"Bold, Disruptive Innovation"

From “Nike: Falling Short” (January 2024): “Given that the company fell well short of the 2015 Investor Day targets, with a similar outcome on the 2017 Investor Day targets, you might expect that they’d approach the latest round of forecasting [through FY25] with an extra dose of caution. Fast forward to the Q2 FY24 results: as opposed to an initial expectation of mid-single digit growth, management now expects revenues to increase by ~1% in FY24e, to ~$51.7 billion. In addition, Nike remains well short of its high-teens EBIT margin target (FY24e at ~13%); in combination with the revenue shortfall, that puts FY24e EPS at ~$3.6 per share, ~30% below where they expected to be… At ~$109 per share, Mr. Market continues to have a somewhat more optimistic view of Nike’s future than I do… Storytelling is an important part of Nike’s brand and business model – but it should not be a part of their communications with investors. The fact that they’ve repeatedly set overly optimistic goals is a red flag that factors into my investment decision.”

Nike reported Q3 FY24 results in late March, with another negative surprise for investors. As CFO Matt Friend outlined in his introductory remarks, the ~1% revenue growth that they expect to report in FY24 is unlikely to be much improved in FY25: “We expect revenue and earnings to grow versus FY24, with operating margins expanding. However, we are prudently planning for revenue in the first half of fiscal 2025 to be down low single digits.”

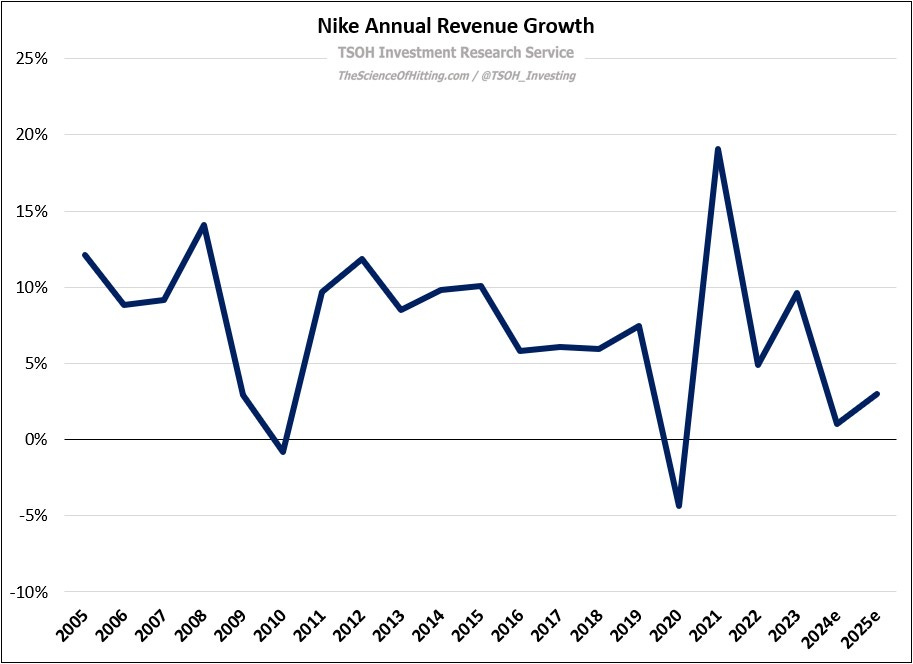

This continues the death by a thousand cuts approach to financial guidance that I’ve come to expect from Nike. As you can see below, they reported ~10% or higher revenue growth in two of the past ten years (FY15 – FY25e CAGR of +5.7%). Given that their guidance during this period has typically called for high-single digit annualized revenue growth (on the low end), there continues to be a clear disconnect between their targets and their results.

While I certainly don’t give management a pass for continually missing their targets, I’m encouraged that they’re becoming a bit more forthright about the issues they face. Specifically, here’s what CEO John Donahoe said in his opening comments on the Q3 FY24 call: “Nike is not performing to our potential. While our Consumer Direct Acceleration Strategy has driven growth and direct connections with consumers, it's clear we need to make some important adjustments. We need to make adjustments in four areas: (1) we need to sharpen our focus on sport; (2) we must drive a continuous flow of new product innovation; (3) our brand marketing must become bolder and more distinctive; (4) while Direct will continue to play a critical role, we must lean in with wholesale partners to elevate our brand and grow the total marketplace.”

In a CNBC interview, Donahoe spoke about some of these issues in more detail. He argued that the company has relied on “iterative innovation”, with a lack of the “bold, disruptive innovation that Nike is known for”, with the blame falling to operational / supply chain challenges during the pandemic and work from home (“it’s really hard to develop a boldly disruptive shoe on Zoom”).

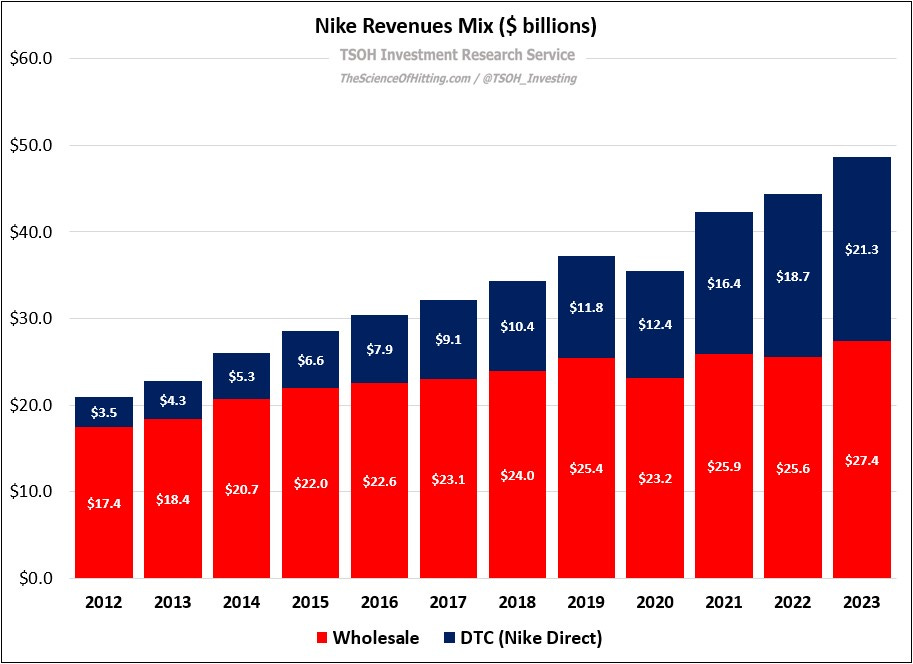

In addition, Donahoe said that the overwhelming focus on Nike Direct that began in the early 2010’s must be more balanced: “We recognize that in our movement toward digital, we over-rotated away from wholesale a little more than we intended. We've corrected that.” As you can see below, Nike Direct accounted for 44% of Nike’s FY23 revenues, up from 30% in FY18. Direct grew by ~15% p.a. over that period, compared to ~3% p.a. for Wholesale.

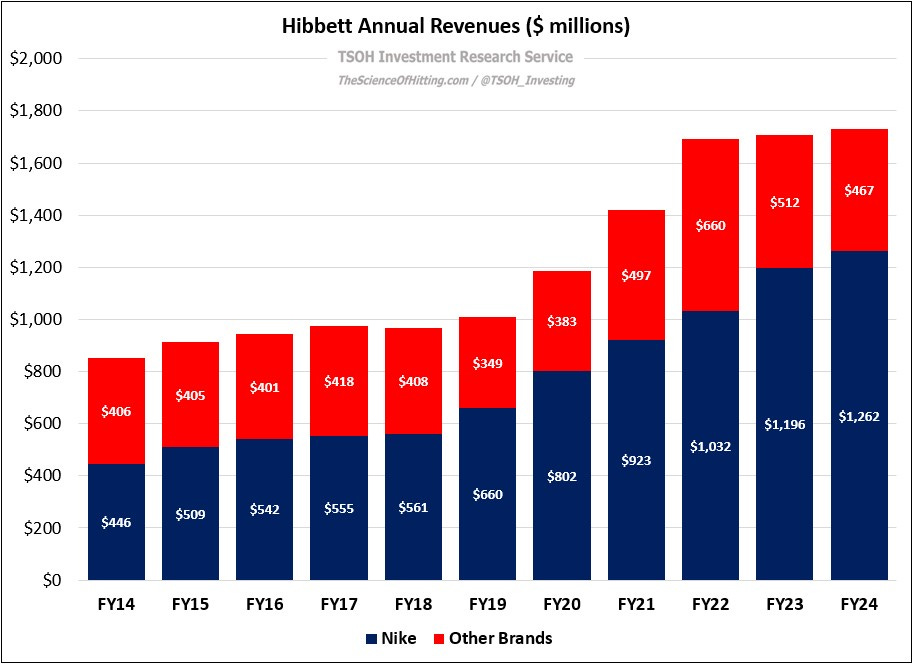

Both of those points are applicable to Hibbett, which I wrote about at the beginning of the year. The company’s business is heavily reliant to Nike, which accounted for ~73% of its FY23 revenues. On Hibbett’s recent conference calls, management has voiced a similar desire (need) for bold and disruptive products from Nike: “On the innovation pipeline, things are going a little bit slower than we’d like… We'd like to see it go a little faster… Some of our secondary brands are doing a nice job on innovation, or at least newness… Some brands are doing a little better with innovation, and they’re succeeding, but others are still, unfortunately, very slow with innovation; that's continuing to create challenges.” (Hibbett isn’t alone here; on JD Sports most recent call, CEO Régis Schultz said, “I think that Nike has been, and they recognize this, slow… The most important thing was for Nike to recognize they needed to bring something new, and I think they did that last week.”)

On Nike’s rotation back towards wholesale partners, it’s interesting to think about what this could mean in practice. (As a reminder, Nike reduced its number of global wholesale partners by ~50% from FY18 to FY22.)

As Donahoe said on the call, “We're increasing our investment in wholesale to help us elevate and grow the entire marketplace. We recognize that wholesale partners help us scale our innovation and newness in stores and to connect our brands in the path of the consumer.” This comment from CFO Matt Friend was even more direct: “We don't like the way our brand is showing up in wholesale, and we own that. We need to elevate the experience for consumers when they come into interaction with our brand… Being able to elevate and to position our brand correctly, to tell stories about the products that we're bringing to market, that is absolutely critical.”

Put simply, there’s recognition that retailers like Hibbett are an important part of the Nike brand and business model. There are opportunities to partner, as we’re seeing with the connected loyalty programs that will help consumers to take advantage of perks offered by Hibbett and Nike (discounts, increased access to limited edition drops, etc.). As noted in the HIBB write-up, outsized exposure to Nike presents a clear business risk. At the same time, the past decade tested Hibbett’s role in the marketplace / value chain as Nike focused on growing its Direct business – a test that they passed. Now that the tide is starting to turn back in the other direction, Hibbett strikes me as well positioned to benefit from its relationship with Nike. (My hunch is that the most tangible example is more access to drops / limited availability SKU’s.)

Conclusion

Earlier this week, The Oregonian reported that Nike co-founder Phil Knight continues to believes John Donahoe is the right CEO for Nike: “He is a proven leader whose unique talents set him apart in business. I have the utmost trust and confidence in his ability… He has my unwavering support.”

The fact that Knight felt the need to publicly express his support for Donahoe speaks to Nike’s current situation: they have badly underperformed their long-term financial targets. FY25 revenues will likely be at least $20 billion below reasonable expectations based on the goals communicated over the past decade (starting with the 2015 Investor Day). As discussed in “Falling Short”, they have either consistently overestimated underlying growth in their industry or they have not commanded as much incremental share as expected. The rise of competitors like On hasn’t helped (FY23 revenues of ~$2 billion), and I think those kind of competitors are unlikely to go away.

Are Nike’s latest innovation platforms the solution? That’s a difficult question to answer. In my opinion, answering that question confidently is even more difficult if you have doubts about management (as I do). It doesn’t help that management’s commentary from 12-18 months suggested they were well positioned; for example, from the Q1 FY23 call: “Nike’s relentless pipeline of innovative product continues to create separation between the competition… We have a really strong innovation pipeline.” Fast forward to the present, and it’s clear that this “relentless pipeline of innovation” has hit a snag.

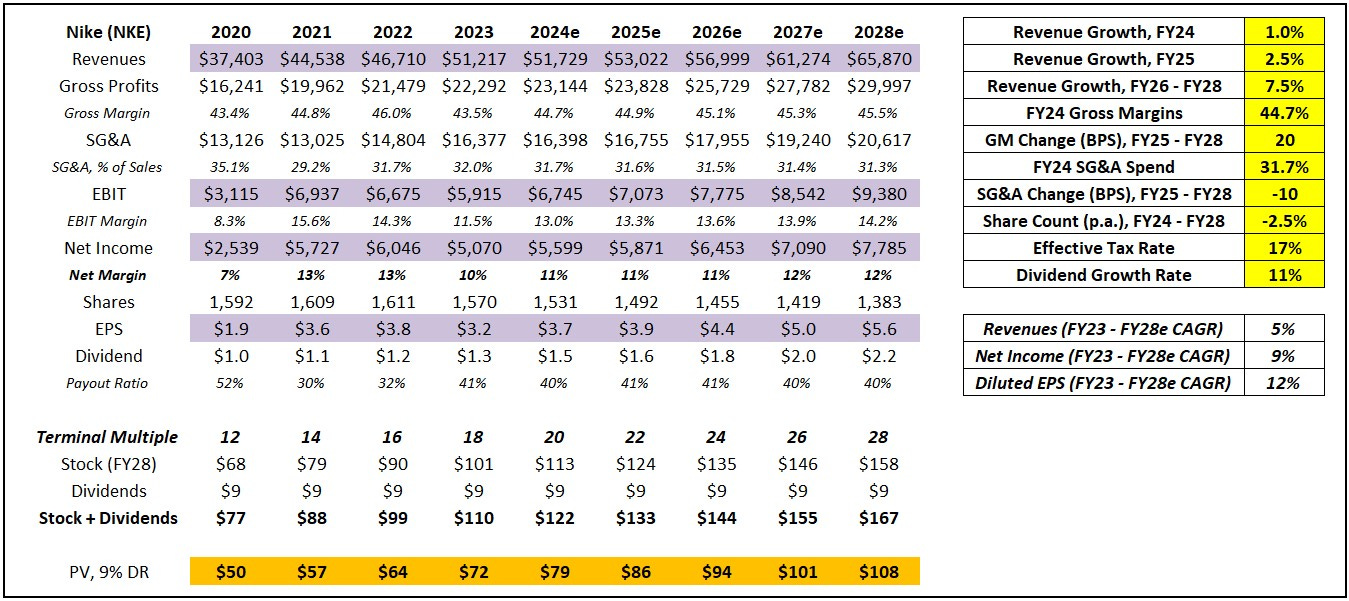

From an investment perspective, I continue to view Nike somewhat skeptically. While it helps that the stock price has struggled since I first wrote about the company back in July 2022 - down ~10% compared to a ~30% climb for the S&P 500 - it still trades at a mid-20’s forward P/E. As you can see in the financial model, I think you need confidence on a path to high-single digit growth with EBIT margin expansion beyond FY25 to argue the stock is particularly attractive here. (Nike will host an Investor Day later this year; based on Friend’s recent comments, I’m cautiously optimistic they’ll remove their rose-colored glasses for the next round of Investor Day targets.)

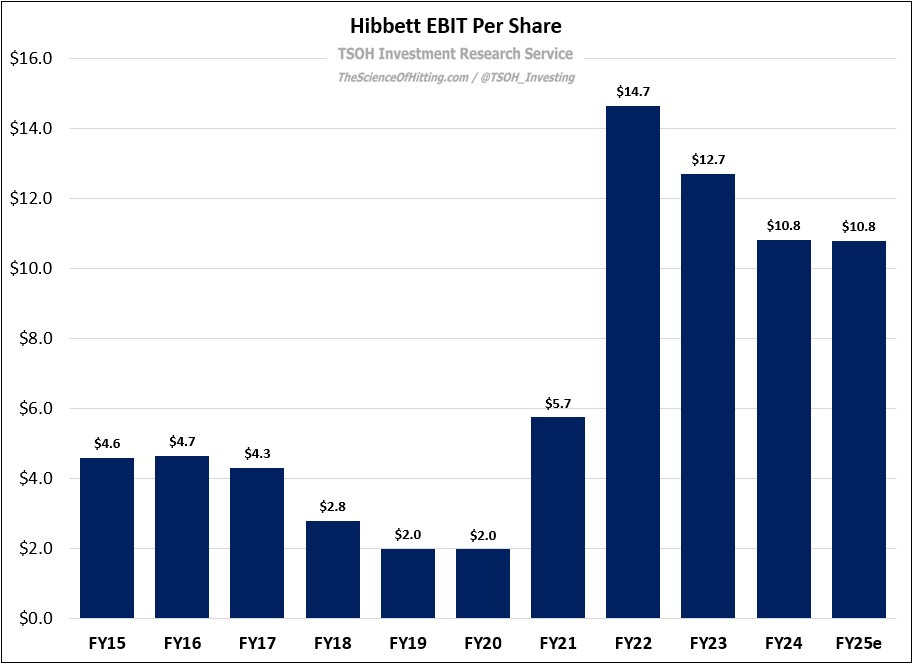

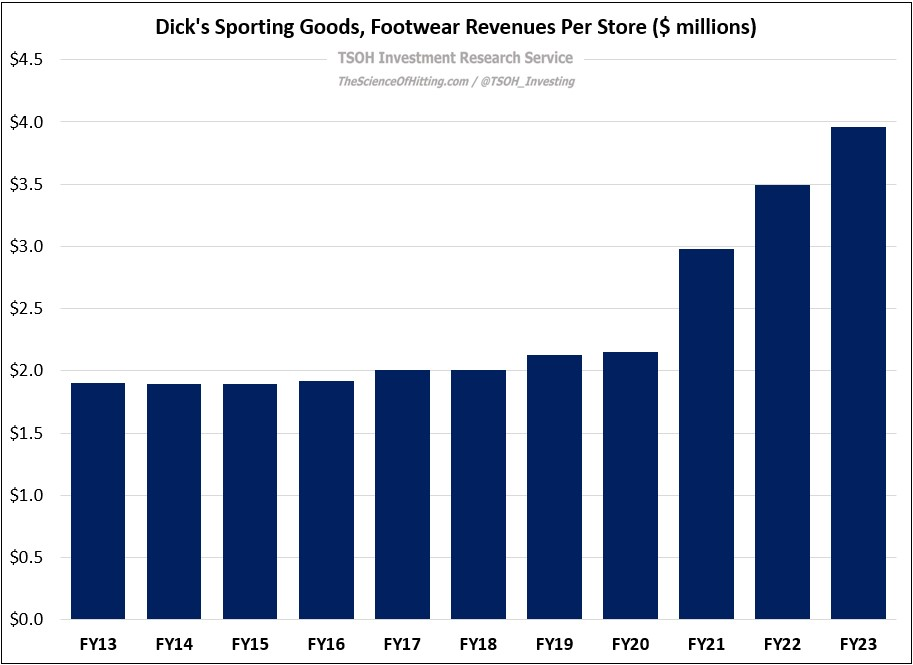

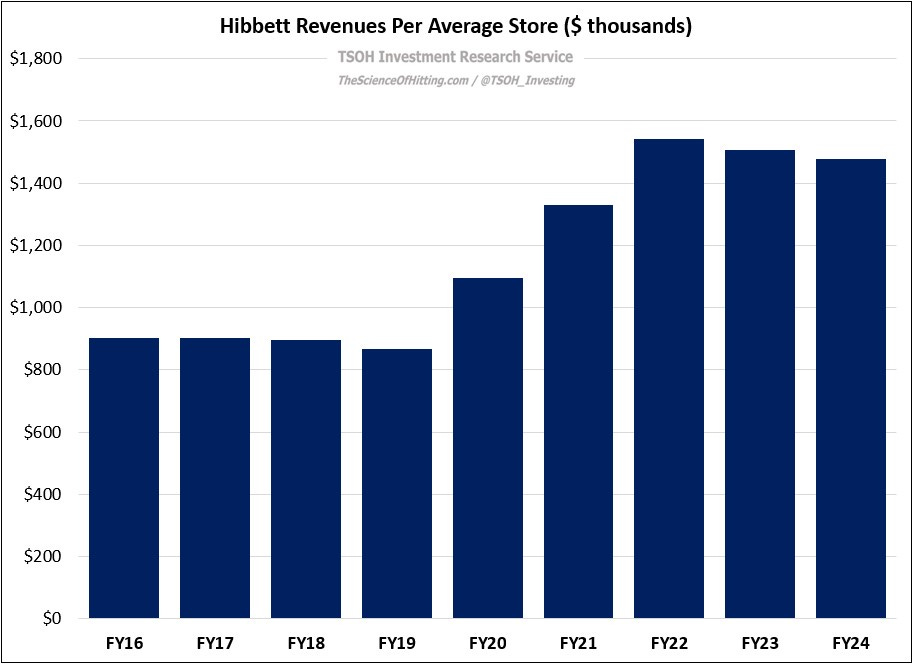

In my view, Hibbett may be the more interesting opportunity. At ~8x forward earnings, it’s safe to say Mr. Market sees an uncertain future (at best). That doesn’t seem too far off the mark when you consider that they’ve reported negative comps in each year for FY23 – FY25e, but it also follows two years of unprecedented strength (+22% in FY21 and +17% in FY22). In addition, these recent results look less encouraging when compared to the impressive footwear results reported by peers like Dick’s Sporting Goods.

That view seems counter to HIBB management’s focus on expanding the footprint (FY24e unit count +4% YoY), a decision supported by the ~65% increase in average per store revenues since FY18. In addition, Hibbett has repurchased >$400 million of stock over the past five years, with the share count down >50% from FY15 - FY25e. If those two factors coincided with “a multiyear cycle of innovation that's brings freshness and newness to consumers”, as Donahoe said on Nike’s Q3 FY24 call, that could become a nice tailwind for Hibbett. Here’s another way to say that: If you’re optimistic that Nike’s innovation will have a material impact on their U.S. business, alongside their renewed focus on supporting retail partners, Hibbett may be a particularly effective way to express that view. (Nike President Heidi O’Neill: “I see wholesale partners being more important as we go forward - those who are closely connected to consumers and communities in unique ways.”)

In this instance, I think it may be worthwhile to keep a close eye on insider activity. As noted in the write-up, CEO Mike Longo bought ~$270,000 of stock on the open market in May 2023 at ~$36 per share; at that time, it had fallen >50% from where it traded a year earlier. Today, at ~$70, that purchase looks quite well timed. I’m not 100% sure further insider activity would be enough for me to make a move on Hibbett, but it would be a notable development.

For now, I’m going to keep watching NKE and HIBB from the sidelines.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

Great prospective insight into HIBB -- as today's news proves. Well done.

Thanks Alex for this great up !! Its clear, easy to understand and conveys lot of information in an effective way. I am curious to know the reason for swift increase in revenue per store for Dick's sporting goods from 2020. Please share if you have already analyzed it