Meta: Taking Big Swings

Meta CEO Mark Zuckerberg: “I'm doing something wrong if I'm not building something new. Even when we put together the business case for investing $100 billion in AI or some huge amount in the metaverse… ‘How are you confident enough to do this?’ You can't know for certain from the outset. But the day I stop trying to build new things, I'm done... It’s not even a question for me, whether we're going to take a swing at building the next thing.”

The sun has been shining bright on Meta’s FOA business over the past year. One key reason has been a significant revenue reacceleration (attributable to the user growth / engagement and advertising dynamics that I’ve discussed in recent quarters), with Q1 FY24 TTM revenues up 21% YoY to $140.3 billion (an increase of ~$25 billion from $115.5 billion for Q1 FY23 TTM).

The other reason has been Meta’s “year of efficiency”: on that ~$25 billion increase, adjusted FOA expenses declined slightly, to $68.1 billion. The net result was segment operating income for TTM Q1 FY24 of $72.2 billion – an increase of more than 50% versus the year ago period. (At the 2022 lows, Meta had an enterprise value of ~$200 billion - or <3x FY24e FOA EBIT.)

On the broader investment thesis, I believe the key considerations which informed by initial decision on Meta back in 2018 – specifically, the long-term sustainability of their dominant position within FOA - remain intact today.

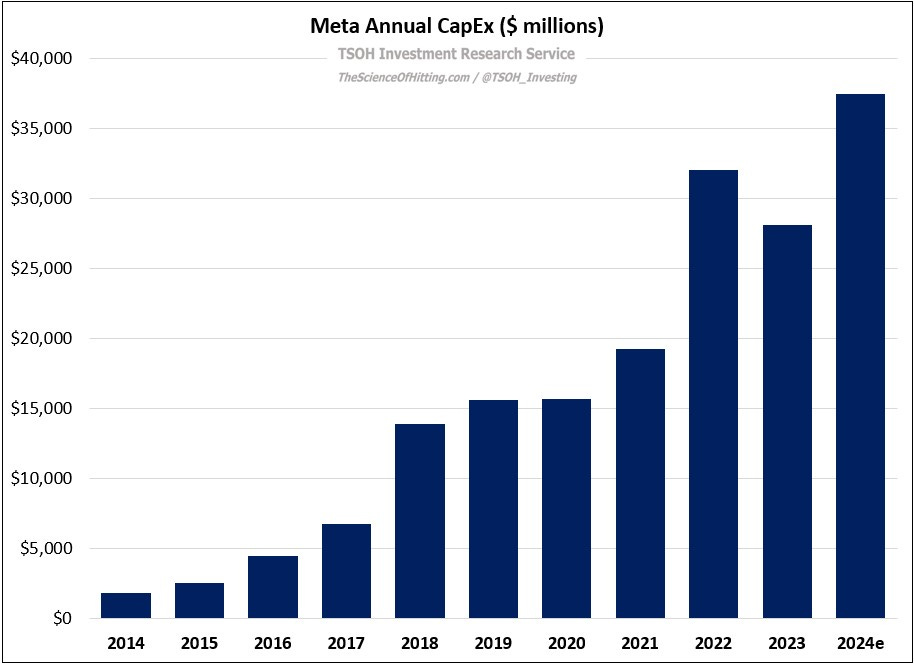

But the market’s reaction to Meta’s Q1 FY24 results – specifically the CapEx and OpEx guidance – may reflect turning tides. It seems like we could soon face that difficult situation where investors need to appropriately balance an ownership mentality / long-term time horizon with less than ideal short-term results; it requires an assessment of the shortfall relative to prior expectations (most notably, by choice or as a result of other factors), as well as the long-term implications that are likely to follow. In numbers, the midpoint of FY24e CapEx is now $37.5 billion – up $4 billion from the prior guide, and with management noting that further increases are likely in FY25 and beyond.

On OpEx, the midpoint of the FY24 guide increased by $1 billion, to $96.5 billion, with that change attributable to higher infrastructure costs (the depreciation expense that flows through on higher CapEx) and higher legal costs (we don’t know what expectations were heading into the quarter, but you can see on page 20 of the 10-Q that legal-related accruals increased ~$1.2 billion in Q1). As you can see below, that puts Meta on track (by my estimates) for revenue growth in FY24 that will be roughly in-line with total expense growth – an outcome that would lead to much less extreme swings on the income statement compared to what we witnessed in 2022 and 2023.

But what about FY25 and beyond? As Zuckerberg noted on the Q1 call, he believes Meta needs to invest “significantly more” over the coming years to build the world’s leading AI models and large scale AI services: “Even with shifting many of our existing resources to focus on AI, we’ll still grow our investment envelope meaningfully before we make much revenue from some of these new products… We've historically seen a lot of volatility in our stock during this phase of our product playbook, where we're investing behind scaling a new products but aren’t yet monetizing it.” I think this is the biggest concern for Mr. Market: as Meta aggressively pursues emerging opportunities around AI and the metaverse, will they live up to the financial guardrails they’ve previously communicated to investors? (Q1 FY22 call: “Over the next several years, our goal from a financial perspective is to generate sufficient operating income growth from FOA to fund the growth of investments in FRL while still growing our overall profitability.”)

I’ll dig in on the financials and valuation in a moment, but first I want to discuss Meta AI. Why are they aggressively pursuing this, and how - if at all - does it tie-in with the long-term success of the core business (FOA)?