FIVE: Below And Beyond

From “It's All About Delivering Value”: “Five Below remains somewhat differentiated in U.S. retail in terms of its product mix / merchandising and target demographics (teens / tweens and their parents). And while the company may be (is) moving closer to some U.S. retail peers as a result of the ‘Five Beyond’ roll-out, I still see a shopping experience and brand image that’s quite different than pOpshelf, Target, Dollar Tree, TJX, etc. (CEO Joel Anderson: ‘There's still a lot of value in Five Below… the customer really doesn't want us to lose Five Below, and we're not planning to.’)”

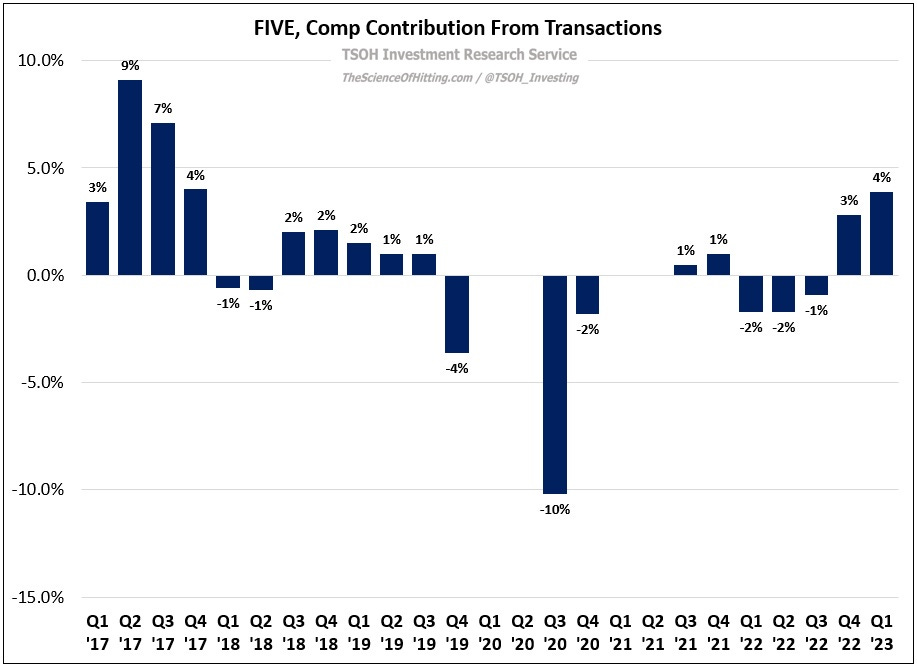

Despite a combination of macro pressures and challenging comparisons, Five Below delivered solid results in Q1 FY23. Most notably, I was impressed by the +4% increase in comp store transactions (offset by a ~1% decline in ticket), the highest growth rate in more than five years (excluding the 2021 results, which were comping against store closures in mid-2020). While the “Five Beyond” roll-out is top of mind in the investment community, the Q1 results highlighted Five Below’s ability to weather a tough environment (and while selling stuff that “nobody really needs”). That outcome speaks to a retailer that hasn’t lost sight of what customers care about: differentiation (the “Wow” factor) and value. While price points may be subject to cyclicality, the demand for value will be ever present. As long as FIVE’s merchants / operators deliver on that promise, the company’s future will be a bright one. (“The one thing that's been consistent since the beginning, and something we're probably even more focused on now, is delivering value, specifically in the $1 - $3 range. You walk in our stores, there's a 16-foot wall [of SKU’s], it's all $1. That is really resonating with customers.”)

(For the above chart, note that management did not quantify the split between comp transactions and comp ticket on the calls or in the quarterly filings in 1H 2020 and 1H 2021, i.e. the periods impacted by store closures / lapping store closures; I left the metric at 0% in each of those quarters.)

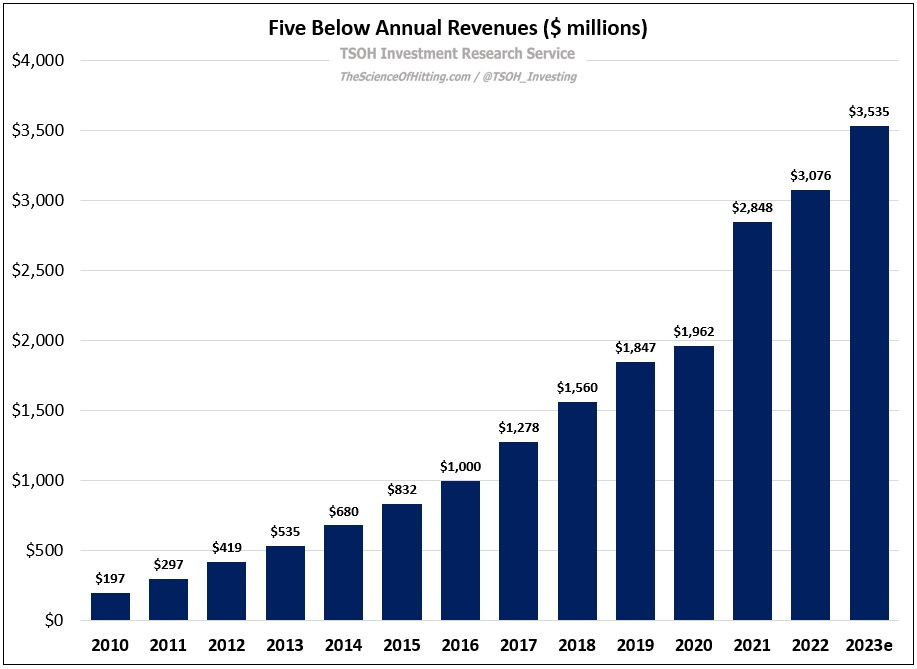

As a reminder, Five Below’s business model has been built around three key ideas: a “trend right” assortment, an attractive store environment for the target customer, and affordable products (as noted in the deep dive, FIVE’s co-founders believed Toys R Us had never really figured out how to sell to kids). While the model has evolved over time, most notably in terms of the range of price points, the core idea is unchanged. The result, as shown below, is a retailer that will have more than 1,500 U.S. stores by yearend, with 2023e revenues of ~$3.5 billion (trailing five-year CAGR of +18%).

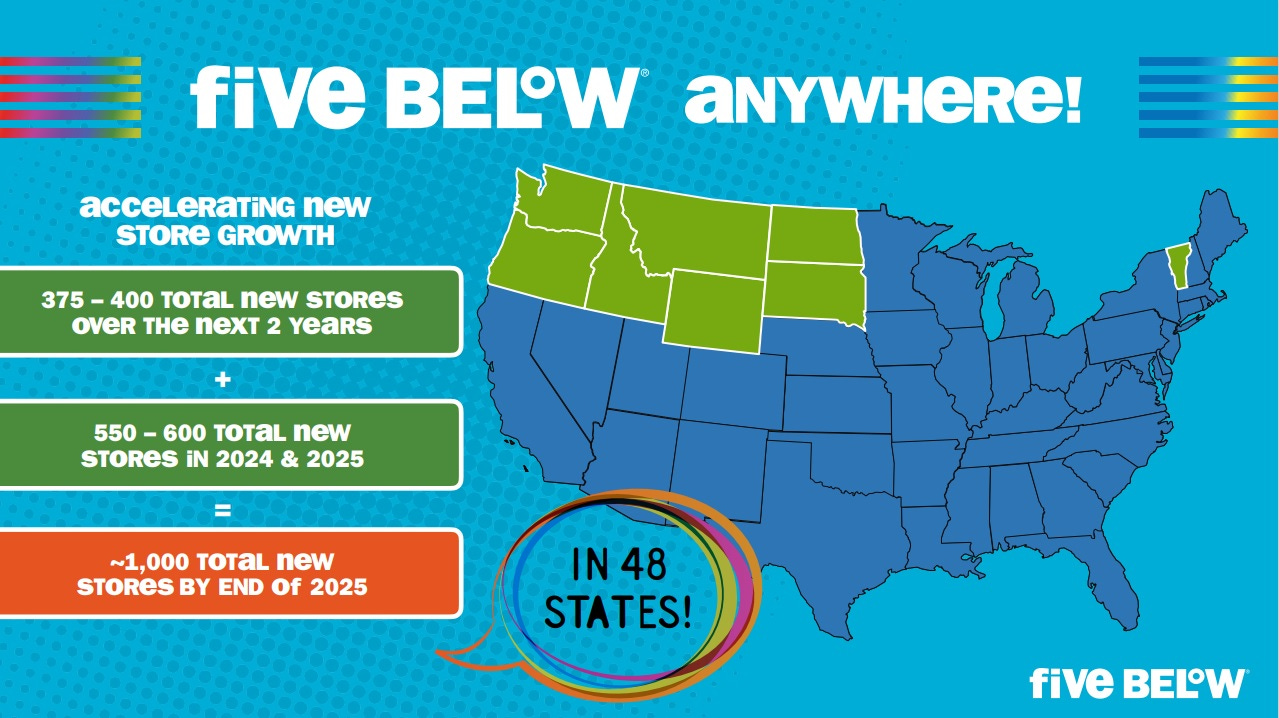

As outlined at the company’s 2022 Investor Day, they have no plans on slowing down. The most notable example is management’s long-term unit growth targets: by 2030, the company plans on having 3,500 U.S. stores.

As it relates to the first half of that timeline, here’s what Anderson said at Investor Day: “Our plan is to open 375 - 400 stores over the next two years [in 2022 and 2023]. We also plan to open 550 - 600 stores in 2024 and 2025 combined… It took Five Below 18 years to open our first 1,000 stores. This has us opening another 1,000 stores in the next four years.”