"Let's See Nike Being Nike"

From “Nike: Falling Short” (January 2024):

“Mr. Market continues to have a somewhat more optimistic view of Nike’s future than I do… Storytelling is an important part of Nike’s brand perception and business model – but it should not be a part of their communications with investors. The fact that they’ve repeatedly set overly optimistic financial goals is a red flag that factors into my investment decision; I can’t quantify that for you, but you should know it is part of my thought process on Nike.”

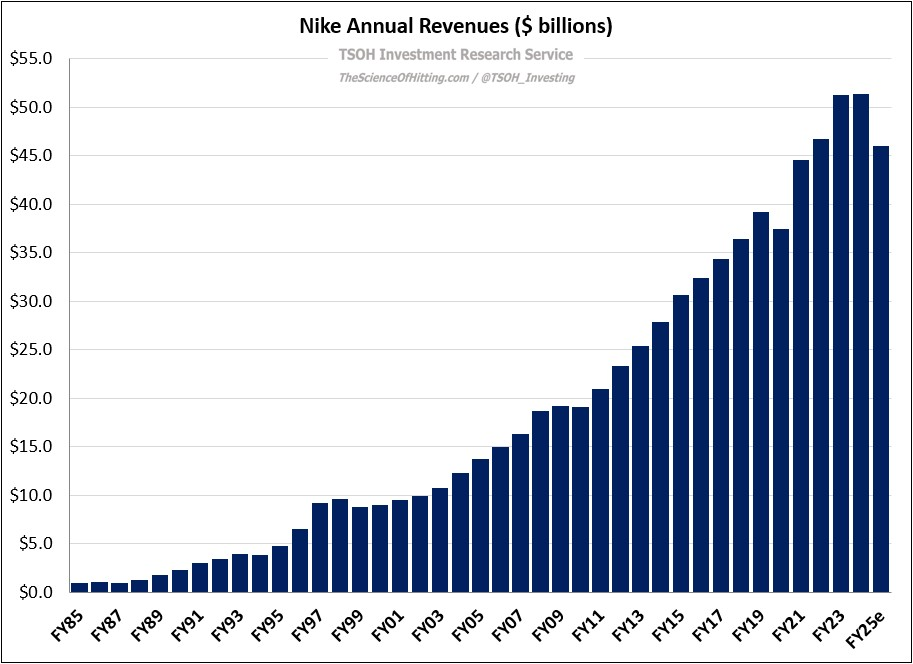

It has been a tough year for Nike, with the stock down ~30% since “Falling Short” was published back in January (over the same period, the S&P 500 is up ~25%). While I’ve primarily framed my Nike concerns in financial terms (expectations versus reality), what has become clearer over time is the impact this has also had on their strategy and brand image: chasing financial targets, among other factors, led to costly mistakes that Nike needs to rectify.

The good news is that change is underway. Management has started making tough decisions, which will bring material near term financial pain - but that is a price worth paying to position Nike for brighter days ahead.

As I discussed in “A Transition Year” (July 2024), CEO John Donahoe missed a critical opportunity earlier this year. While founder Phil Knight had expressed his “unwavering support” for Donahoe, that finally reached a breaking point: on September 19th, Nike announced that Donahoe would be replaced by Elliott Hill, a former exec who spent 32 years at the company before retiring in 2020. (“The decision to bring Hill back was led by Knight.”)

Nike’s Q2 FY25 earnings call, held on December 19th, was Hill’s first chance to outline his long-term strategic vision to the investment community - and in my view, it was an encouraging start. As I’ll discuss today, there were a few notable revelations that foretell the important changes underway at Nike.