Meta: "The Decisive Period"

From “Meta: More To Come” (February 2025): “At first, it seemed each passing quarter, like clockwork, brought news of higher total expense and CapEx guidance, which Mr. Market responded negatively to. Contrast that with two weeks ago, when Zuck noted in a Facebook post that FY25e CapEx would be ~$10 billion higher than expectations – and Meta’s stock went up.

What explains this response from Mr. Market? I think that the answer is straightforward: there has been some needed clarity on the near-term financial benefit from these investments, particularly within FOA, with strong evidence that Meta is seeing an attractive ROI. What was once viewed skeptically, in some ways similar to the large losses at FRL, is now seen as the path to improved FOA financial results. These large CapEx investments are directly contributing to higher revenues and profits at FOA / Meta.”

When Meta reported Q2 FY25 results last week, the press release included the following update on FY25 CapEx: “We expect 2025 capital expenditures, including principal payments on finance leases, to be in the range of $66 billion - $72 billion, up ~$30 billion YoY.” In addition, the release discussed early expectations for FY26: “We currently expect another year of similarly significant CapEx dollar growth as we continue aggressively pursuing opportunities to bring additional capacity online to meet the needs of our artificial intelligence (AI) efforts and business operations.” In total, that puts FY26e CapEx at ~$100 billion; for some context on how far we’ve come, the consensus FY26e estimate in Feb 2024 - 18 months ago - was <$50 billion.

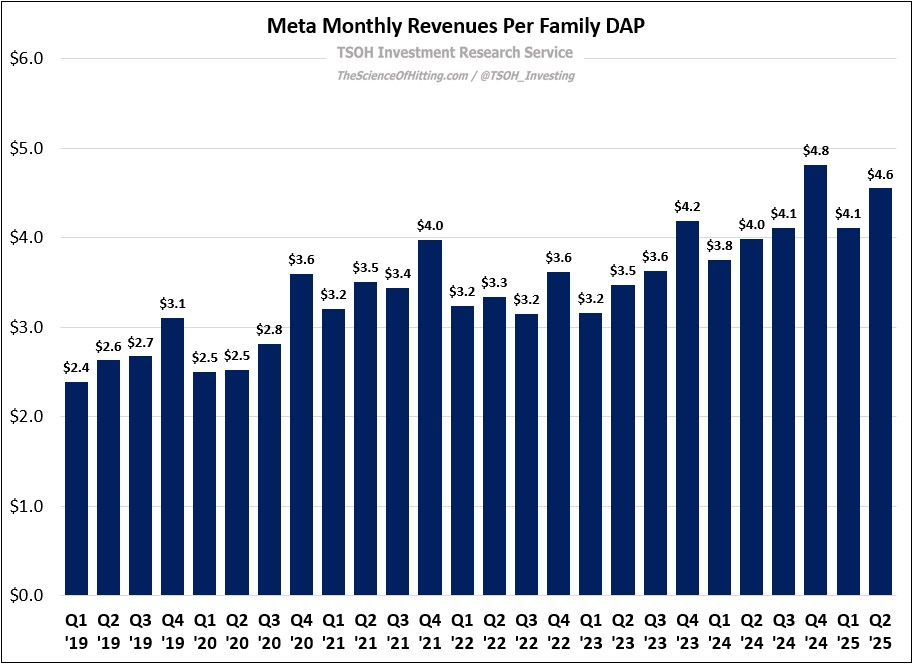

And yet, Mr. Market responded positively to the quarter, sending the stock up >10%. The reason why is because this input - explosive CapEx growth – is just one part of the story. As we look at the output – Meta’s recent financial results – we can clearly see that the first phase of this CapEx ramp has been a home run. As I wrote back in November 2022, when Meta’s FOA CapEx ramp was well underway, we could roughly gauge what would be required to generate a sufficient ROI on the incremental spend (“at least 500 basis points of FOA revenue growth above baseline expectations”). While it’s tricky to pinpoint what “baseline expectations” should be, the number that I had in my head at that time was roughly 10% YoY revenue growth; as shown below, the top-line growth rates Meta has reported as of late have cleared that bar by a wide margin, coming in at +20% or better in eight of the past nine quarters.

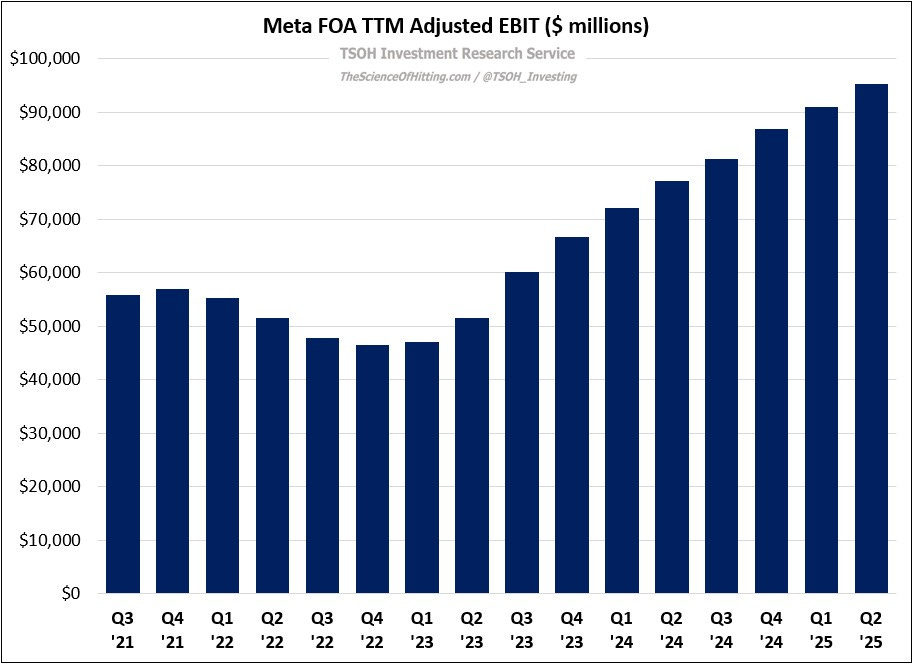

Along with continued daily active people (DAP) growth - up ~6% YoY to ~3.48 billion de-duplicated DAU’s across the apps - the business is benefiting from higher engagement / time spent and improved ad effectiveness (ROAS). As management has consistently quantified on the past few calls, these metrics were directly impacted by the first phase of the CapEx ramp, the spending that Mr. Market originally viewed with skepticism. Stated directly, Zuck’s early CapEx bet on GPU’s paid substantial dividends, which has driven TTM FOA EBIT to ~$95 billion – a cumulative increase of >80% versus 24 months ago.