Markel: "A Long-Term Mentality"

Markel CEO Tom Gayner: “At Davenport, I was assigned to cover Markel from the day of the IPO [in December 1986]... They had a long-term mentality from day one... I wanted to own the stock and be connected to the company.”

This update is long overdue. While I’ve owned Markel since January 2014, the company has been an infrequent topic of discussion since the launch of the TSOH Investment Research service. I’ll rectify that today. In this write-up, I’ll focus on four key topics: recent results in Markel’s insurance businesses; the ongoing evolution of Ventures (the non-insurance businesses); some notable capital allocation decisions over the past few years (most notably a meaningful reduction in their equity exposures during the early days of the pandemic – a decision management has been criticized for, but one that I believe isn’t as black or white as many might assume); and today’s valuation.

Insurance

Markel is principally a specialty insurer that’s focused on niche markets with hard-to-place risks (excess & surplus, or E&S, lines); some notable examples include summer camps, classic cars, gymnastics schools, horse owners / equine operations, and insurance for highly specialized professionals (“everybody from architects to zookeepers”). Markel focuses on markets where it has the underwriting expertise and unique knowledge to meet customer needs (difficult to replicate), combined with the discipline to avoid writing business when risks are underpriced. As management wrote in the 1986 letter (shortly after the IPO), their corporate strategy is “specialization and diversification”; nearly 40 years later, that description is still applicable.

As an example, consider the company’s experience with its specialty physician offering (through the Shand / Evanston unit). In the early 2000’s, when the market hardened and rates improved, the book of business increased seven-fold, from $14 million to $97 million. Then, as aggressive competitors drove down rates, annual volumes decline by more than 30% over two years. (“Shand’s professionals have repeatedly demonstrated the fortitude to walk away from underpriced business.”) This is one notable example of disciplined underwriting at Markel, which is critically important to long-term success in the insurance business (this may bring to mind what National Indemnity experienced throughout the years from 1980 to 2004).

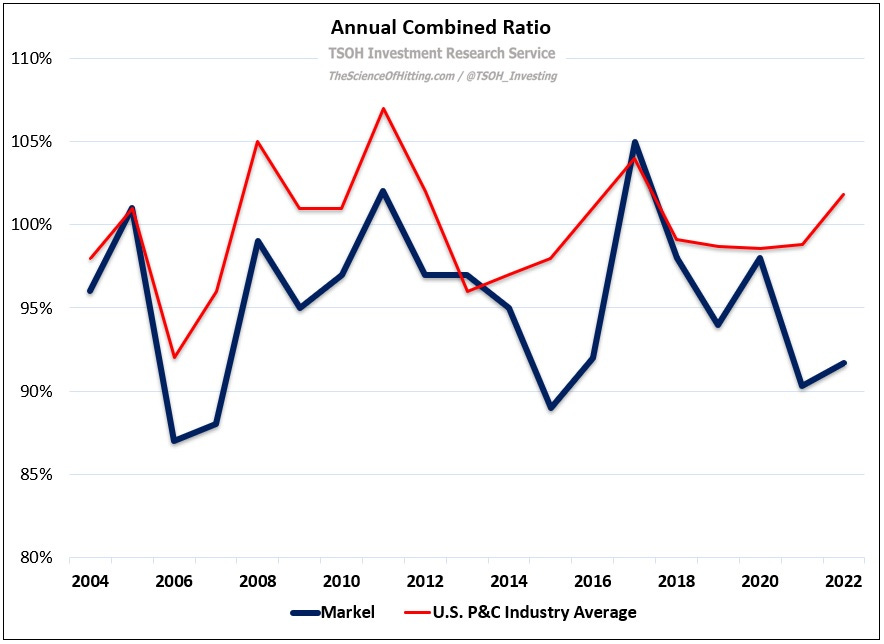

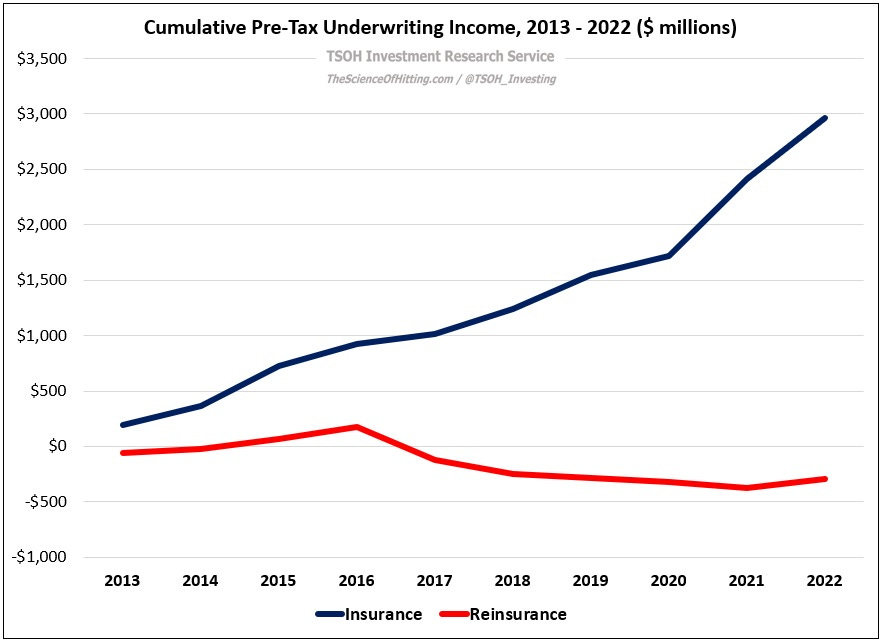

In terms of underwriting profitability, the combination of focus and discipline shines through: over the past decade, Markel’s insurance businesses have reported an average annual combined ratio of 95% - roughly 400 basis points lower than the U.S. P&C industry average. Markel’s results include favorable reserve development in each of the past 15+ years, which reflects the company’s conservative culture / underwriting assumptions. Aligned incentives play a role in these outcomes: as noted in the 2016 letter, Markel’s underwriters receive extra incentive compensation “if and only if our insurance operations produce an underwriting profit”. (The 2013 acquisition of Alterra, which nearly doubled the size of Markel’s insurance operations, greatly expanded its presence in Reinsurance; over the past decade, results within Reinsurance have lagged the Insurance segment by a wide margin.)