"Running On Clouds"

A winner in global premium sportswear

In 2005, Olivier Bernhard laced up his shoes for the last time.

But while Bernhard was at the end of a successful career in the world of duathlons and triathlons, he had already set his sights on another challenge: creating the perfect running shoe (“cushioned landing, explosive take-off”).

After tinkering with dozens of prototypes, Bernhard approached his former sponsor, Nike – but they turned him down. (“Had he been in Nike's position, Bernhard admits he might have laughed himself out of the room as well, because the prototype he presented was, in his words, hideous.”) Shortly after, Bernhard partnered with Caspar Coppetti and David Allemann to launch On Holdings (in 2010), followed by the addition of Marc Maurer and Martin Hoffmann in 2013, who became On’s co-CEO’s. The company’s name was inspired by the feeling Bernhard had running in their shoes: “He seemed to be floating above the ground - like running on clouds.” This culminated in a September 2021 IPO, at $24 per share (it closed on Friday at $38 per share).

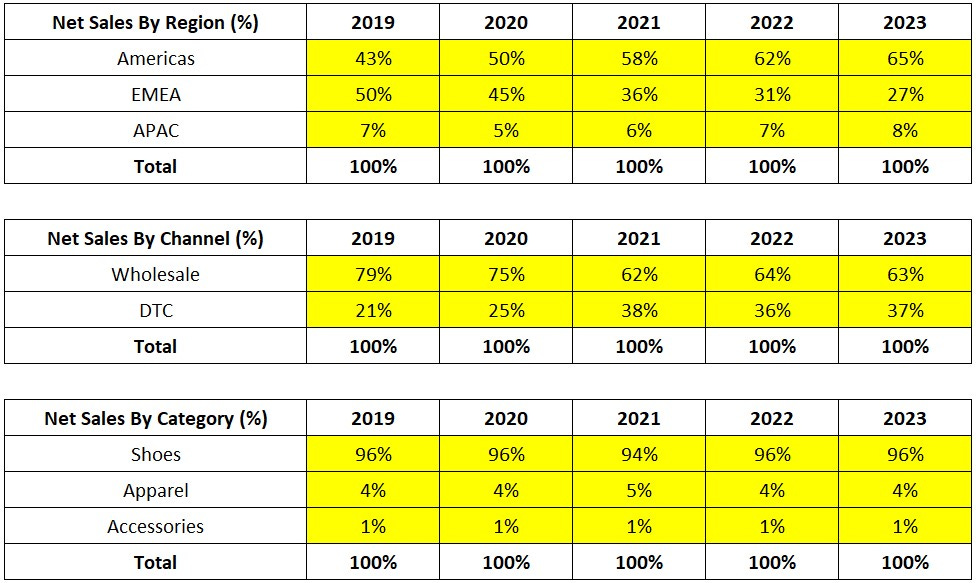

While On’s roots are in Switzerland, it moved quickly to establish a global presence. That includes expansion into major markets like Germany (2011), the U.S. (2013), Japan (2013), Brazil (2018), and China (2018). As a result, the business now has significant exposure to North America, primarily the U.S., which accounted for ~65% of its FY23 revenues. On’s shoes were originally (solely) distributed in specialty running stores, but they have since expanded to retailers like Dick’s Sporting Goods (currently in ~25% of DSG doors), as well as a sizable DTC business at nearly 40% of FY23 revenues.

What underlies geographic expansion and expanded global distribution is customer demand: management expects FY24 revenues of ~2.3 billion Swiss francs (~$2.5 billion), with a trailing five-year revenue CAGR of >50%.