"A More Normalized Environment"

An update on Floor & Decor (FND)

From the 2011 Berkshire Hathaway meeting:

Warren Buffett: “The immediate situation [in housing] is terrible. It’s been flatlined now for a long time… In 2010, we bought the largest brick operation in Alabama [for $50 million]… We’re going to see plenty of household growth in future decades, and our companies are well-positioned to make significant money when we get a normalized level of home building… I think it may turn up by year-end – but it really isn’t that important to us. When I decided to buy the brick company [Jenkins Brick and Tile], it was not because I thought brick would turn in two months, six months, or a year. I thought, over time, it would be a good investment at the price we paid... I feel good about the decision, but I won’t feel good about our brick results the next six months.”

Charlie Munger: “One advantage we have in buying very cyclical businesses is a lot of people don’t like them… What difference does it make to us if earnings - say they average $300 million a year - come in a very lumpy fashion? What do we care, as long as it’s a good business? We have an advantage on that: nobody else was bidding for the brick plant in Alabama.”

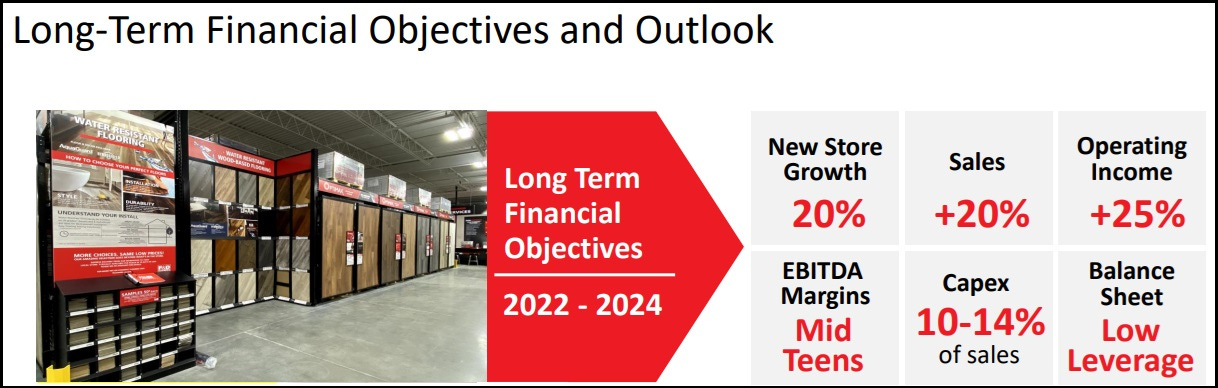

At Floor & Decor’s March 2022 Investor Day, management shared their near term financial guidance (for FY22e – FY24e). In short, they expected that aggressive new unit expansion and same store sales (comps) growth would lead to ~20% annualized sales growth, with ~150 basis points of cumulative margin expansion resulting in ~25% annualized EBIT growth through FY24e.

Well, it has not gone according to plan.