Meta: A Precarious Position

Of all the decisions that we face as long-term investors, there are few that I find more difficult than intelligently reacting to disappointing financial results.

In the fog of uncertainty created by missed expectations, inactivity feels like an admission that you’re simply at the whims of Mr. Market. For that reason, there’s a strong desire to do something, anything. Double down or get out.

That brings us to Meta’s FY21 results, including disheartening Q1 FY22 revenue guidance, which led to a stock price decline during Thursday’s session of more than 25% (Meta’s market cap dropped by ~$250 billion, the largest one-day decline for a company’s valuation in market history).

Financials

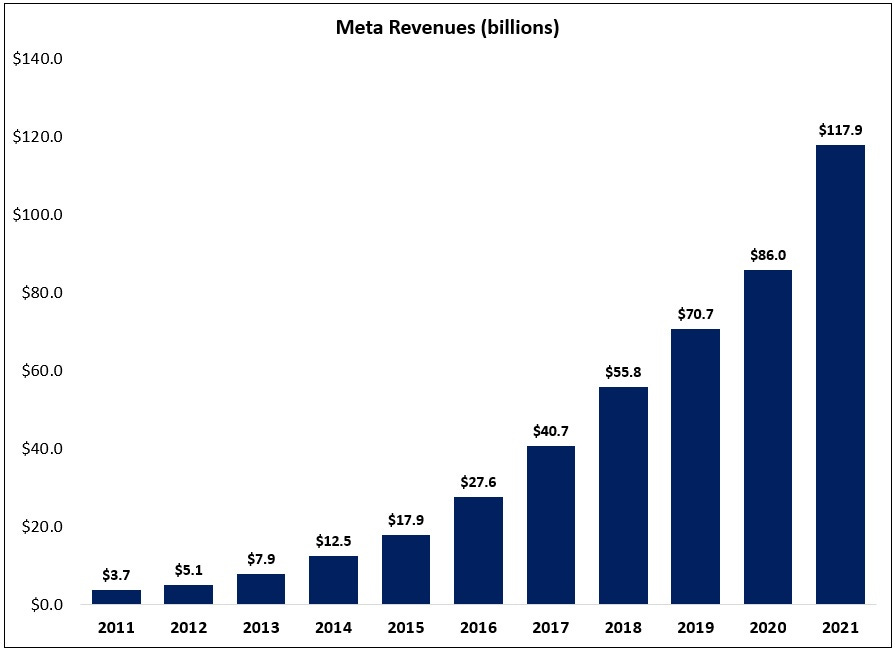

Meta generated $117.9 billion in FY21 revenues, up 37% from FY20 (an incremental $32 billion in sales). As shown below, revenues have more than quadrupled since FY16, with a trailing five-year CAGR north of 30%.

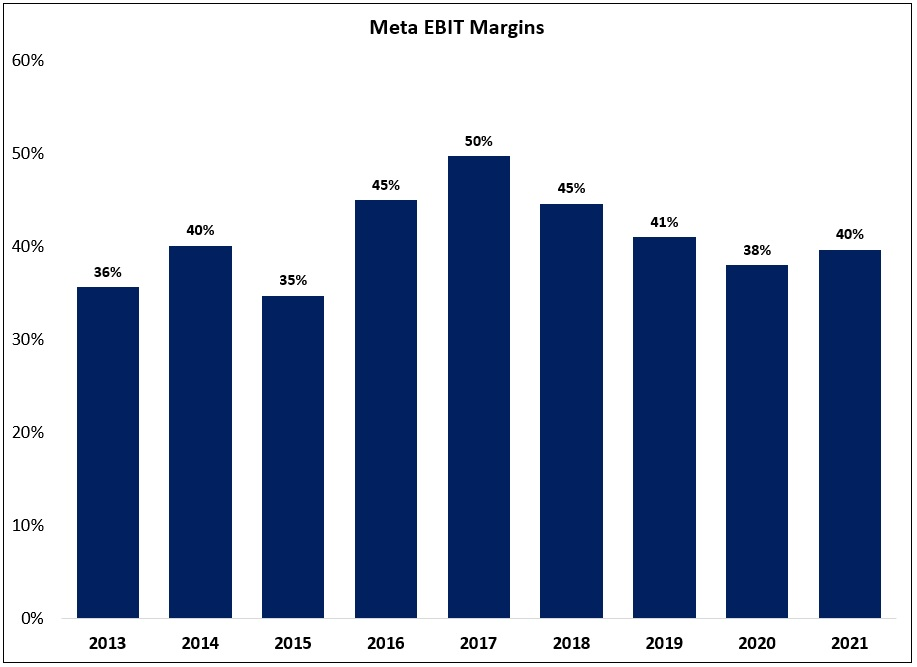

The company reported $46.8 billion in operating income in FY21 (+30% trailing five-year CAGR), with EBIT margins of 40%; while the company generated ~160 basis points of margin expansion in FY21, you can see that corporate EBIT margins remain well below the level reached in FY17.

That outcome partially reflects some necessary investments in the core business, particularly for platform safety and security. But it’s also attributable to sizable growth investments, most notably behind the AR / VR (metaverse) efforts at the Facebook Reality Labs (FRL) segment that are putting meaningful short-term pressure on the consolidated income statement.

As discussed last quarter, the company’s prior commentary led the analyst community to believe Meta was investing a few billion dollars a year at FRL. That all changed in Q3 FY21, when it was revealed that FRL investments would reduce operating profits by ~$10 billion in FY21. This quarter, we received a segment breakdown for the first time – and its provided us with a lot of important information about Meta’s businesses (FoA & FRL).