Nike: Falling Short

Note: Happy New Year! I hope everybody enjoyed the holidays. I’m waiting for Fidelity to finalize performance reporting through yearend. As a result, the Q4 2023 Portfolio Update will be sent to subscribers on Monday, January 8th.

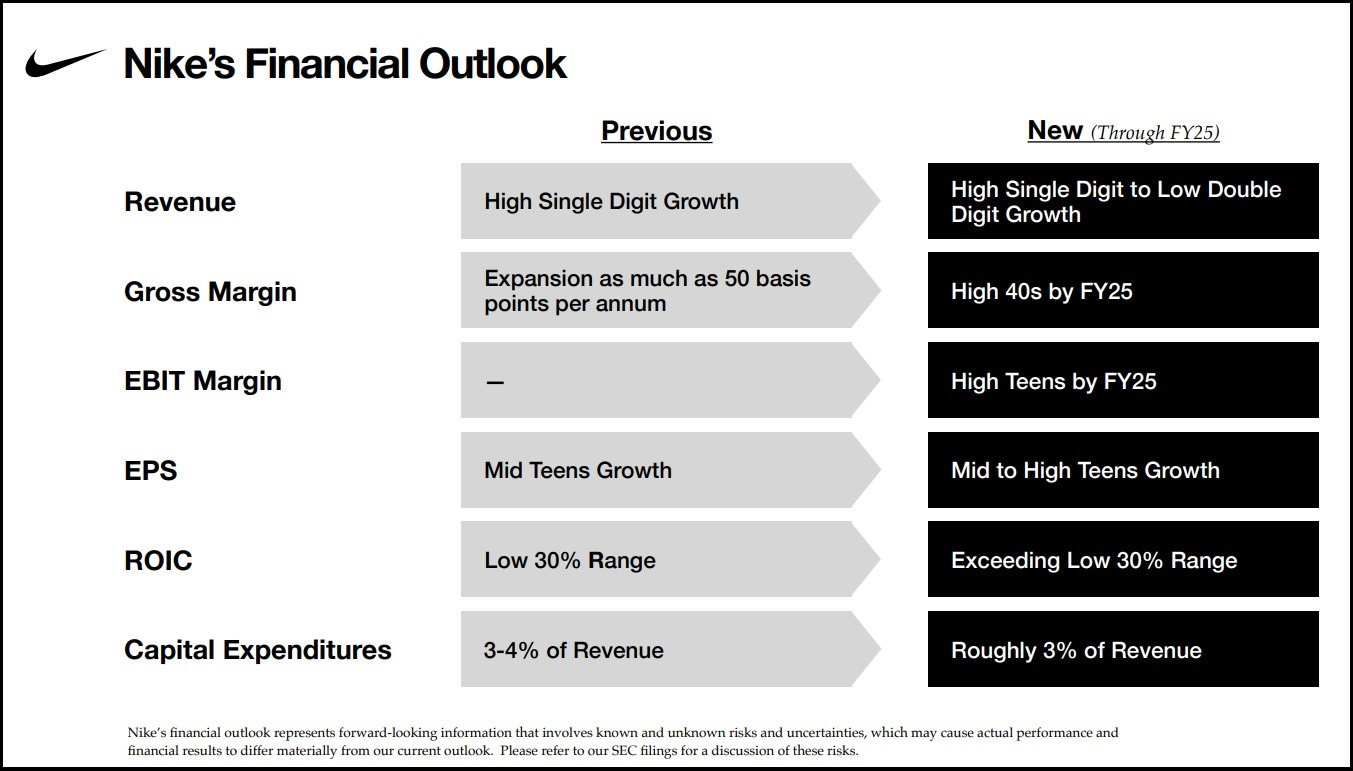

In conjunction with the release of Nike’s Q4 FY21 results in June 2021, the company provided investors with updated financial targets through FY25. As you can see below, the outlook called for ~10% annualized revenue growth through FY25, with the combination of EBIT margin expansion and share repurchases driving mid-teens to high-teens EPS growth. (Note that John Donahoe, a Nike board member since 2014, became CEO in January 2020).

At that time (in FY21), Nike’s annual revenues and EPS were $44.5 billion and $3.6 per share, respectively. For the revenue target, at a consistent +10% per annum over the forecast period, that would put FY24e at ~$59.3 billion; for the EPS target, at a consistent +15% per annum over the forecast period (the low end of the guide), that would put FY24e at ~$5.4 per share.

Given that the company had ultimately fallen well short of the 2015 Investor Day targets (as discussed in “I Hate Advertising”), with a similar outcome on the 2017 Investor Day targets, you might expect that they’d approach the latest round of forecasting with an extra dose of caution. Fast forward to the company’s Q2 FY24 results, which were reported in late December: as opposed to an initial expectation of mid-single digit growth, management now expects revenues to increase by ~1% in FY24e, to ~$51.7 billion. In addition, Nike remains well short of its high-teens EBIT margin target (FY24e at ~13%); in combination with the revenue shortfall, that puts FY24e EPS of ~$3.6 per share about 30% below where they expected to be at this time.

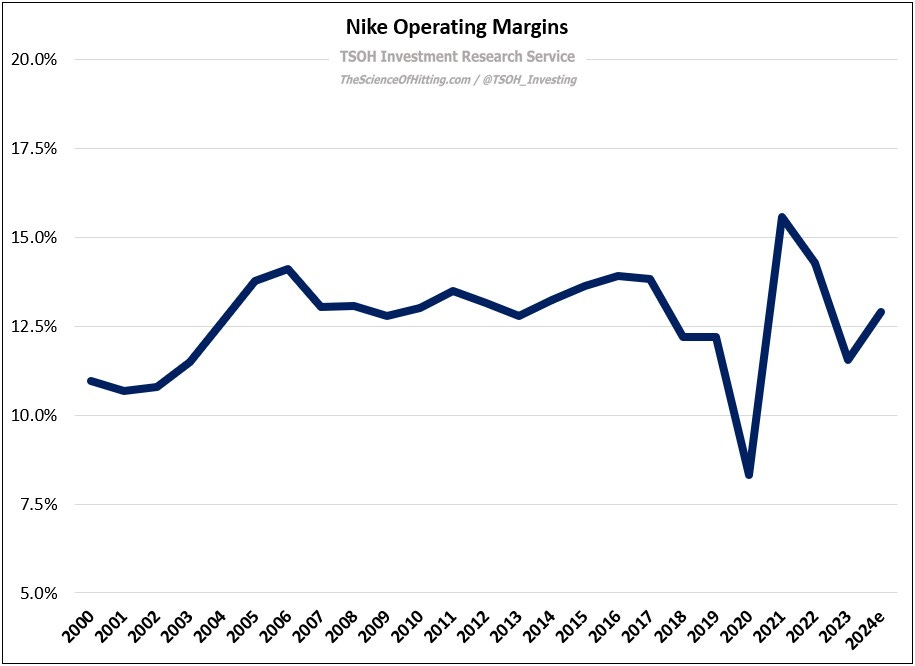

Needless to say, this is cause for some concern. On revenues, either Nike management has consistently overestimated underlying growth / demand in their industry, or they have not commanded as much incremental share as they expected. On profitability, they continue to forecast future outcomes that are vastly superior to their current performance and their historic results (EBIT margins exceeded 15% in a single year over the past quarter century).

My gripe isn’t management’s inability to forecast results with pinpoint accuracy. Instead, it’s the lack of conservatism in the face of consistent underperformance. At some point, it’s a red flag that should lead investors to wonder whether other proclamations from management should be taken with a grain of salt. As I’ll discuss in today’s update, that makes me somewhat uneasy on certain aspects of Nike’s business - most notably in China.