"In The Penalty Box"

An update on Scotts Miracle-Gro (SMG)

Today’s post is sponsored by AlphaSense, the leading market intelligence and search platform that helps investors to make more thoughtful decisions. You can access a free expert transcript with a former SMG manager here.

“Our valuation is completely unfair, but I get it - we’re in the penalty box… This is a very unique consumer franchise that is not being properly valued.”

- Scotts Miracle-Gro (SMG) CEO Jim Hagedorn

From “The Bridge Year” (September 2024): “I don’t have strong views on what the company should do with Hawthorne. What I would hope is SMG management would have stronger views by now, to have gathered some conviction on the best way to play their hand from here… What I find most concerning about Hawthorne is that I don’t believe key individuals at SMG – specifically Hagedorn – truly want to own / invest in this business long-term.”

On April 10th, the company announced that The Hawthrone Collective (THC) will be transferred to an independent strategic partner. The company will receive immaterial value from the transaction ($39 million promissory note), but they’ve retained 95% of the upside on a merger or change in control, as outlined on page seven of the 10-Q. As Hagedorn framed it in a Barron’s interview, “We are going to spin it off so we can get it back.” All-in, they have spent ~$2 billion on the Hawthorne assets, which are now worth pennies on the dollar. It has been a complete disaster – but it’s coming to a close, and I’m happy they will return to 100% focus on the lawn and garden franchise.

Importantly, this experience has left management with some scars.

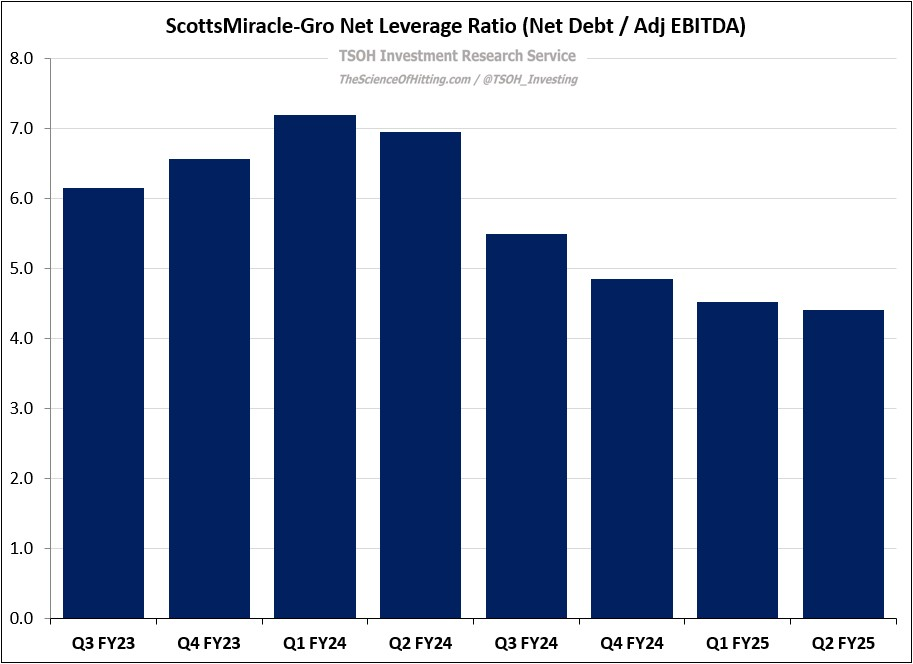

On the Q2 FY25 call, Hagedorn indicated that leverage and M&A will be approached differently going forward: “The journey through the cesspool that we have been on after COVID probably makes us more conservative. I would say 3.5x max [on leverage], maybe 3.25x… Compared to where we’ve been historically, it's probably a lower number that will make the Street and my family happier. In regard to M&A… I think we have a lot of value [in the core business]… The bias right now is to drive our business without M&A… As the CEO, with Smith & Hawken, maybe our European businesses, and with Hawthorne - I think that, like a lot of other businesses, our M&A activity was expensive. If we had taken all of that money and given it back to the owners, we might have happier shareholders and a much higher stock price.”

This was music to my ears, and it’s a material change to the story.

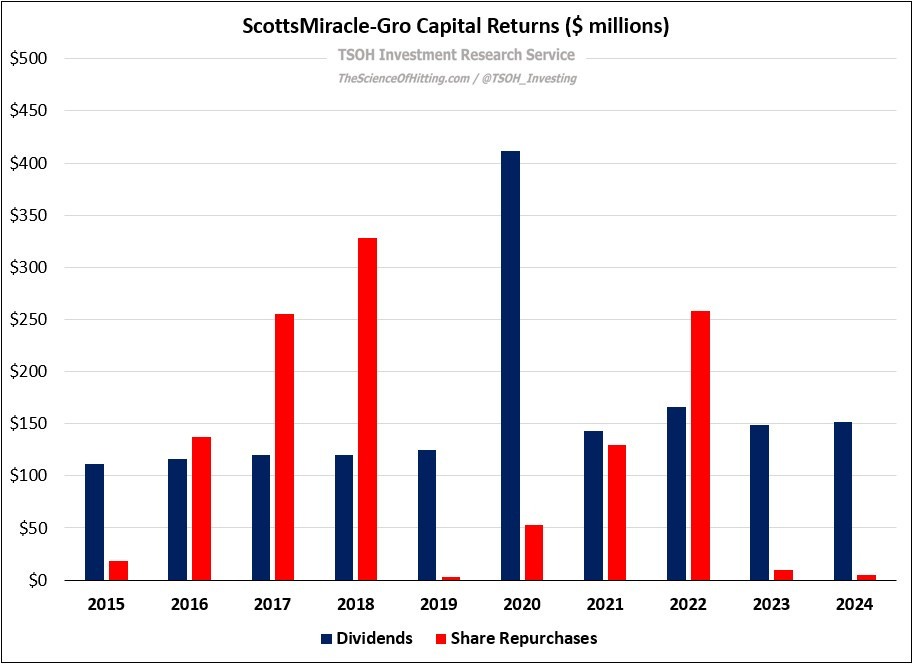

After a period of value destructive M&A, it suggests a return to the capital allocation policy of 2015 - 2018, when >100% of SMG’s free cash flow was returned to owners (it also helps that the company’s stock price has declined ~60% over the past five years). As Hagedorn bluntly stated on the Q2 FY25 call, “In my view, our equity price makes no sense when you consider our accomplishments, our growth trajectory, and our superior position in this very important consumer space.” (Net leverage remains elevated at ~4.4x, but has meaningfully improved from ~7.0x in 1H FY24.)

That brings us to the core U.S. Consumer business. As discussed in “The Bridge Year”, I was concerned to learn that broader financial / business pressures at the company, largely attributable to Hawthorne, had bled into decision-making in the core lawn & garden franchise. In a CNBC interview, Hagedorn shared an update: “A year and a half ago, when we were desperate for sales, we had to really incent retailers to buy our stuff. Now, I’ve basically said, ‘I want my money back; I’m out of trouble and I want my margin back.’ It’s significant, hundreds of millions of dollars.” As he went on to explain, retailers pushed back, which led to a compromise - heightened joint promotional activity, including in-store support, was has driven sales growth and share gains for SMG: in 1H FY25, their retail point-of-sale (POS) units increased by 12% YoY, on top of the +9% POS units growth in FY24.

That said, this 12% increase in 1H FY25 POS units has only resulted in a 2% increase in POS dollars. As Hagedorn explained in further detail on the Q2 call, this reflects some continued concessions with retail partners on pricing:

“Coming out of COVID, the promotional dollars we did to incent sales [given outsized inventory build that had to be addressed], I want that back. But what we've heard from a lot of retailers is, ‘Customer counts are down at stores. Our big, durables business is off. We're suffering, it's not a great time to take price.’… We also had a belief that some of our product lines, whether grass seed or lawn fertilizer, were getting pretty pricey. I ended up agreeing with the sales team: instead of saying we want the money back, put it to [promotion]… The retailers are promoting us very heavily… For all this money [we’ve given up], they are spending at least that much to promote our products… It's a very competitive consumer landscape. On everyday pricing, you're not seeing the velocity that you’re seeing on promotions… This money is being put to work by retailers in the way they committed to, and the way we hoped that they would. On promotion, product is selling really, really well… but consumers are looking for good deals right now – and if the deals aren't there, they are a little more careful… I think that is the lion's share of what you are seeing, in regard to the difference between POS dollars and POS units… There are very steep promotions right now, and retailers are using the money we gave them.” (CFO Mark Scheiwer quantified the impact as ~60% mix, primarily due to outsized volume growth in soils and mulch, with the remaining ~40% due to the heavy promotional activity described above.)

I’m of two minds about this situation.

On the one hand, I typically subscribe to Pat Dorsey’s views on pricing as a signal of competitive advantage, or lack thereof: “If a company raises prices 2%, 3%, 4% every year... And then one year they suddenly don’t. They say ‘The economy is tough, we wanted to take it easier on customers this year’ – that is a load of crap. It means something has changed in that industry.”

On the other hand, I can also appreciate Hagedorn’s argument. There is a potential long-term benefit from a further strengthening of SMG’s relationship with key retail partners, especially if they are able to further widen their moat while offsetting much of the financial impact through volume growth; a collaborative relationship with HD, Lowe’s, etc., will pay long-term dividends.

That said, it must be reinforced by innovation and brand building (the marketing increases detailed on slide 10 are on top of +14% advertising expense growth in FY24). This comes at a time when SMG is also trying to communicate a specific strategy / customer use case (multi-bag / regular feeding programs), supported by promotional activity / signage inside retail partners doors; if it works, it will drive volume growth in the U.S. Consumer segment, but at a lower net price per bag sold. Again, I can see the merit of what they are saying - but it still violates Dorsey’s pricing power test.

In the near term, even with this trade-off on net pricing, the combination of higher sell-through and supply chain / fixed cost leverage has driven meaningful margin improvements in FY24 / FY25e. (Scheiwer: “Multi-bag volumes from a category like lawn, that’s incremental to gross margins… Price decreases make it a little different dynamic, but it’s margin accretive.”)

The target is ~3%+ annualized revenue growth, led by the volume contribution over pricing, along with sustained margin improvement. If successful, management sees a path to ~$700 million of FY27e EBITDA, or ~$500 million of normalized operating income (accounts for SBC and run rate CapEx). At $59 per share, the company has a market cap of ~$3.5 billion and an enterprise value of ~$6.0 billion; on FY27e, it trades at ~12x EV / EBIT.

Conclusion

My initial interest in SMG, the inspiration for last June’s initiation, came about as a result of some commentary at the 2024 Markel Omaha Brunch (Markel still holds a small SMG position). Over the course of the past year, it has remained on the back burner, primarily because I did not have confidence in their long-term strategic vision at Hawthrone - and, as a corollary, their capital allocation prowess. Not to be repetitive, but this is worth stating clearly: despite a strong and fairly stable core business, SMG came under real financial pressure in the past 2-3 years. It’s a reminder of just how critical effective capital allocation / M&A are to the long-term value of a business.

But now we’ve seen three significant changes: (1) the Hawthorne transaction; (2) clarity on the go-forward strategy as it relates to financial leverage and capital allocation priorities; and (3) clarity on the volume-focused strategy in the core business, which should provide incremental protection against competitive threats, both from private label and other branded suppliers (as noted on slide 19 of the Q2 FY25 slide deck, private label has been ceding share). It’s a strategy that will be dependent upon SMG being the lowest cost manufacturer, which is an attainable goal given their industry leadership position. (Hagedorn: “While we were consolidating lawn and garden, retail was consolidating; today, probably 90% of lawn and garden is sold in five retailers… How do we stay powerful? We advertise, we bring consumers into the store, we deliver to the stores every week, we merchandise product for the retailers, we sell it for them because there are very few people in these departments now – that is how SMG became as important as it is.”)

From a financial perspective, net leverage should return to target levels within 18 - 24 months. From there forward, my expectation is that the entirety of SMG’s free cash flow will be returned to shareholders, largely to fund repurchases - which, at current prices, could reduce shares out by >5% per annum. In summary, this investment is likely to work well if management delivers on their goal of ~3%+ annualized (organic) revenue growth in the core business; along with the tailwind from higher margins and capital returns, that should drive sustainable double digit per share TSR growth.

The main issue that gives me pause is my confidence level on the inherent strength of, and the long-term growth opportunity within, the core U.S. lawn and garden franchise. Another way to say that is the pricing discussion feels like it has changed slightly, and I want further POS evidence that supports their decision-making. (As a general rule, I’m also a bit gun shy on investments where a large percentage of the expected TSR is attributable to capital returns; in my experience, it’s a setup with higher value trap risk).

SMG is intriguing, but I’m not ready to make the leap yet.

One final note: the Hagedorn family owns ~25% of the company, and Jim turns 70 this year. Given what has taken place since the pandemic, along with a flat stock price over the past decade, I wonder how much longer he’ll keep taking those early morning flights to Marysville – and, when Jim retires from the CEO role, if the Hagedorn’s would consider selling the business.

Note - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.