Meta: More To Come

From “A Pivotal Year” (February 2024): “You can be quite confident that Meta will not fall short on key initiatives from a lack of conviction or outside pressure that constrains Zuckerberg’s aggressiveness. Given his track record, I think that’s a trade-off long-term shareholders should be okay with.”

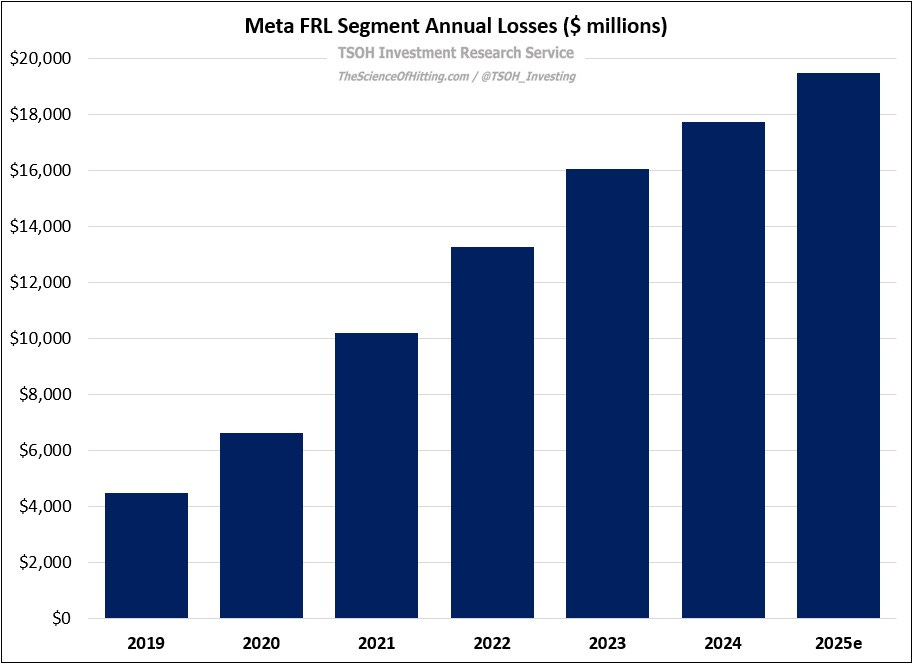

As I see it, the significant stock price volatility that Meta experienced over the past five years started with questions about the financial trajectory at Family Of Apps (FOA). Over time, the relative importance of that concern lessened as Meta shareholders learned that the metaverse foray, housed within Facebook Reality Labs (FRL), was a much bigger financial hole than many assumed. That revelation, along with Zuck’s clear commitment to funding growing FRL losses, ultimately led to a stock price decline of more than 75% from the 2021 highs to the 2022 lows. (On FY25e losses, a notable 10-K disclosure: “We expect to spend ~50% of our FRL operating expenses on our wearables initiatives, and the remaining ~50% on our metaverse initiatives.”)

Around this time, Meta was also in the early innings of a massive CapEx ramp: as you can see below, FY25e is now expected to exceed $60 billion, up ~4x from five years earlier. At first, it seemed that each passing quarter, like clockwork, brought news of higher total expense and CapEx guidance, which Mr. Market responded negatively to. Contrast that with two weeks ago, when Zuck noted in a Facebook post that FY25e CapEx would be about $10 billion higher than analyst expectations – and Meta’s stock price went up.

What explains this response from Mr. Market?