Floor & Decor: "Wind In Our Face"

From the conclusion of “A True Category Killer”: “Based on everything that I’ve seen to date, Floor & Decor is a clear candidate for inclusion in the portfolio. But despite that upbeat conclusion, I’m going to hold off for now on making an investment in FND. That hesitation isn’t indicative of any major concerns about the company, its management team, or the valuation.

Simply put, I’ve only truly known about this company for a month or two, so I want to take a bit more time to think about the business [and the industry]… The coming year may present some macro headwinds for Floor & Decor; as President Trevor Lang said at an investor conference in late 2022, ‘It's definitely going to be a bit tougher before it gets better’. If Mr. Market concludes that these hiccups are a good reason to offer this high-quality business at a cheaper valuation, I’d be amenable to that outcome; as always, if I decide to make a move on FND, I’ll disclose it to you beforehand.”

On February 23rd, Floor & Decor reported its Q4 FY22 results.

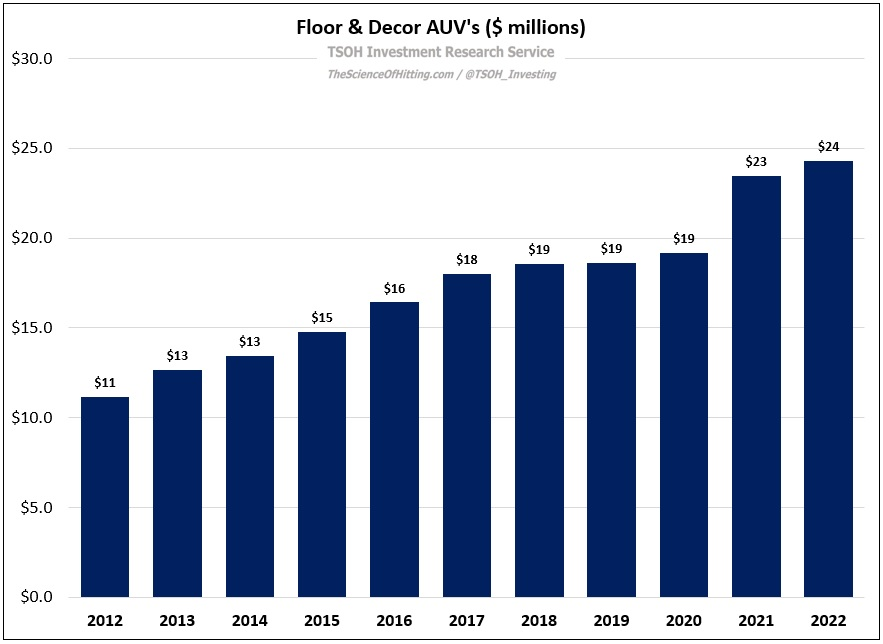

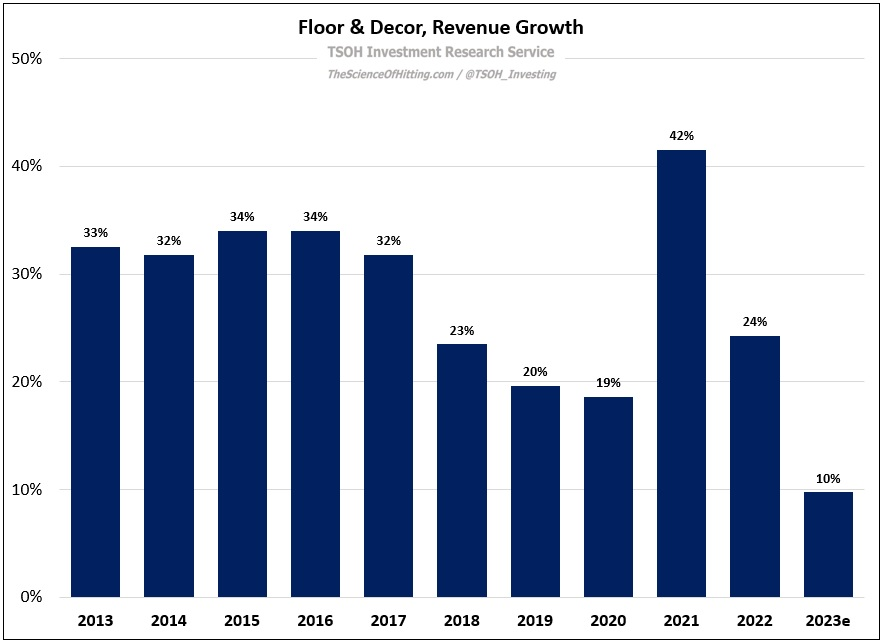

At a high level, it was another impressive year for the company, particularly after considering some of the external factors that surfaced throughout 2022. For example, despite lapping 42% revenue growth in FY21, the top-line grew another 24% in FY22, to $4.27 billion. In addition, adjusted EPS grew by 13% YoY, to $2.8 per share – up ~140% from FY19 EPS of $1.1 per share. The underlying long-term growth drivers discussed in the deep dive, most notably new unit expansion and improved per store economics, continued to deliver.

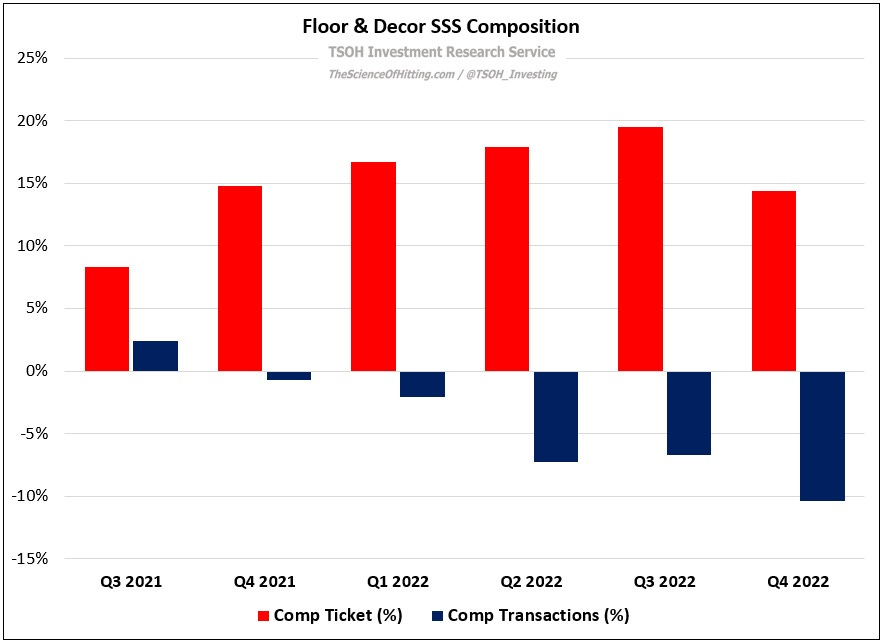

What the consolidated FY22 results fail to capture is the recent change in trend. Specifically, Q4 comps increased 3%, a meaningful deceleration from the first nine months of the year (Q1 at +14%, Q2 at +9%, and Q3 at +12%). As discussed last week on HD, it’s important to understand the composition of what’s happening: the results over the past 12+ months showed an outsized gain in ticket (due to a combination of COGS inflation and rising Pro mix) relative to the decline in comp transactions. In Q4, that gap closed significantly, with a 14% increase in ticket largely offset by a 10% decline in transactions. Based on the Q4 commentary, there’s reason to believe that the difficult transaction trends will hold, at least through 1H FY23 (during the Q&A, management said quarter to date comp transactions have declined at a similar rate to the -10% reported in Q4). At the same time, the benefit from higher ticket is likely to fade throughout 2023: management made it clear that they will pass through a meaningful percentage of expected COGS and supply chain efficiencies to customers as they materialize.

The net result is FY23 comp guidance of flat to down 3%, which implies a mid-single digit YoY comp decline for Floor & Decor’s base / mature stores (as discussed in the deep dive, the waterfall impact from the maturation of new stores adds 300 – 400 basis points to the company’s annual comps).

The impact of the comp headwind will have a material effect on revenue growth. As shown below, management’s guide implies ~10% top-line growth in 2023, well below the figures that FND has reported over the past decade. (They aren’t alone: after a few years of abnormally strong results, Home Depot and Lowe’s are both guiding to roughly flat revenues in 2023.)