The Markel Style

Note: On a recent Sunday afternoon, I spent a few hours talking with Ben Gilbert from Acquired. Long story short, Ben signed up for TSOH after a fellow subscriber pointed him to some of my research on Costco (a big thank you to whoever told him!). If you have some time and would like to hear the history of Costco, give it a listen - Ben and David are masters of their craft.

From “A Long-Term Mentality” (April 2023):

“In a vacuum, the timing [of the equity sales] was atrocious. That said, as management wrote in the 2020 letter, that decision gave them the flexibility to continue writing insurance premiums at what they believed to be favorable rates. (They also needed the cash for the Lansing deal at Ventures, which was signed in the early days of March 2020; Lansing and Harvey collectively had 2019 revenues of ~$1.1 billion.) The subsequent results provide some support for that argument: earned premiums in the insurance operations in 2021 and 2022 (collectively) were $14.0 billion, nearly 50% higher than the $9.8 billion of premiums in 2018 and 2019. In addition, this business has produced very attractive underwriting results for Markel, with a cumulative underwriting gain in 2021 / 2022 of $1.28 billion, compared to $380 million in 2018 / 2019 (the past two years account for more than 40% of the cumulative pre-tax underwriting profits that have been generated in Markel’s insurance businesses over the past three decades).”

The improvement in Markel’s insurance business has largely continued into 2023, with earned premiums climbing 11% through the first half of the year (at $4.0 billion, 1H FY23 earned premiums were higher than the $3.9 billion reported for the entirety of 2016). A growing book of business, in combination with disciplined underwriting over the years (~93% combined ratio in 1H FY23), led to a pre-tax underwriting profit of $264 million for the first six months of the year. When added to the aforementioned $1.28 billion in 2021 and 2022, that brings the tally over the past 30 months to >$1.5 billion – higher than the cumulative underwriting income generated by the insurance businesses over the prior decade. (As it relates to the current environment in the insurance industry, this comment from the Q2 call was noteworthy: “There's a number of product classes where we feel it’s very attractive, where we're seeing great opportunities to grow… That’s one of the benefits of having a very broad and diversified product portfolio: we can sort of choose points that are most attractive in the insurance market cycle.”)

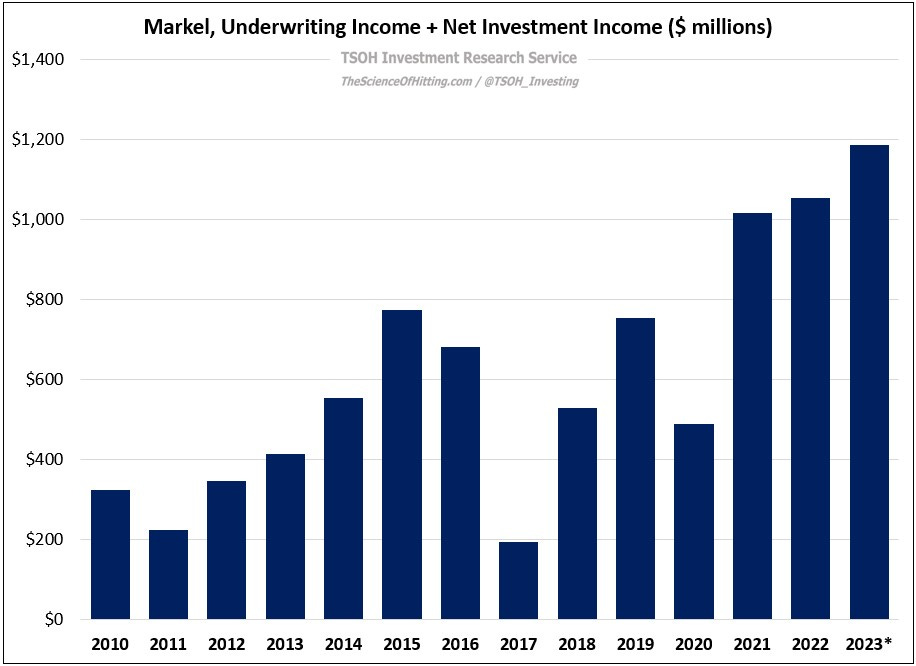

In addition to these attractive underwriting results, Markel has seen a significantly larger contribution from the investment portfolio. Net investment income in 1H 2023 totaled $329 million, an increase of ~75% from the year ago period (as shown below, run rate interest income was nearly $600 million in Q2 FY23). This reflects the impact of higher short-term interest rates, which has driven a meaningful increase in the interest income that Markel earns on its nearly $15 billion portfolio of fixed income and short-term investments (at four to five years, the duration on the fixed income securities is roughly matched to the expected duration of the insurance liabilities).

In total, the insurance businesses earned $593 million in 1H 2023. In the following chart, I’ve annualized that figure to show how it compares to the results at Markel since 2010. Long story short, the combination of premiums growth, effective underwriting, and the tailwind from rising interest income has led to a substantial increase in the profitability of the Insurance segment.

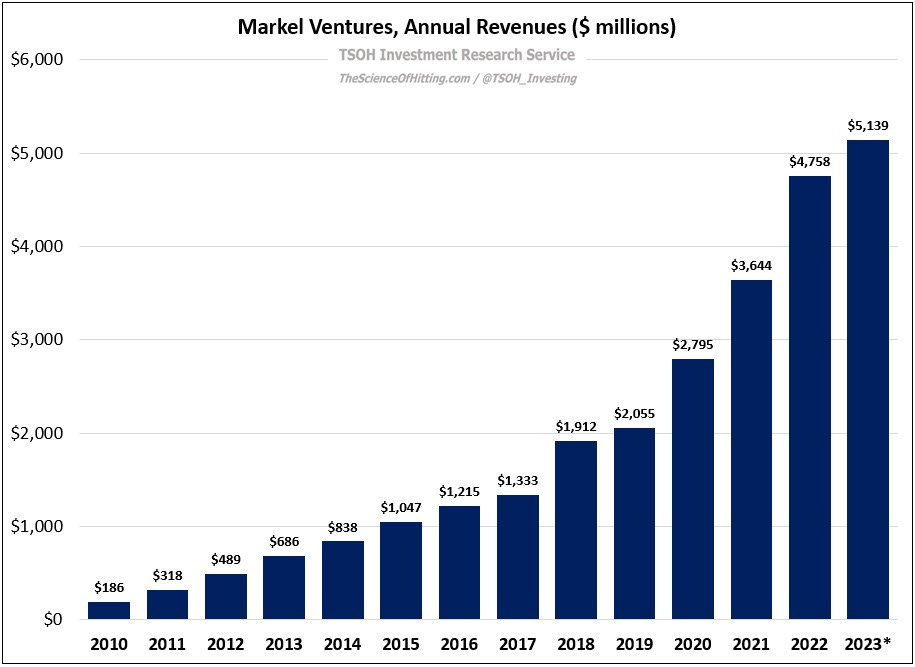

At Ventures, revenues increased 8% in 1H FY23; that result partly reflects a full reporting period from Metromont, with the low-single digit increase in Q2 FY23 likely more representative of current organic growth. As with the insurance businesses, I annualized the 1H FY23 profits (EBITA) to give a sense for the pace of improvement in the non-insurance businesses over the past 10+ years. (As a reminder, acquisitions have significantly contributed to the growth at Ventures; based on disclosures over the past 3-4 years, I think we can roughly guesstimate that the contribution to Ventures run rate annual revenues from VSC, Lansing, Buckner, and Metromont has been ~$2 billion.)

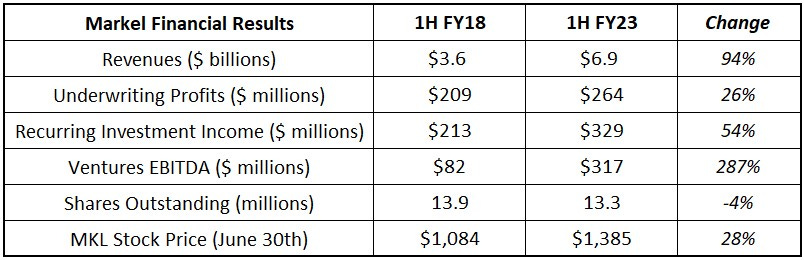

As we look back over the past five years, I agree with CEO Tom Gayner (from the Q2 call): “Markel’s share price on June 30, 2018, was $1,084; five years later, it stood at $1,385, an increase of 28%. This combination of facts, along with many other factors, seems to have created a situation where many of the indicators of the economic value of Markel have appreciated at a faster rate than the share price. In response to those circumstances, we've repurchased shares… our rate of repurchases was higher in 1H 2023 than in any other period. It's also a matter of public record that in five of the last six quarters, I’ve personally taken money out of my pocket to purchase Markel shares.” (Revenues are adjusted for investments gains / losses.)

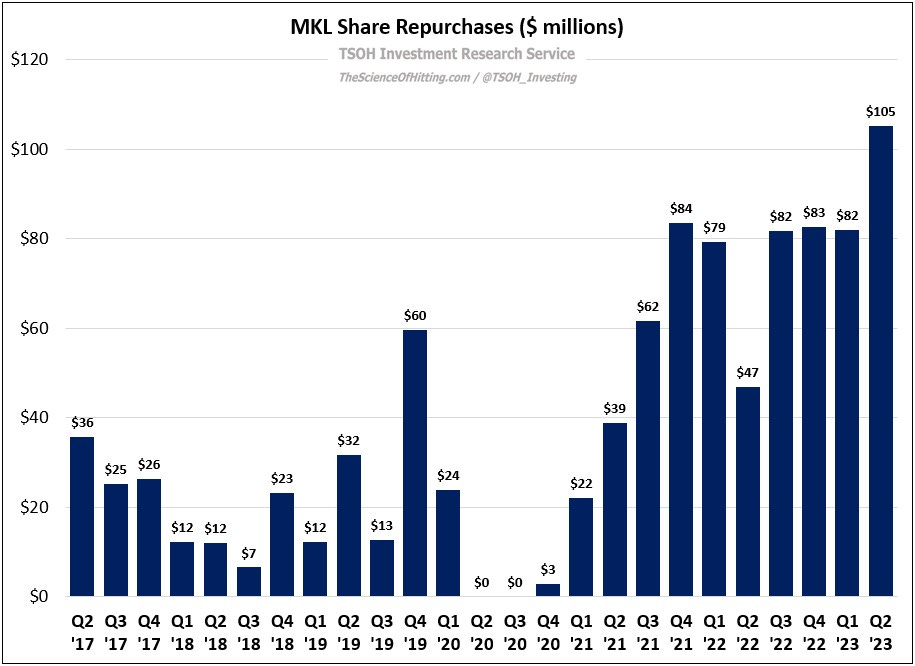

Here's the quarterly share repurchase activity over the past six years; as you can see, Markel repurchased $105 million of its stock in Q2 FY23 - the largest quarterly rate in its history (2017 was the first time that the company repurchased >$100 million in a year). In addition, Gayner has continued to buy more shares on the open market (he added another ~$148,000 of stock on August 7th). In total, these actions suggest management believes the stock is an attractive proposition near current levels; given my purchases in July, I naturally agree. (May 2023 Meeting: “Over the past year, the two largest buyers of MKL stock were Markel Group and Berkshire Hathaway - and I hope at least one of those two knows what they’re doing.”)

The Markel Style