Meta: A Pivotal Year

Note: I recently joined Andrew Walker of the “Yet Another Value” Empire to discuss “Letting Winners Run”, which led to a broader discussion about the art of long-term investing, cash flow considerations for investors, identifying great managers, thesis creep, and more. You can listen to the episode here. Thank you to Andrew for having me on! (And for something pertinent to today’s write-up, check out his October 2022 post on Microsoft and Meta.)

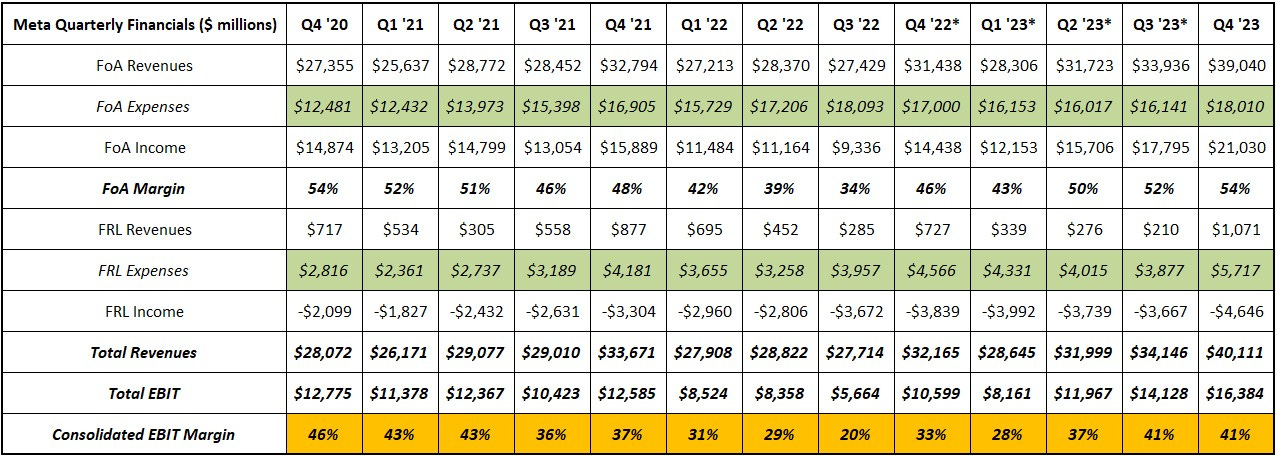

During Meta’s Q1 FY22 call in April 2022, CEO Mark Zuckerberg spoke about the company’s long-term ambitions in the Reality Labs (FRL) segment, which had generated an operating loss of more than $10 billion in FY21 (and ~$21 billion for FY19 - FY21). In response to investor concerns about the massive sums allocated to FRL, he set the following guardrails for Meta’s long-term financial objectives: “On Family of Apps (FOA), I am confident we can return to better revenue growth rates over time and sustain high operating margins. On FRL, we are making large investments to deliver the next platform… I recognize it's expensive to build this… Over the next several years, our financial goal is to generate sufficient FOA income growth to fund the growth of investments at FRL, while still growing overall profitability. That is not going to happen in 2022… Longer term, that is our goal and expectation.”

Over the next few quarters, Meta’s consolidated income statement faced intense pressure: the combination of growing FRL losses, along with revenue and expense headwinds at FOA (with YoY revenue declines in Q2, Q3, and Q4), resulted in 2H FY22 operating income of $16.3 billion – down ~30% from 2H FY21. As I wrote in “Meta: Phase Change” (February 2023), a turning point emerged at the end of 2022: “This is a clear indication that the actions being taken will meaningfully impact profitability; given that FOA generated >$45 billion of FY22 operating income, or ~3x higher than run rate FRL losses, you can appreciate why this is a very big deal for Meta.”

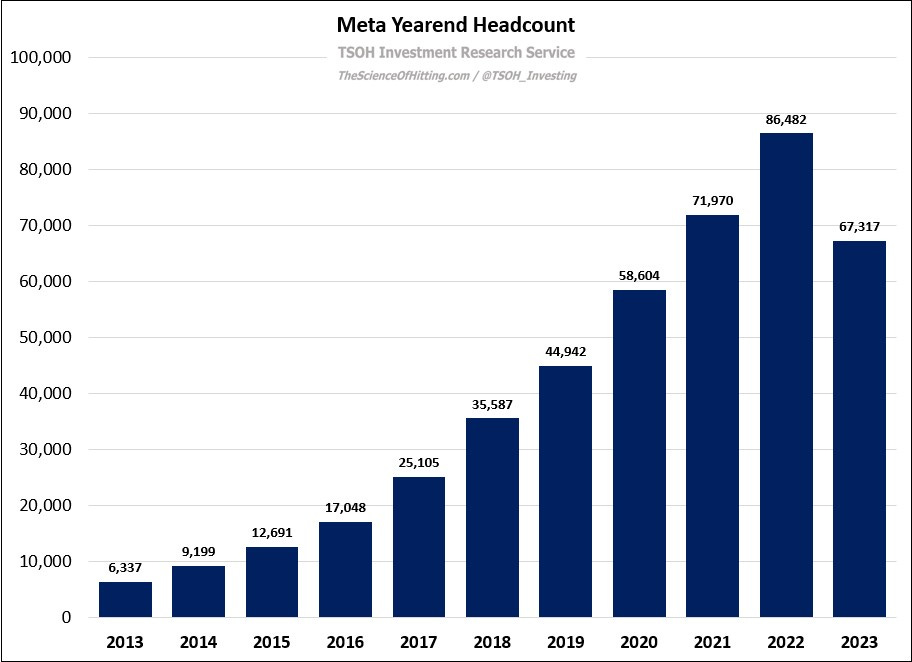

Fast forward to the end of FY23: Meta’s revenues were +16% YoY to $134.9 billion, compared to adjusted operating expense growth of just +2% YoY. Adjusted operating income exceeded $50 billion, an increase of more than 50% (~$33 billion in FY22). In addition, despite massive CapEx outlays, free cash flow reached a record high of $43 billion in FY23, which helped to fund ~$48 billion of share repurchases over the past two years at an average cost of ~$190 per share. (On Friday, the stock closed at $468 per share.)

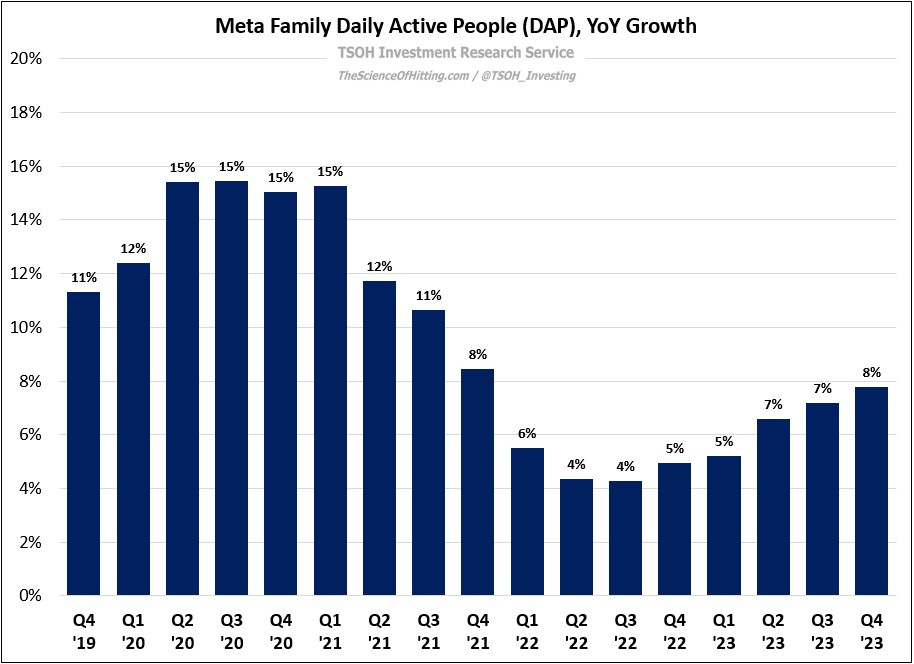

While OpEx efficiency was a significant contributor to these results, Meta’s business also continues to benefit from increases in time spent / engagement and a growing user base, with daily active people across the family of apps growing 8% YoY in Q4 FY23, to 3.14 billion. (One notable stat from the call: watch time across all video types increased by >25% YoY in Q4 FY23.)

In addition, the company has made significant ongoing investments to improve its advertising offerings / ROAS. As I argued in February 2022, the likely long-term outcome from industry headwinds was that Meta’s relative standing within the digital advertising business would ultimately be improved, not weakened (when we made it to the other side). As CFO Susan Li noted on the follow-up call, “We have made meaningful improvements on performance and measurement… Advertising is a relative performance game. We’re very well-positioned because of the investments we’ve made.”

The Q4 press release nicely summed up the change in trajectory over the past 15 months: “This was a pivotal year for our company. We increased our operating discipline, delivered strong execution across our product priorities, and improved advertising performance for the businesses who rely on our services. We will look to build on our progress in each of those areas in 2024 while advancing our ambitious, longer-term efforts in AI and FRL.”

That has coincided with a staggering move for the stock: after falling from ~$380 per share in September 2021 to ~$90 per share in November 2022, Meta shares now stand near all-time highs. With that move comes a new question: is Meta stock still an attractive investment at current levels?

That is the question that I’ll address in today’s write-up.