DG: Driving Productivity

From “The DG Playbook” (March 2025): “While this [Home Depot] comparison is obviously influenced by industry-specific and macroeconomic factors at HD during the mid-to-late 2000’s, I see this as an instructive case study for Dollar General (DG) shareholders to think about. Today’s setup can work out very well if the base improves alongside sound capital allocation.”

DG shares, which are up ~75% thus far in 2025, are down ~35% over the past five years. That statistic helps to frame why the stock may still be an interesting opportunity: while we’ve come a long way from the lows, Mr. Market still isn’t a big believer in, or at least has some doubts about, DG.

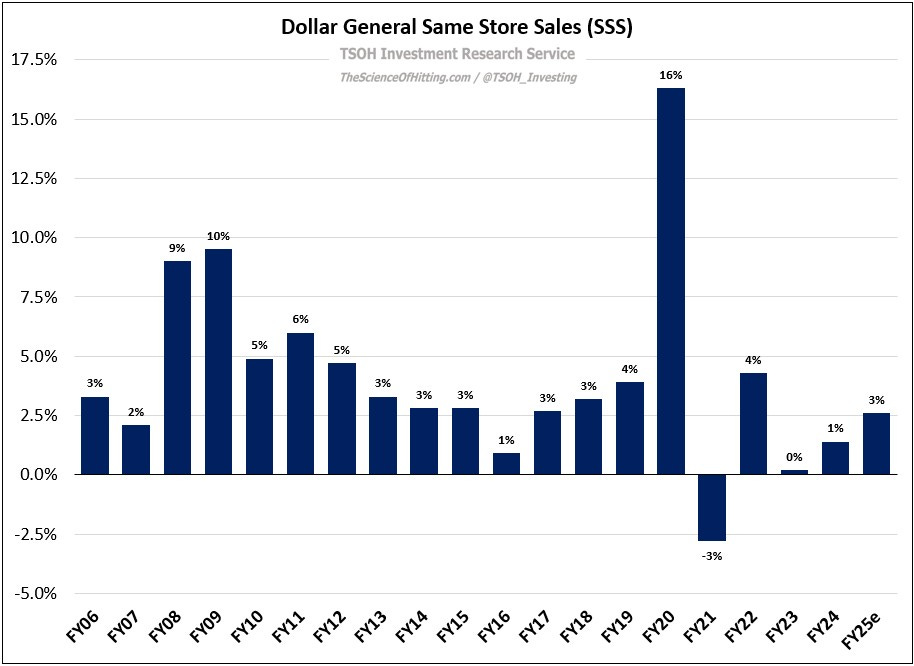

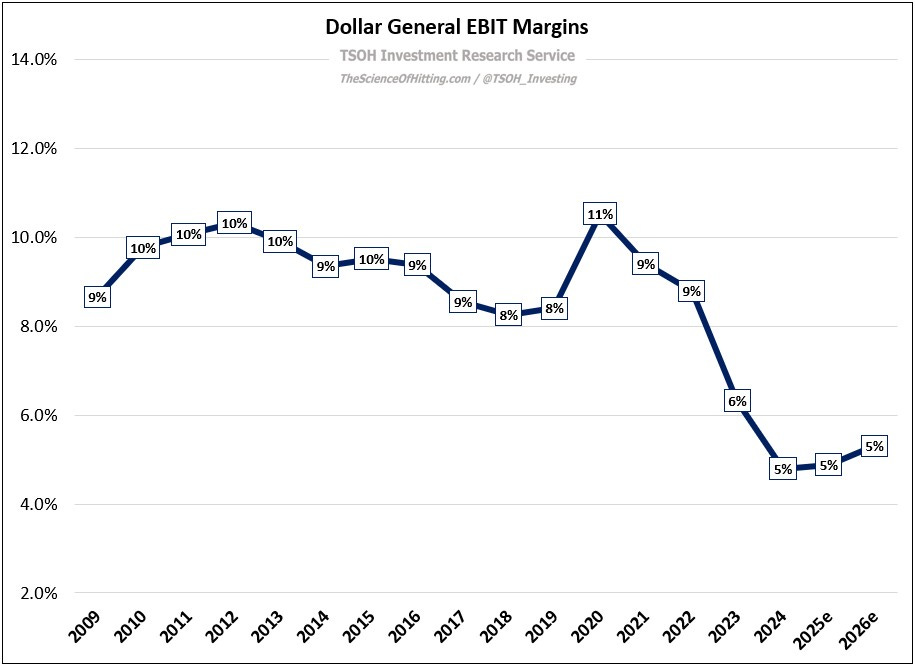

There’s some merit to his skepticism, which I think is largely captured among this list of factors / concerns: (1) relatively lackluster same store sales (SSS) growth over the past five years, albeit off +16% comps in FY20; (2) despite some encouraging recent progress, FY25e gross margins and EBIT margins of ~30% and ~5%, respectively, well below DG’s historic results (more on EBIT margins in a moment); (3) non-consumables weakness, which raises questions about heightened competitive intensity from companies like Walmart and Amazon; (4) slowing unit growth; and (5) leverage / capital allocation questions following the ill-timed share repurchases completed during FY20 – FY22 (~$7.8 billion at an average price of ~$215 per share).