ScottsMiracle-Gro: In The Weed(s)

“I wanted to create the Procter & Gamble of lawn and garden.”

- ScottsMiracle-Gro CEO Jim Hagedorn

My interest in ScottsMiracle-Gro (SMG), the leading marketer of branded consumer products for lawn care and gardening, arose from an offhand comment at Markel’s Omaha Brunch (the gist of which was in reference to significant industry volatility since the pandemic, which Markel saw firsthand at Costa Farms). Upon checking, I also learned that Markel has been buying shares of SMG. Those factors, along with its weak stock price performance in recent years, were the motivation for today’s research on ScottsMiracle-Gro.

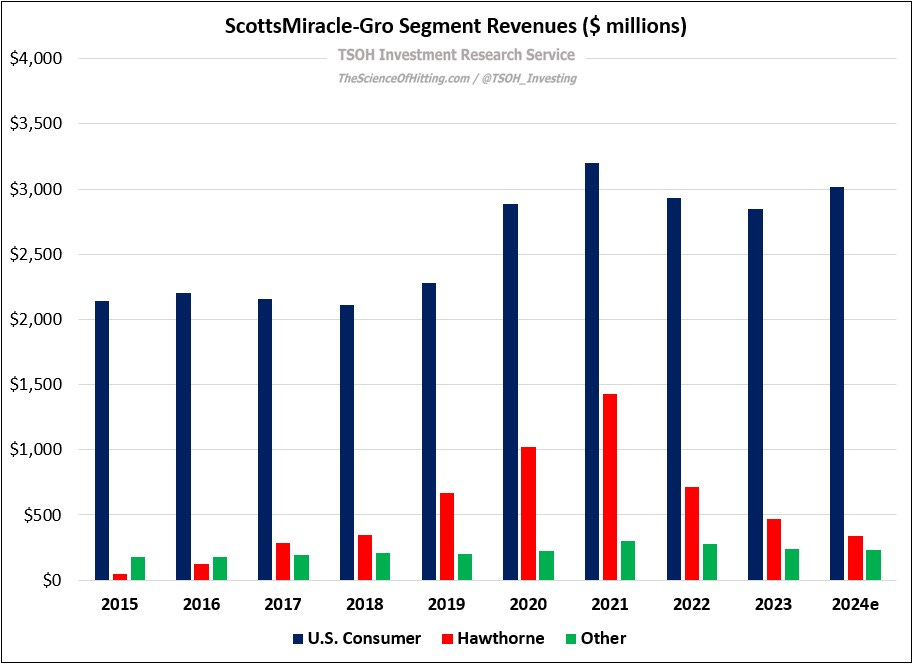

For SMG, the following chart captures the significant business volatility weathered over the past five years. That is particularly noteworthy at the Hawthrone segment, where revenues more than quadrupled from FY18 to FY21, only to decline by ~75% over the next three years through FY24e. (“Other” primarily consists of SMG’s Canadian lawn and garden business.)

Hawthorne is an indoor and hydroponic gardening business that focuses on serving cannabis growers; they supply key equipment and inputs like lighting, nutrients and supplements, and filtration devices. The industry attracted capital during the 2010’s, supported by a more accommodating regulatory environment for recreational and medical demand (for context, three-quarters of Americans now live in a state where cannabis use is legal in some form).

But over time, the combination of excess supply, pricing pressures, and substantial business challenges that primarily stem from the disconnect between state and federal laws, has led to a significant industry downturn.

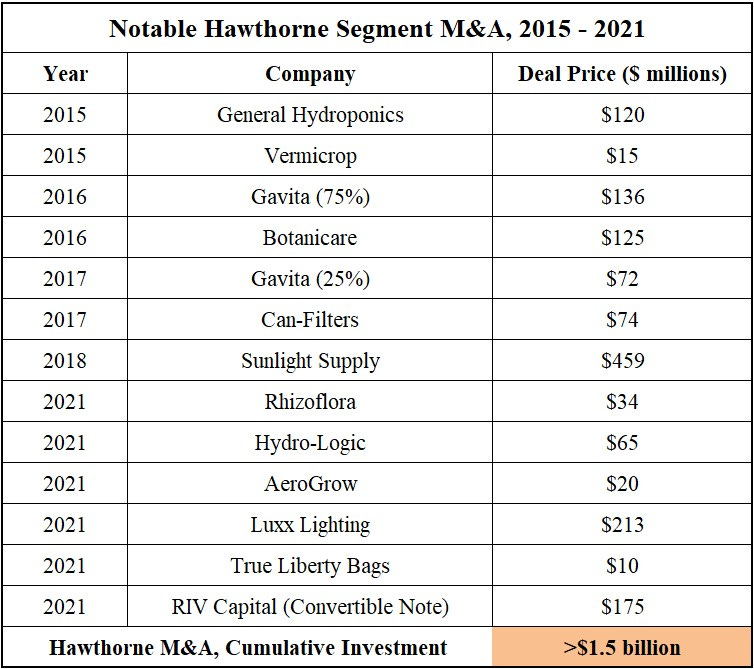

Hawthorne, which started in 2014, leaned heavily on M&A; as you can see below, Scotts allocated more than $1.5 billion to Hawthorne M&A from 2015 to 2021, including the 2018 purchase of Sunlight Supply for $459 million, the largest deal in their history. (That >$1.5 billion is inclusive of $175 million in RIV Capital convertible notes). Given the ~75% revenue contraction noted earlier, suffice to say it has not gone to plan of late; as a result, Hawthrone incurred more than $800 million of impairment charges in FY22 and FY23.

While much less extreme, the company’s core U.S. Consumer segment has lived through its own cycle over the past five years. As you can see above, it was a relatively steady business pre-pandemic, with revenues growing ~2% p.a. for FY15 - FY19 (as CFO Matt Garth put it at a recent investor event, “that business had grown at GDP plus or minus 1% for decades”). Two years later, in FY21, segment revenues reached $3.2 billion – 40% higher than in FY19. It has since given back some of that growth, but is still on track to generate ~$3.0 billion in FY24 revenues (trailing five-year CAGR of ~6%).