Celsius: "Fully Optimized"?

Note: Here are the links to prior TSOH research on CELH and MNST

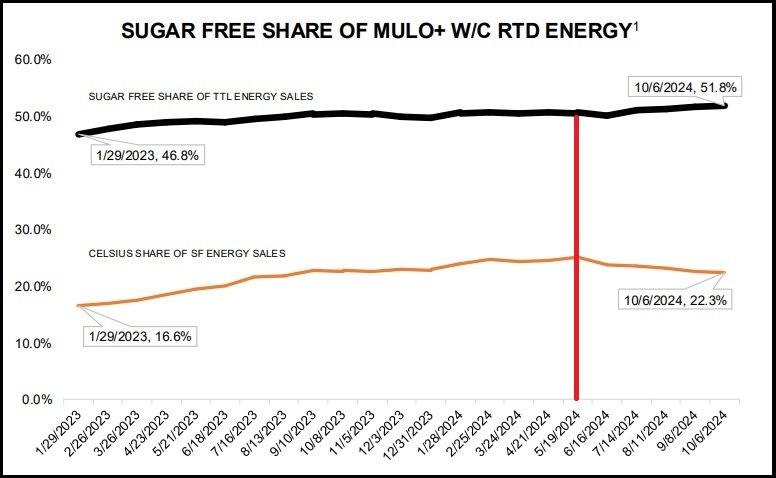

From “Competition Has Never Been Greater”: “Sugar-free energy drinks now account for half of the category, up from ~30% at the start of 2018. This has clearly worked to Celsius’ benefit, but it has also led to a competitive response from Monster and Red Bull… To quote management, ‘Competition within the category has never been greater… The full-sugar category has stagnated for several years, and the growth fight has moved to sugar-free.’”

In recent years, Celsius benefited from - or, more accurately, was the leading contributor to - the rising mix of sugar-free drinks in the category, while also gaining share in the subcategory. But in recent months, Celsius has started ceding some market share: on MULO+ W/C, their share during Q3 FY24 was ~11.8%, down half a point from Q2 FY24. (Celsius only competes in sugar-free, so they have a low-20’s share in their addressable market.) Combined with the broader category pressures I wrote about in September, that led to mid-single digit YoY growth for Celsius in the retail channel during the quarter.

That last comment speaks to another issue for Celsius: their reported results have become wildly disconnected from retail sales / customer consumption. The primary reason this happened is because of the strategic distribution agreement with PepsiCo that was signed in August 2022. Over the coming quarters (through YE 2023), Celsius’ reported revenues benefited as cans were added into Pepsi’s network, as well as from improved distribution (more stores and more units per store). That said, there was never any indication from management that the impact from the inventory build was a massive tailwind to the reported results; in a single quarter, the quantified incremental revenue tailwind from this infill never exceeded $25 million (in Q1 FY23).

When Celsius reported its Q1 FY24 results, CEO John Fieldly said the following: “Our revenues would have been higher, except that it was adversely affected due to inventory movements by [PepsiCo], which is beyond our control… Ongoing fluctuations may be expected in subsequent quarters because our largest distributor constitutes ~62% of our North America business.” He was correct to warn that inventory fluctuations might continue, but they have struggled to roughly quantify the likely impact. The most notable example occurred this quarter (Q3 FY24). When CFO Jarrod Langhans updated on this topic at an investor conference in June 2024, he said the following: “All indications are we’re in a good place now. I think we are kind of at the point where they’ve fully optimized their business.”

Management repeated a similar message in early August, with Langhans saying, “I think that we're in pretty good shape.” (As management would later disclose, the cumulative impact during 1H FY24 was less than $50 million.)

But that turned out to be a faulty assumption.