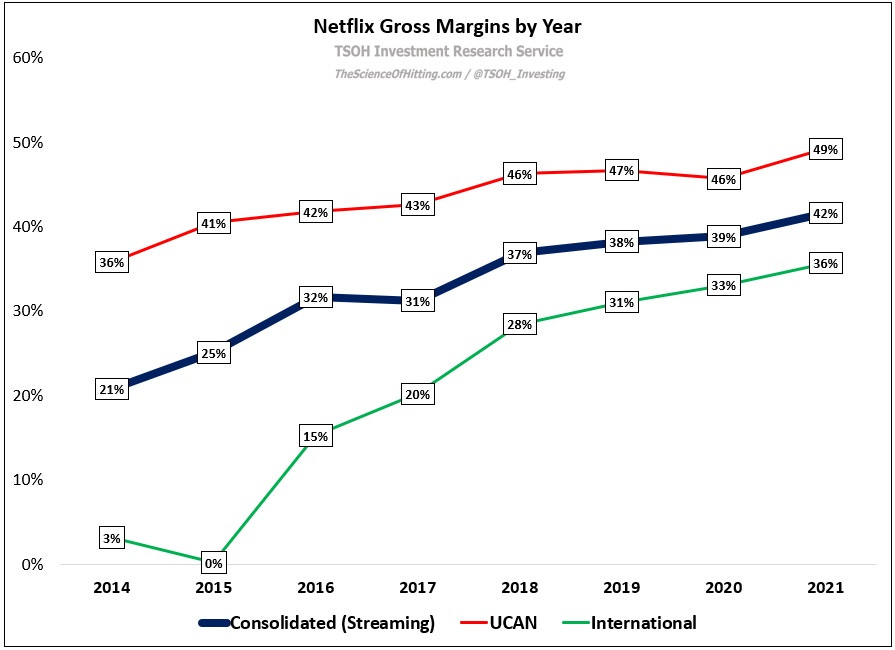

Personally, I think that’s a half-truth: it will only be an attractive long-term business for the companies who establish sustainable competitive advantages and execute against – and stay committed to - a sensible strategy. It requires significant upfront investments, but I believe the payoff for the winners will clearly justify the cost over time. (It also helps to think about this from a regional perspective, as I discussed in March 2022; it provides context on the lifecycle / maturity of the different “businesses”.)

DTC Strategy

At a high level, these companies have two options: go wide or go deep.