"They're Actually An Asset"

A review of Disney's Q1 FY25 results

Note: Access all prior Disney (DIS) research on the TSOH website

From “Disney: The Path Forward” (August 2024):

“In management’s quarterly commentary, they wrote the following: ‘From movies to television, sports to news, theme parks to consumer products, Disney has an unmatched portfolio of businesses. Individually, each of these businesses is at the top of their industry - but what makes Disney distinct is the way these businesses work seamlessly together to generate value.’ The last line is presented as a statement, but I think it’s an open question: does their significant financial exposure to U.S. pay-TV, primarily as a result of their sizable sports rights distribution (ESPN) business, accelerate or hinder Disney’s ability to evolve and to maximize their ‘core’ assets?”

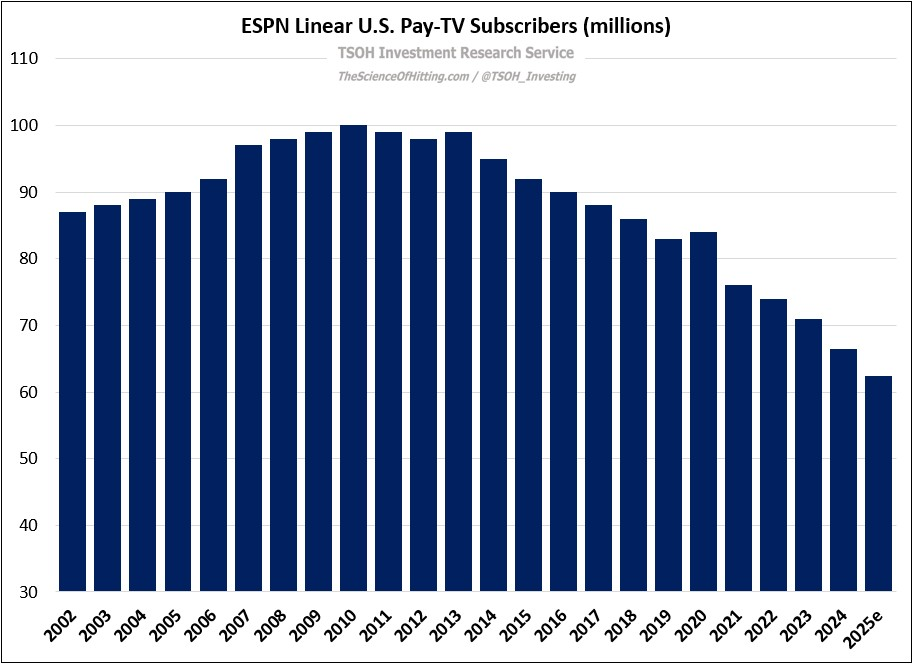

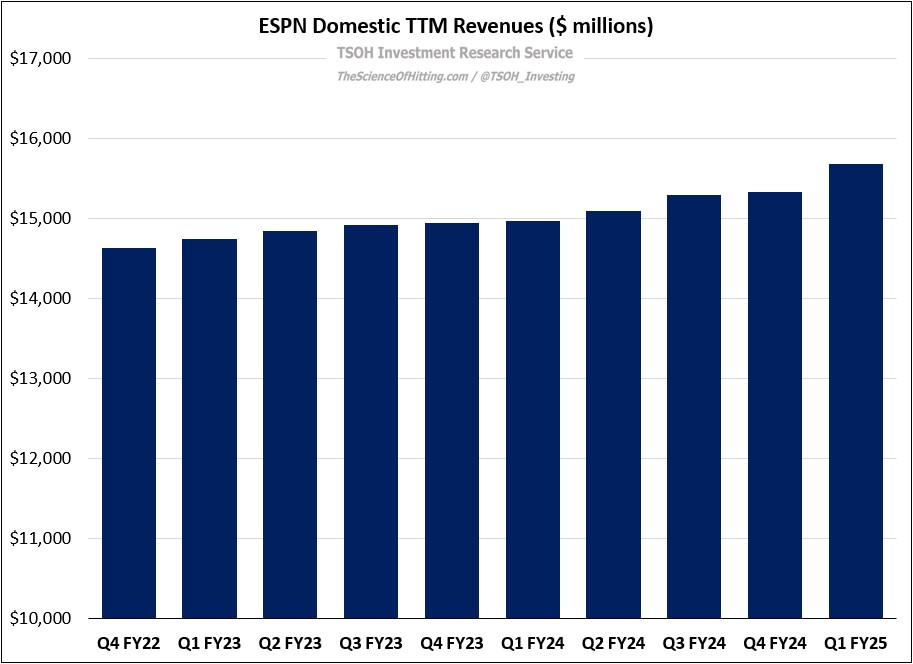

A good place to start today’s discussion is where Disney’s Q1 FY25 call ended; in response to the final question during the quarterly call, which referenced the company’s U.S. linear TV business, CEO Bob Iger said the following: “We’re at a point where the linear networks are not a burden at all; they're actually an asset.” As we think about that comment, a reminder that Iger said in 2022 - when he wasn’t Disney’s CEO - that traditional TV was “marching to a distinct precipice, and it is going to be pushed off” – a statement clearly aligned with the following ESPN linear distribution data. (ESPN has lost ~13% of its linear subscribers over the past three years; revenue growth primarily reflects the benefit of higher per sub affiliate fees.)

What explains the change of heart?

As opposed to just talking his book (that’s part of it too), I think this reflects an evolution in how Iger, and Disney, are responding to sustained pressures in U.S. linear TV. That evolution was apparent in another comment from Iger during the Q&A: “As it relates to ESPN, the goal all along is [was] to make it as accessible as possible, in as many ways as possible, to the consumer.”

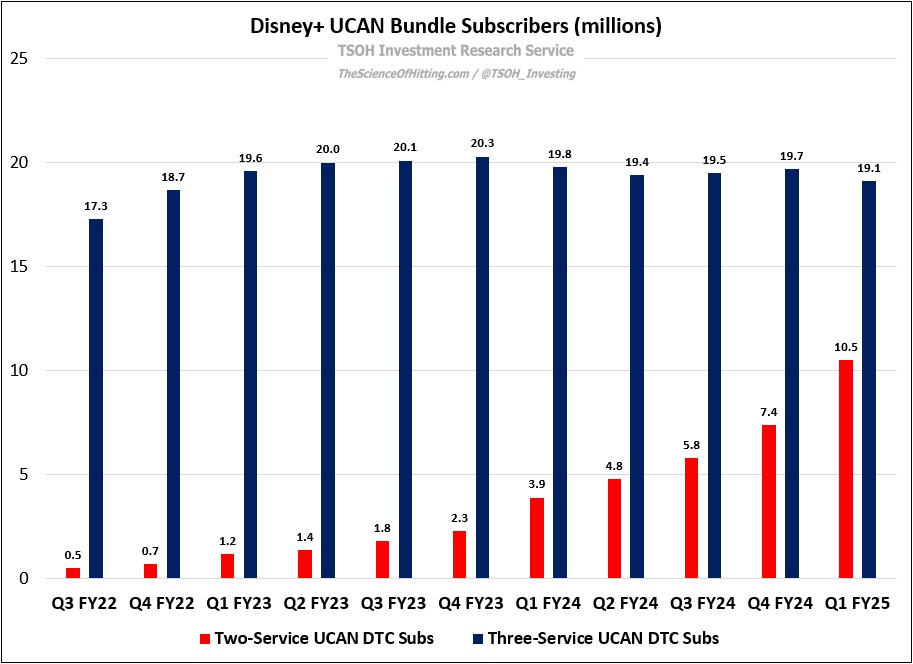

For those who have read TSOH Investment Research for some time, you will likely appreciate why this caught my attention: as I’ve argued many times, the problem with ESPN+ is that it’s largely supplemental; they have spent seven years pursuing a strategy that has not helped them to achieve Iger’s stated goal. On that point, I think their recent (successful) move to drive adoption of two-service UCAN DTC subs is indicative of a strategic shift, i.e. recognition that ESPN+ will not be a singular solution to the ESPN problem.