Disney: The Path Forward

From “Turbocharged” (September 2023): “That data [Disney’s Parks growth broken down between attendance and per capita guest spending] points to a potential risk for the Park, Experiences, and Products (DPEP) segment: at some point, Parks pricing moves out of reach for certain customers (families); that was exacerbated by nickel-and-diming on policies around digital photos and hotel parking, which have since been fixed. My read on the DPEP plans over the next decade is that these issues - affordability and accessibility - are high on the priority list.”

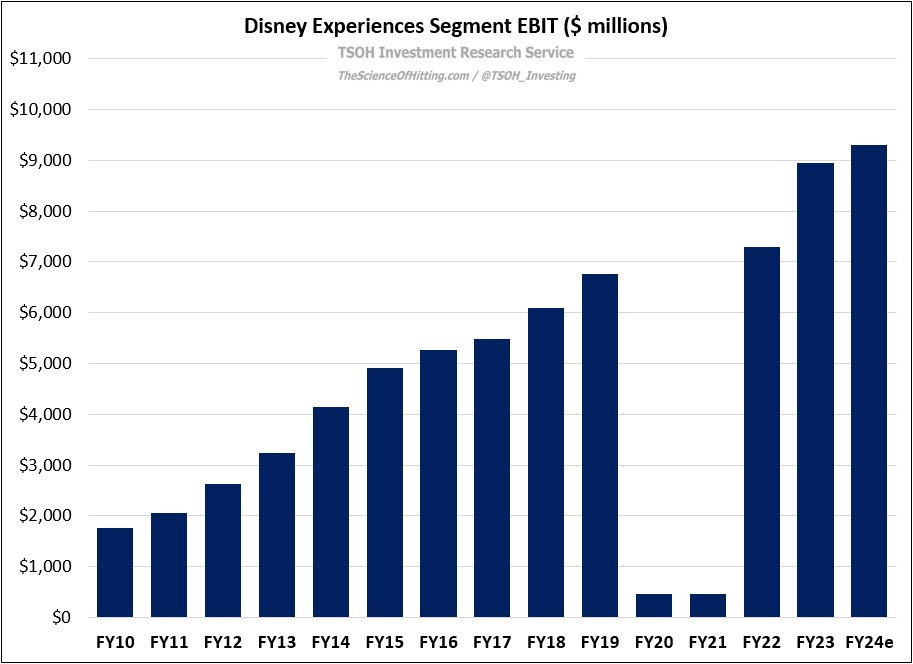

The most notable takeaway from Disney’s Q3 FY24 results is that the Parks business is facing near term challenges (which mirrors the commentary from Comcast management a few weeks ago). This follows 10+ years of stellar financial results, particularly after the pandemic. While bumps in the road were a certainty over a long enough time horizon, the tricky part for Disney is they still have plenty of work left to do in the video businesses, particularly as it relates to live sports rights distribution at ESPN (and success isn’t assured).