Fever-Tree: A Broader Opportunity

From “Fever-Tree: A Premium Business?” (September 2023):

“I see a management team with a clear understanding of its position / role in the marketplace and a track record of strong execution, primarily in terms of continually solidifying their brand image and broadening its geographic reach and product portfolio… [They are] protecting / improving their valuable brand image and capitalizing on a global opportunity… Over the long run, I think this will result in continued growth and attractive economics for the business.”

In 2019, Fever-Tree (FT) reported revenues of £261 million, with nearly 50% attributable to a single product category (tonics) in a single region (the UK).

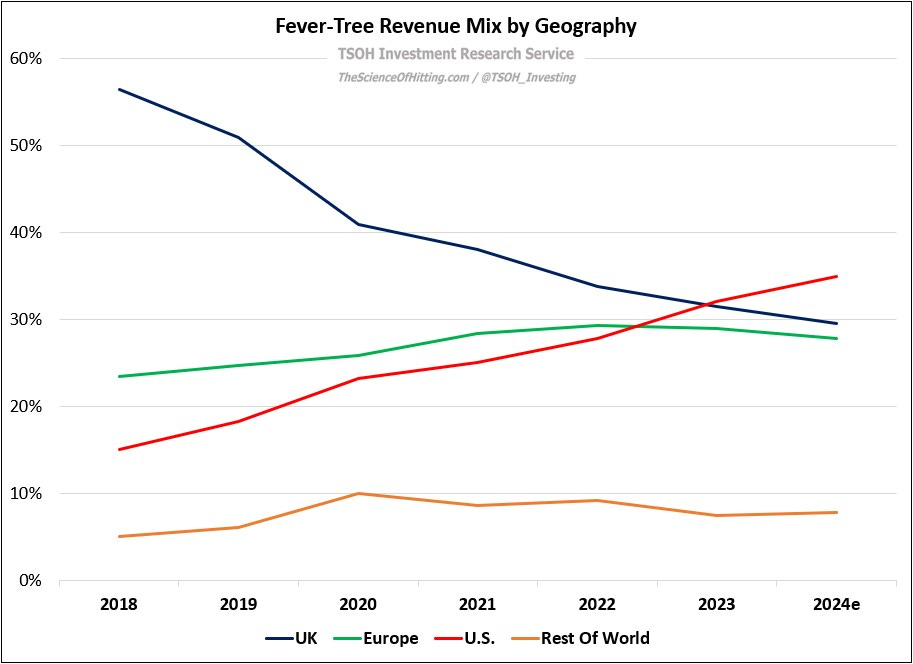

The subsequent results in that submarket have been discouraging: in 2023, FT’s UK tonics business generated revenues of £86 million – down roughly 25% from 2019. But despite a material headwind from a slice of the business that accounted for nearly half of FT’s revenues, the overall business still grew ~9% annualized for FY19 - FY23 (UK tonics fell to ~24% of 2023 revenues). That reflects two key developments: (1) geographic expansion, most notably a burgeoning U.S. business, and (2) product range expansion, leveraging FT’s top brand to pursue other mixer and beverage markets.

In summary, over the past few years, Fever-Tree became a business with different geographic / product exposures and medium-term growth prospects. As I’ll discuss in today’s write-up, my view is that these developments have led to broader and much larger long-term opportunities for the company.

The U.S.

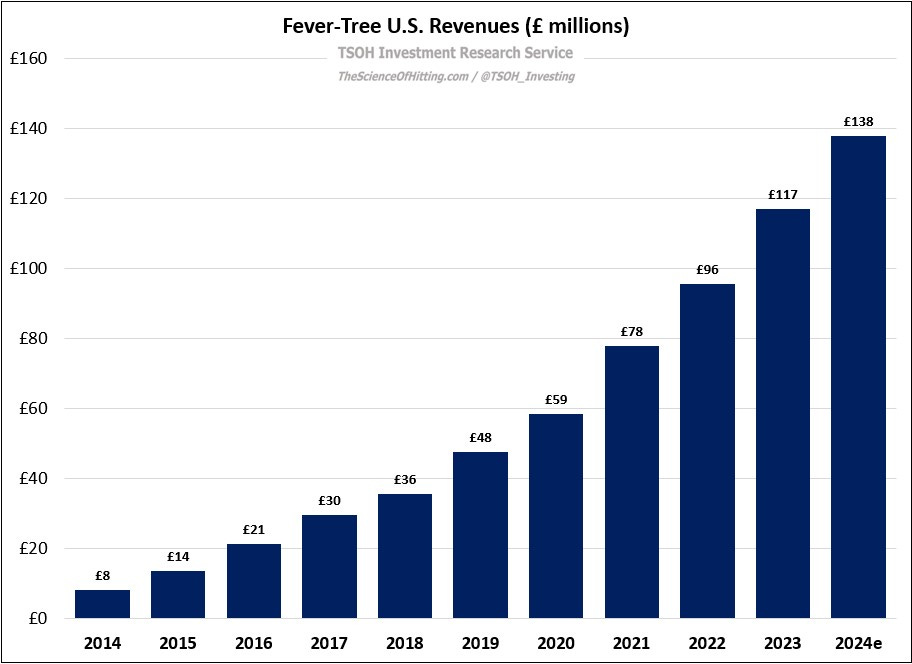

That evolution is most evident in the United States, where FT generated FY23 revenues of £117 million (+27% trailing five-year CAGR); at +24% YoY in constant currencies, the business outpaced the growth of the broader U.S. mixer category by a wide margin in FY23. (“Extended our position as the largest premium mixer brand in the U.S., with a greater retail sales value than all the other premium brands combined.”) The U.S. has quickly become FT’s largest geography: it will account for roughly 35% of the company’s FY24e revenues, compared to a mid-teens percentage back in 2018. In my view, this is just the beginning; given the size of the U.S. market, I think many years of double digit annualized revenue growth lie ahead. (CEO Tim Warrillow: “The premium spirit category in the U.S. is ~12x larger than its size in the UK.”)

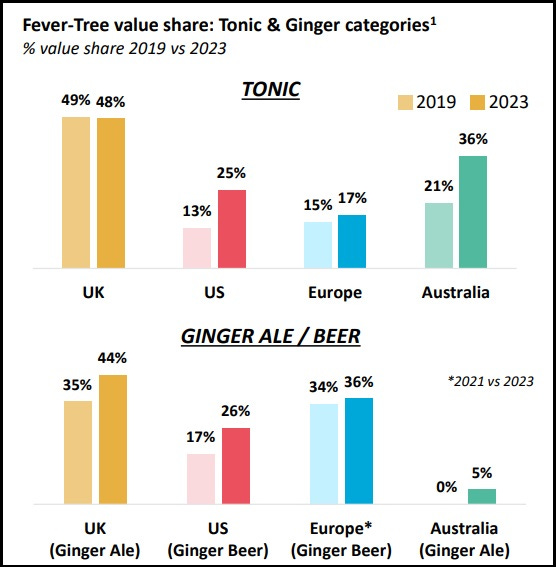

As you can see below, the company’s growth in North America has been largely attributable to ongoing success with the core offerings, as FT has continued to take value share in tonics and gingers over the past few years (total value share of ~25%, up roughly ten points from their share in 2019).

In addition, the company has benefited from new flavors that pair with spirits like tequila (Pink Grapefruit) and vodka (Sicilian Lemonade). Finally, FT is set to make inroads on new use cases, most notably in non-carbonated cocktail mixers and with adult sodas (which I’ll loosely defined as FT beverages consumed individually, i.e. not as a mixer). Success with the core offerings and expansion into new flavors / use cases has led to meaningful On-Trade and Off-Trade distribution gains, which is driving a flywheel of rising brand awareness and sales growth. (Fever-Tree North America CEO Charles Gibb: “The combination of our product quality, innovation, distribution gains, and price point has driven superior sales velocity compared to competitors. This, in turn, means that we deliver higher sales and better cash margins for customers, incentivizing them to prioritize the brand for promotions, in-store displays, menus, and visibility, and thus facilitating further growth for FT.”)

In my view, a key consideration on the company’s expanded product range is that they are able to enter new categories with a unique and compelling brand image / promise. As Gibb puts it, the test is if FT can “leverage the brand's strength and acceptance - the quality of our ingredients and our brand story - to tackle multiple consumer needs and occasions… Whilst we'll always be a mixer at our core, there are huge opportunities if we can extend into incremental space.” While this will require ongoing distribution changes - for example, eventually having cold single serve SKU’s in C-stores or grocery coolers - it’s a similar brand argument to the core tonics / gingers.

As we think about the potential long-term impact, remember that FT is still a small business (as noted in the deep dive, their annual unit volumes are roughly one-third of Coca-Cola’s daily unit volumes). Despite success in premium carbonated mixers, my concern is that FT’s experience in the UK - where revenues have hit a wall - may point to a relatively limited long-term opportunity in the core business (for examples from two additional regions, note the ~$300 million core mixers opportunity in Australia and Canada from slide 27 of the 1H FY20 deck, or the <$1 billion U.S. retail mixer market from slide 24 of the FY22 deck). Again, while it’s early days, I think we’re seeing that the long-term opportunities for the Fever-Tree brand can extend beyond its original range of tonics / mixers. In a similar fashion to Celsius in energy drinks, where the brand and products have found a unique fit with a certain consumer / use case that differs from the positioning of a leading brand like Monster, I think Fever-Tree has the opportunity to pursue a similar strategy in sodas and non-carbonated mixers. (This podcast with Celsius CEO John Fieldly is a great listen, detailing their massive run over the past few years.)