The Disney Streaming Playbook

Last week, I joined Michael Batnick and Josh Brown on “The Compound and Friends” to discuss recent developments in the global DTC video market, Airbnb's evolution during the pandemic, and the bull case for Meta, among other topics. If interested, you can listen to the podcast episode here.

(Recent Disney Posts: Q2 FY22, Q1 FY22, Q4 FY21, Theatrical and IP)

In April 2019, when The Walt Disney Company first unveiled plans for its direct-to-consumer (DTC) businesses, (now former) CEO Bog Iger sat down for an interview with CNBC’s David Faber. During that discussion, Faber asked why Iger believed that DTC would ultimately become an attractive business opportunity for the company (at that time, Netflix had ~150 million global paid subscribers but “only” generated ~$2.6 billion in FY19 EBIT).

This was Iger’s answer: “We have almost 100 years of creating great content that the world loves under Disney and then Marvel, Pixar, Star Wars and National Geographic. And I think when you start with a brand base that is that strong, you have an advantage in the marketplace because of the love that people have for that brand and the desire to be entertained by and spend money on those brands. We've seen that in multiple ways as a company. I grant you that in this new world, while we're still really learning about monetization, we enter this business with real strength in terms of the brand affinity that our products have. And I think that gives us not only the ability to reach more people, but it gives us the ability to do so in more economically viable ways.”

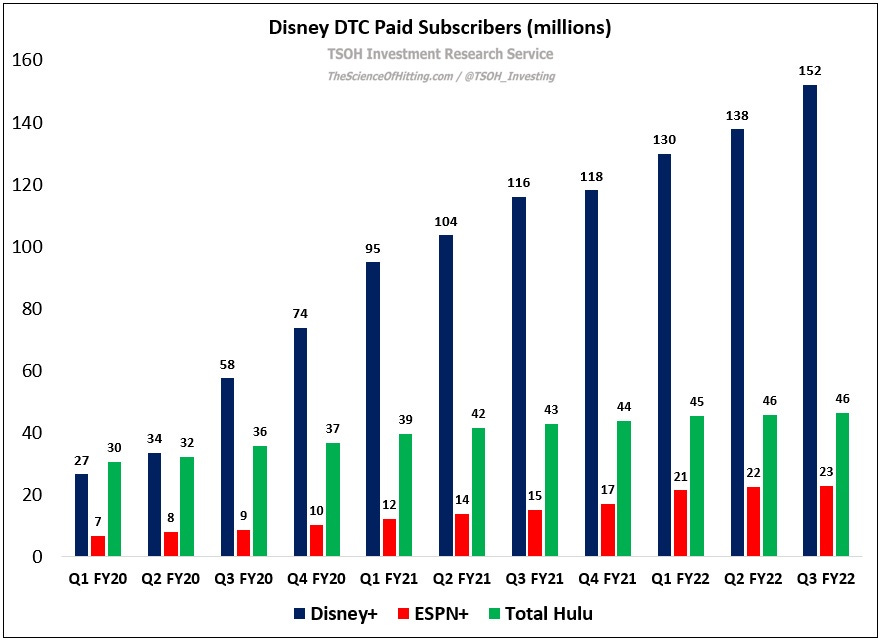

At that time, Disney’s goal for yearend FY24 was 60 – 90 million Disney+ subscribers, 8 – 12 million ESPN+ subscribers, and 40 – 60 million Hulu subscribers. As shown below, they’ve already exceeded the low end of the range for each service, with Disney+ and ESPN+ both reporting a paid sub base in Q3 FY22 that is >2x larger than the midpoint FY24 target.

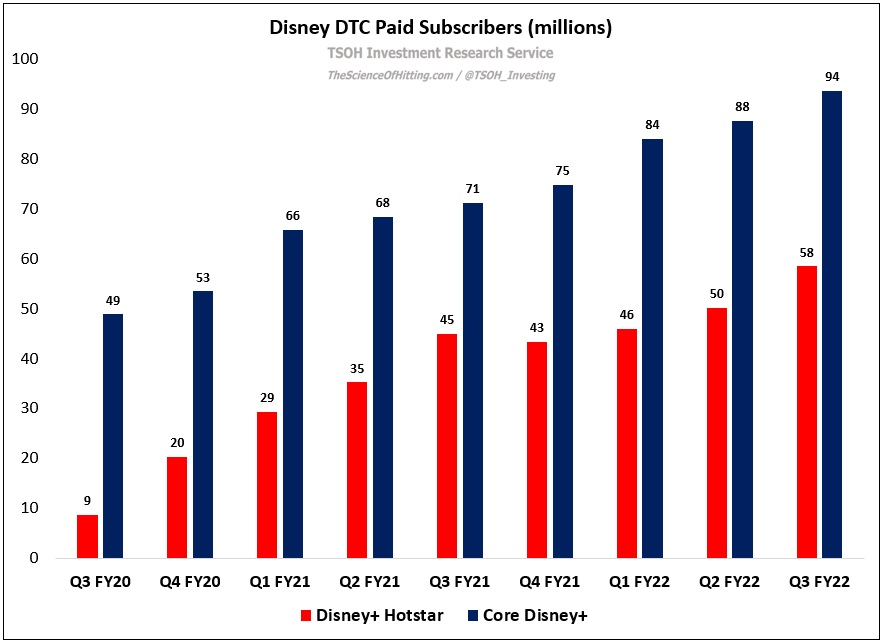

But as I’ve discussed previously, most notably as it relates to the Disney+ Hotstar service in countries like India, not all subscribers are economically equal. The goal isn’t to simply optimize for DTC volumes (global paid subs); it’s to maximize DTC revenues, which also accounts for pricing (ARPU’s).

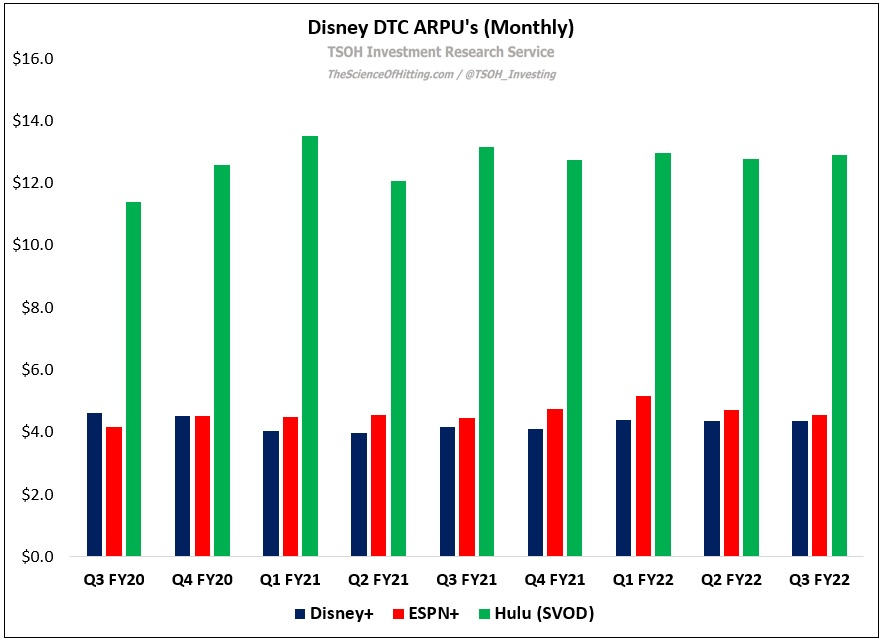

As shown below, Disney still has a lot of work left to do on this front. For it’s namesake service, the ~152 million subscribers are currently paying ~$4.4 per month (with core Disney+ at ~$6.3 per month and non-core / Hotstar at ~$1.2 per month). To put that number in context, Netflix’s average subscriber (globally) is paying ~$12.0 per month. As we look at the two leaders in global DTC VOD, that is the biggest point of differentiation; while Netflix has spent the past 5+ years commanding higher and higher rates from its subscribers around the world, Disney is still in the early stages of that journey. Returning to the Iger quote from above, this will be a critical lever for demonstrating the economic viability of their DTC businesses.

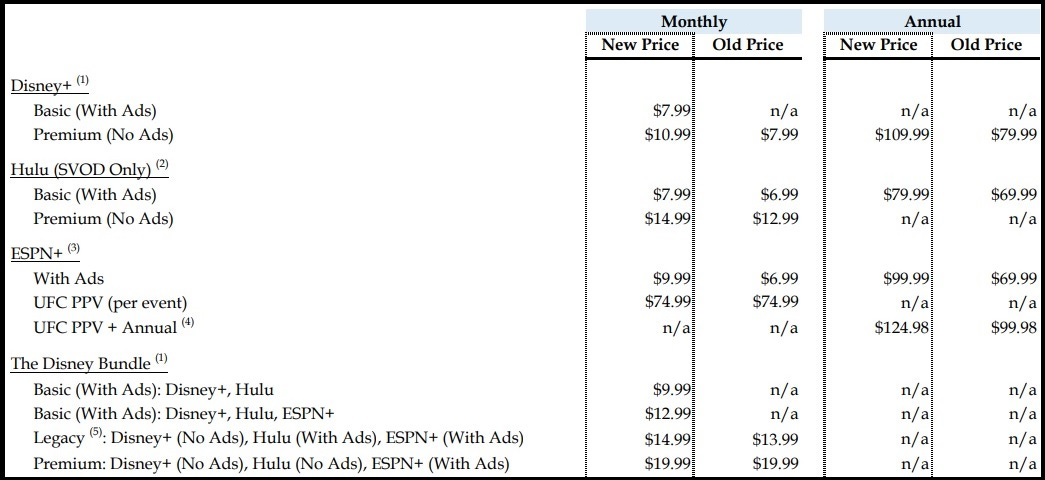

Disney’s DTC pricing power is about to face its first major test. As noted on the Q3 FY22 call, the company is implementing significant price hikes across its services, most notably in the United States. As shown below, this includes a 38% price hike for the subscription tier of Disney+, a 15% price hike for the subscription tier of Hulu VOD, and a 43% price hike for ESPN+.

Two things about these changes stand out to me.

First, note that the company is being much more conservative with its Bundle pricing (with the price for the Legacy Bundle increasing by $1 and the price of the Premium Bundle staying unchanged). As Jeff Bezos wrote in Amazon’s 2015 shareholder letter, “We want Prime to be such a good value, you’d be irresponsible not to be a member.” Disney is taking a similar approach with its DTC Bundle - which, importantly, they’re in a position to effectively do given the breadth and quality of their content; the company is pricing its offerings to nudge consumers to subscribe to all three DTC services, which can work if you have something for everybody in the family / household (demonstrate a reason to “pay” for each service). Given that ESPN+ “only” has ~23 million subs, we know that there are more than 20 million Disney+ and / or Hulu VOD customers who are not currently subscribed to the U.S. DTC Bundle; management clearly plans on trying to change that.

The second thing that caught my eye is the pricing changes on Hulu, as well as the introductory price of the new Disney+ ad-supported tier. As you can see, the company took the Hulu premium tier up by $2 (to $14.99 per month), but only increased the ad-supported tier by $1 (to $7.99 per month). Given what management has said about their all-in ARPU’s for the ad-tier (equal to or higher than the subscription tier), this pricing decision leads me to believe they are increasingly indifferent to which plan customers choose (purely from a financial perspective, they may prefer ad-supported subs). With a $7 price gap between the two Hulu tiers, that implies a significant ARPU lift from advertising. As we think about others in the industry like Netflix – which based on Nielsen data has >2x higher per user engagement in the U.S. than Disney’s DTC services – you can start to appreciate how an ad-supported tier can be a real gamechanger for these businesses. (Not only does it widen the addressable market, it’s accretive to the regional ARPU.)