"Competition Has Never Been Greater"

An update on Monster (MNST) and Celsius (CELH)

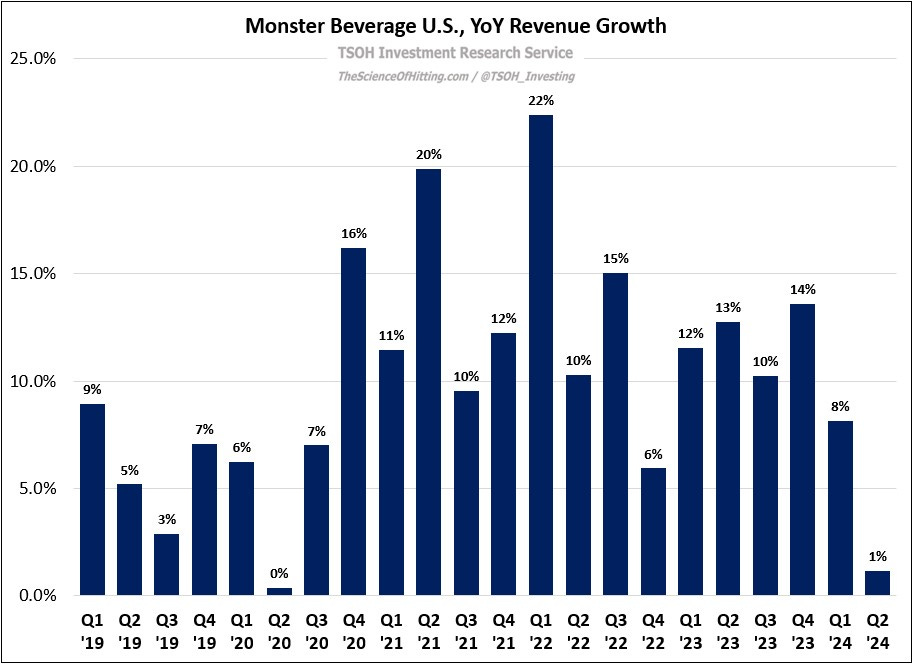

In April 2024, I initiated coverage on two of the leading U.S. energy drink companies, Monster and Celsius. Since that time, Mr. Market has turned more negative on each of them, with their stock prices declining by ~20% and ~55%, respectively, since the beginning of April. This comment, from Monster co-CEO Hilton Schlosberg during the company’s Q2 FY24 conference call, helps to explain this recent price action: “Historically, in the United States, we have only seen volume declines during the financial crisis and during the COVID lockdowns… The current situation is relatively unprecedented.”

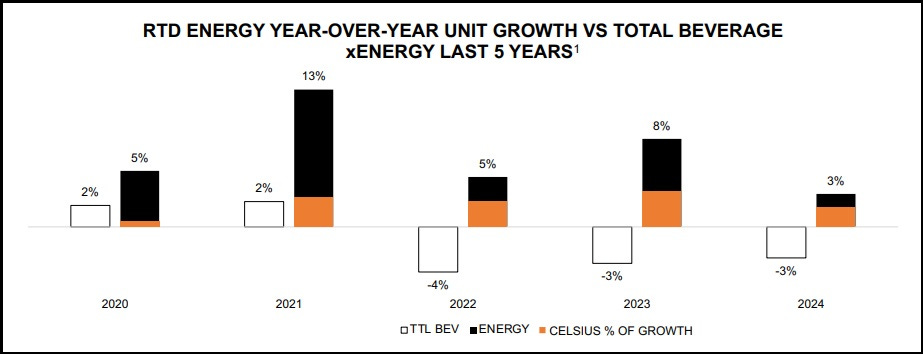

The following graphic, from Celsius’ Q2 FY24 slide deck, quantifies the slowdown in industry unit growth that has been experienced of late; note that the +3% YoY growth displayed for 2024 is a year to date metric, inclusive of 6% growth in Q1 FY24. To quote Celsius CEO John Fieldly, the category saw “systematic and unanticipated category growth pressures” in Q2 FY24.

As I noted in the initial write-up on each company, it’s important to appreciate retail channel exposures and customer demographics within the energy drink category. Here’s how Schlosberg framed it on Monster’s Q2 FY24 call: