Floor & Decor: “A True Category Killer”

“I was able to see customers' reactions to a retail company that reinvented a category. Home improvement was historically done in lumber yard type settings, small hardware stores, or a combination of both. The Home Depot really came in and reinvented the way that was done.

I was on the floor when someone walked in and saw a Home Depot store for the first time… I saw how they were overwhelmed by the assortment, by what the store was. And they'd complain, ‘My gosh, this place is too big and there's too much stuff.’ So, when I got recruited to come to Floor & Decor [in 2012], and I walked into the store in Boynton Beach, Florida, I saw the same reaction from customers I’d seen in the 1980’s and the 1990’s [at The Home Depot]… That experience of being on the floor and seeing the customer’s reaction to our stores was huge.”

- Floor & Decor CEO Tom Taylor (HD employee from 1983 – 2006)

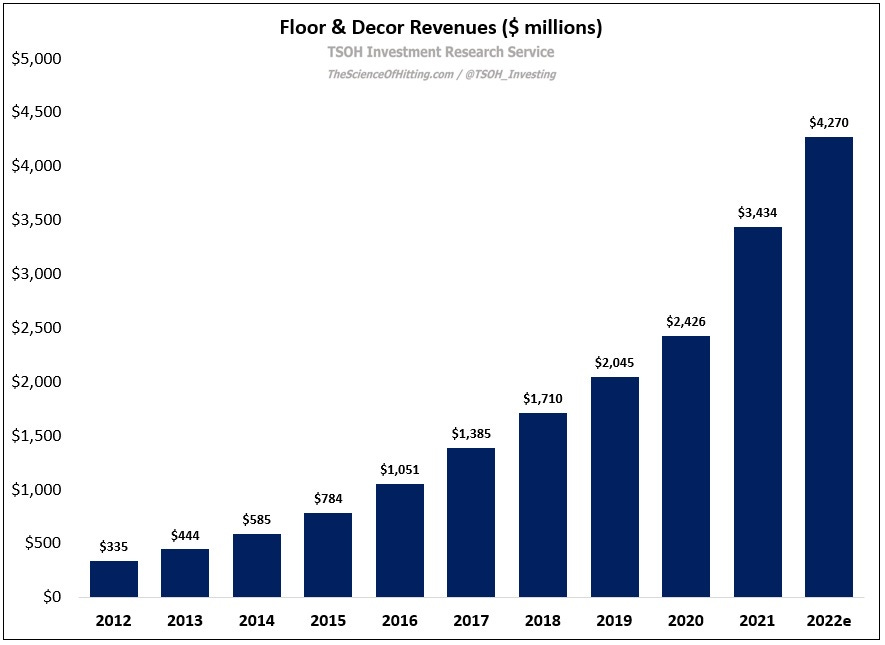

In 2006, after 23 years at The Home Depot, Tom Taylor took off his orange apron. He spent the next six years at a private equity firm before returning to the world of retail; in December 2012, he became CEO of Floor & Decor (FND), a chain of 31 stores with $335 million in annual sales. As noted in the above quote, Taylor accepted the position because he could see the significant opportunity ahead; as he later said at an investor event in 2017, “Floor & Decor is a true category killer.” In Taylor’s first decade, Floor & Decor experienced astounding success: 2022 revenues will be nearly $4.3 billion – an increase of more than 10x since 2012 (10-year CAGR: +29%).

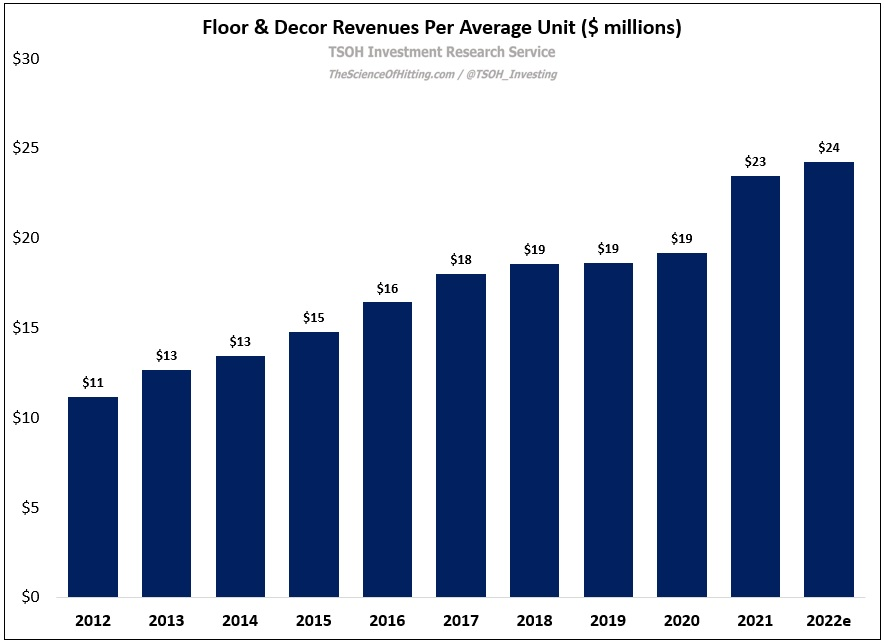

That growth reflects a combination of improved unit economics (sales per average store roughly doubled over this period, to ~$24 million in 2022e) and a meaningful increase in the total store count (up ~6x since 2012).

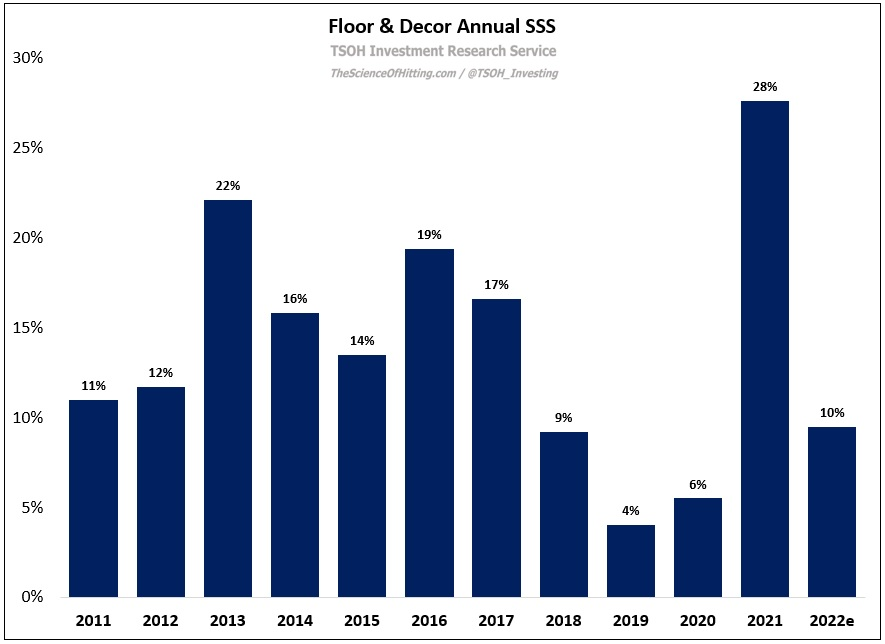

As we think about the per store productivity at FND (revenues per average unit and same store sales growth), it’s important to understand the typical maturation of a store. As discussed at the company’s 2022 Investor Day event, a new store typically generates year one sales of roughly $15 million. Over the course of the next 4-5 years, the store will mature to normalized (average) sales of roughly $27 million annually. As we think about same store sales (SSS), with new stores included in the SSS calculation after they’ve been in operation for 13 months, there’s a sizable tailwind (waterfall) that positively impacts FND’s comps (“we've historically said new stores added about 400 basis points to our overall comp”). In addition, as it relates to average unit volumes, the metric naturally benefits over time from a rising percentage of mature stores in the base (2021 annual report: “almost 60% of our stores have been opened for less than five years”).

Before digging deeper on the company’s financials, let’s take a step back: what is Floor & Decor’s positioning within the flooring marketplace and what explains its impressive results over the past decade?

At a high level, the company’s competitive set can be placed into two buckets: (1) independent and specialty flooring stores and (2) large box home improvement retailers like The Home Depot and Lowe’s.