"It's A Desperate Market Out There"

Floor & Decor (FND) Update

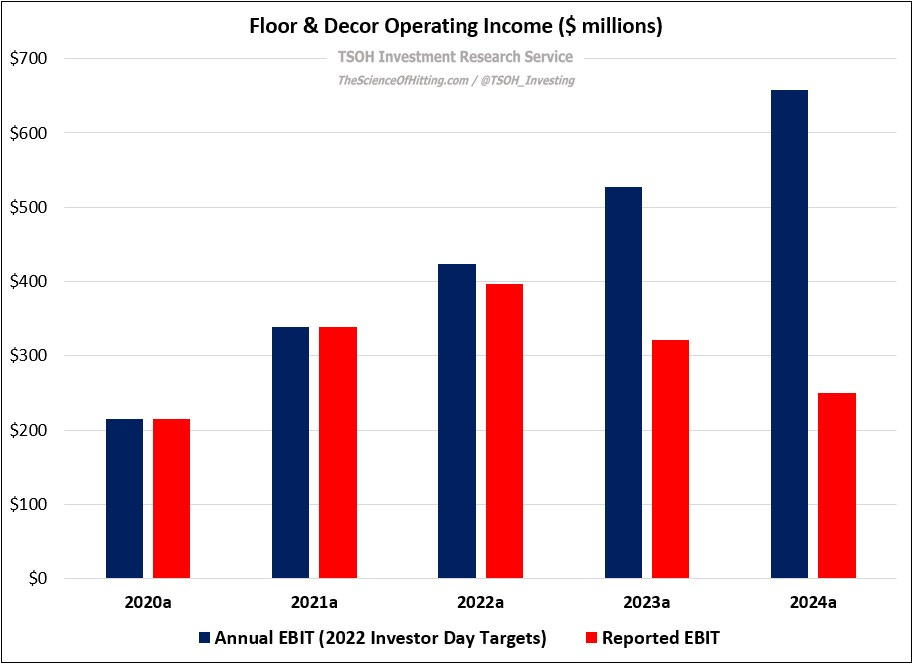

From “A More Normalized Environment” (September 2024): “Floor & Decor (FND) is on pace for ~$250 million in FY24 operating income – roughly $400 million less than the implied FY24e EBIT target from the March 2022 Investor Day. Somewhat amazingly, despite that massive shortfall relative to those medium-term targets, FND closed on Friday at ~$120 per share; that’s ~25% higher than on March 15th, 2022 (the day before the Investor Day). I continue to be surprised by Mr. Market’s willingness to look past FND’s near term challenges… Mr. Market has not exhibited too much (any) concern with this so far. If it continues into FY25, we’ll see if he maintains his indifference.”

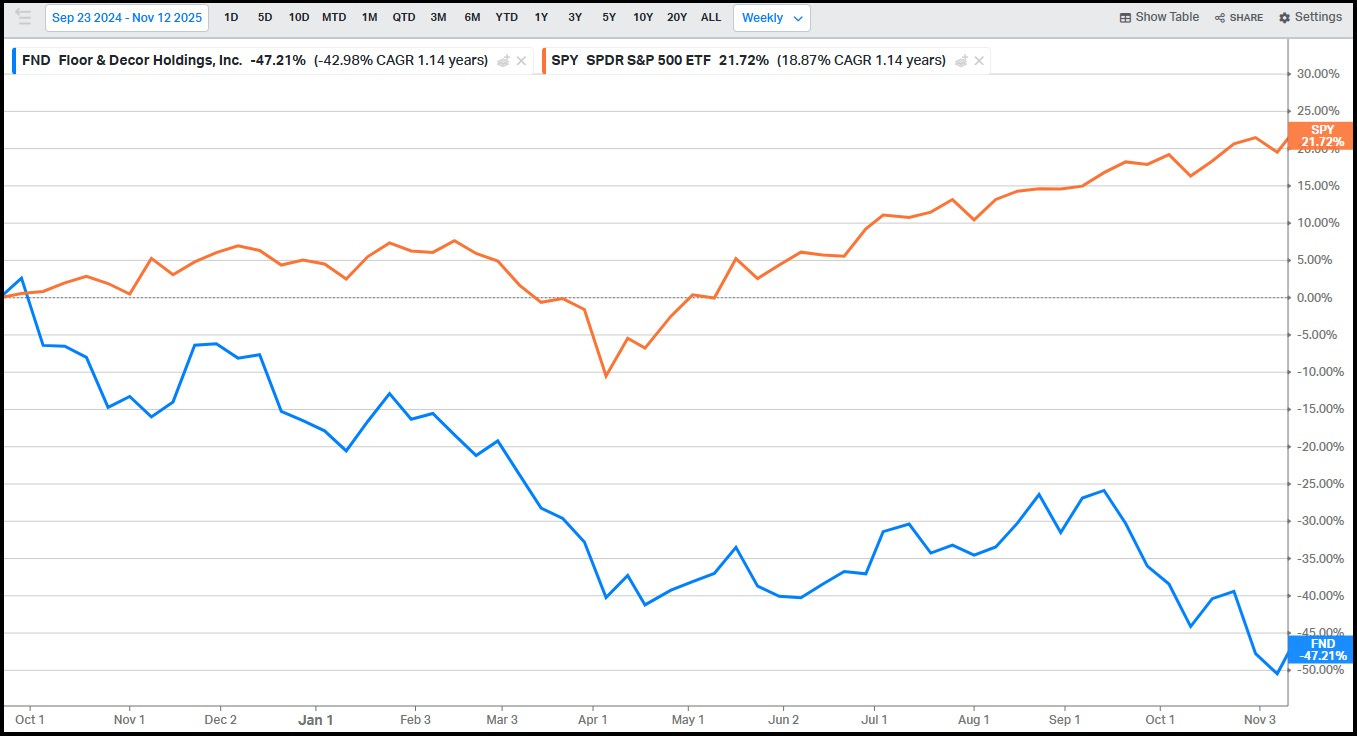

We’re now nearly three years removed from the January 2023 Floor & Decor (FND) initiation, and my stance throughout most of that period has echoed the above: despite little reason to do so based on the near term financials, Mr. Market gave FND a pass - presumably due to optimism on an eventual recovery in U.S. housing turnover activity and its attractive long-term growth prospects. While I can appreciate that perspective, the September 2024 post quantified the magnitude of improvement required to justify ~$120 per share: in rough numbers, nearly 20% annualized revenue growth in FY25 – FY28, and ~75 basis points of annual operating margin expansion, on average, throughout the forecast period. Those assumptions were well beyond what I was willing to underwrite, so the wait for a potential investment continued.

But that has finally started to change: after years of defying gravity, FND has been nearly cut in half since the September 2024 update, to ~$63 per share.

After a long wait, is now the time to buy FND?