SMG: "The Bridge Year"

An update on ScottsMiracle-Gro (SMG)

From “ScottsMiracle-Gro: In The Weed(s)” (published June 2024): “Despite the ballast of a large and consistently profitable core business, the stability of ScottsMiracle-Gro - what had been built over seven decades - was somewhat put into jeopardy from the strategic diversion at Hawthorne, volatility in the U.S. Consumer business, and financial leverage. It is a good example of how a confluence of seemingly small risks – an unsuccessful run of acquisitions and getting over one’s skis on financial leverage – can lead to real pain.”

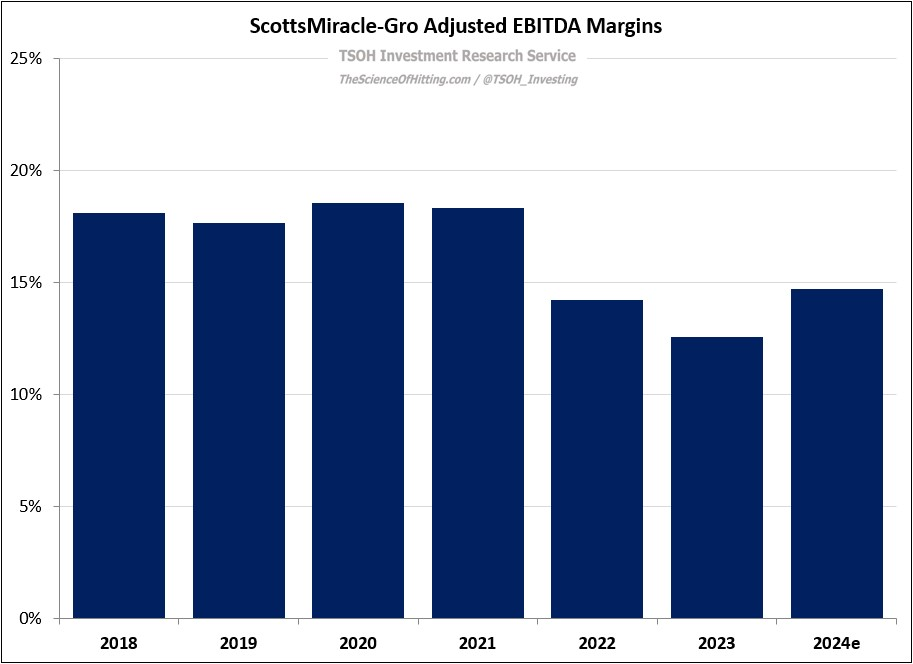

As I see it, a key part of the ScottsMiracle-Gro (SMG) investment thesis is the margin recovery opportunity within the core U.S. Consumer (Lawn & Garden) business. Successful execution here, in combination with effective capital allocation, is a setup that is likely to work out quite well for shareholders from today’s stock price. That said, it’s important to understand how we got here in the first place, i.e. why their FY23 adjusted EBITDA margins were down ~600 basis points from five years earlier. In understanding how the company got here, it is instructive to consider the indirect role that the “real pain” discussed above played in that outcome (how it impacted SMG’s business strategy).