Disney: "Driving Engagement"

From “Disney: The Turning Point” (August 2023): “I commend management for taking meaningful action, which will be critical to building a large and profitable DTC business…. I’ll be very interested to see what impact it has on customer behavior (all else equal, DTC would be profitable with a global ARPU lift of ~10%)… Management’s decision to aggressively raise (U.S.) DTC prices for the second time in ~10 months is an encouraging sign. In my mind, success here - meaning limited churn - would lead to more than just solidifying the base for the DTC business (clearly that’s very important too); it would provide line of sight for the future of ESPN. If they keep growing bundle subs while pushing ESPN+ ARPU’s north of $10, they will be in position to be more aggressive with the DTC transition for their marquee sports rights.”

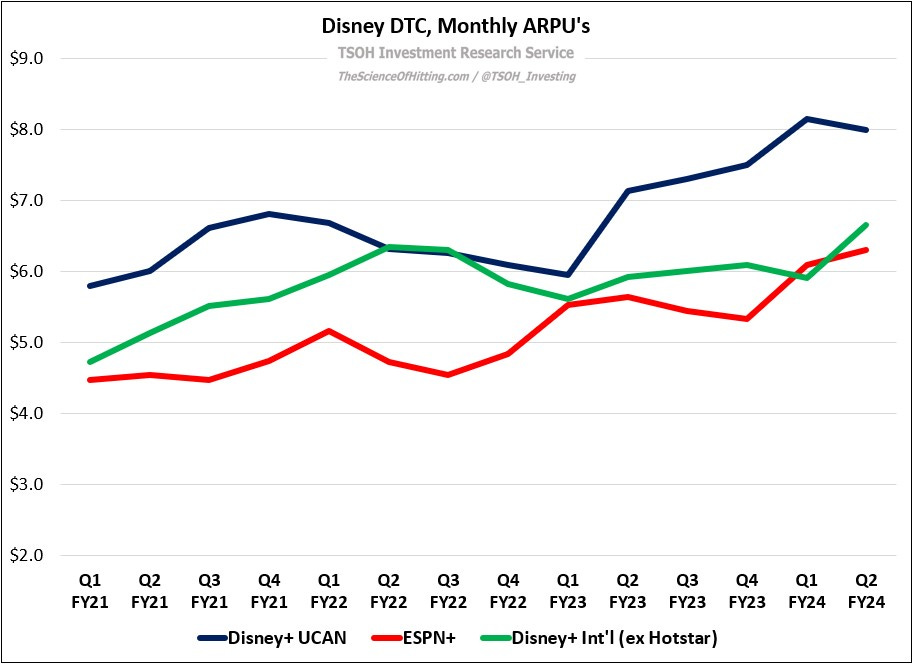

At a high level, Disney’s most recent round of DTC price hikes were a success; as they’ve pushed higher ARPU’s, we haven’t seen a material impact on paid subs, particularly in UCAN (we need some adjustment for the Charter deal, but the rough math is UCAN Disney+ subs were flat / up over the past 12 - 18 months despite 30%+ ARPU growth). At the same time, there are noteworthy developments beneath the surface; in my opinion, they provide key insights into The Walt Disney Company’s ongoing evolution.

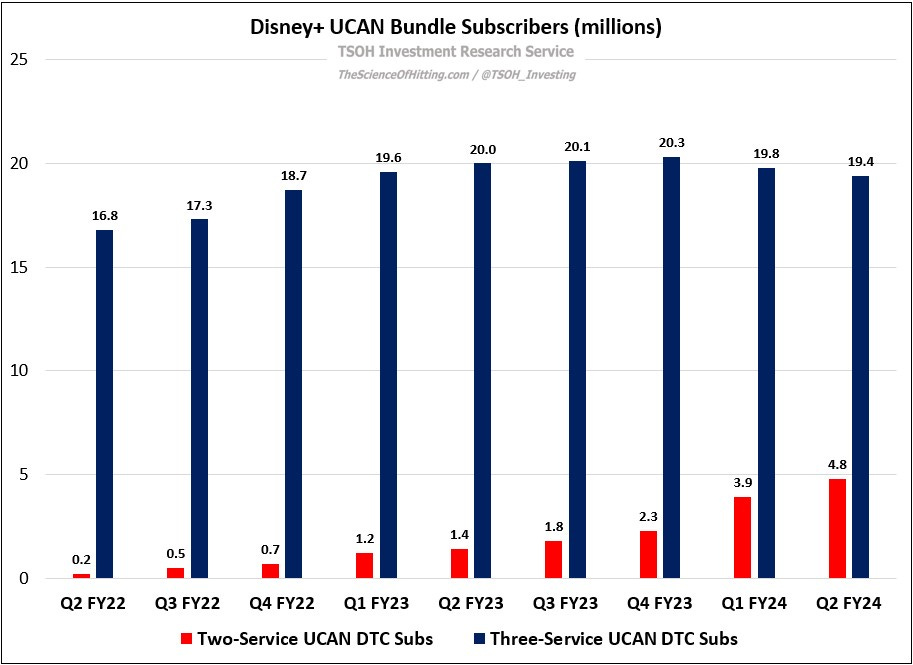

A notable example is the changing preferences customers are exhibiting with respect to Disney’s UCAN DTC bundles. As shown below, the two-service UCAN bundle (with Disney+ and Hulu) continues to gain ground, with nearly five million customers as of Q2 FY24. On the other hand, the three-service bundle, with ESPN+ for an extra $5 per month, has lost nearly one million net customers over the past six months (a mid-single digit volume decline).

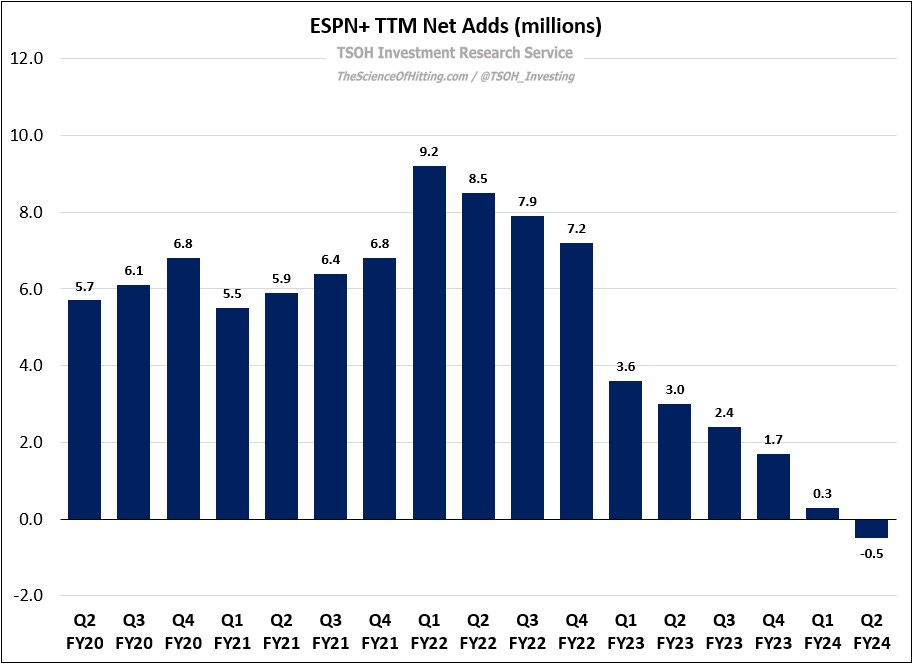

That is flowing through the ESPN+ metrics, which reported a YoY decline in paid subs for the first time in Q2 FY24 (down 2% YoY to 24.8 million). While CFO Hugh Johnston pointed to seasonality, I don’t think historic trends fully support that argument. To me, the more plausible explanation is that 20 - 25 million customers is somewhere close to saturation for a U.S. sports service largely populated with second-tier rights, particularly when it isn’t that easy for the average sports fan to discover compelling content in the current product structure. (They will attempt to address that last issue by adding an ESPN tile to Disney+ in the next seven months.) In tackling the real problem - the distribution of core ESPN sports rights - I hoped that ESPN+ would be the answer; six years later, it largely remains supplemental to ESPN flagship.

This, in my mind, is the crux of the issue.