"It's All About Delivering Value"

An update on Five Below (FIVE)

From “Five Below’s Triple Double” (June 2022):

“My short-term concern is that Five Below experienced huge business tailwinds throughout the pandemic, with two-year stacked comps up ~25%. Will those gains prove sustainable? And, if not, what does the path to normalization look like (timing and magnitude)?... The challenging Q1 results, which were well below guidance despite the fact that management had two months of results in the bag at Investor Day, along with the across the board cuts to its FY22 guidance, are a clear warning sign… I’m going to take my time on this decision. That’s partly in recognition of the near term business headwinds, but it also accounts for some difficult decisions that need to be made to make room for FIVE (I’m struggling to find a position in the portfolio that I’m willing to sell). That said, in light of the recent stock price weakness, dithering presents its own risks; I’ll keep a close eye on the upcoming results and will act swiftly if there’s reason to believe 2022 truly provides a solid base for ~20%+ growth in the years ahead.”

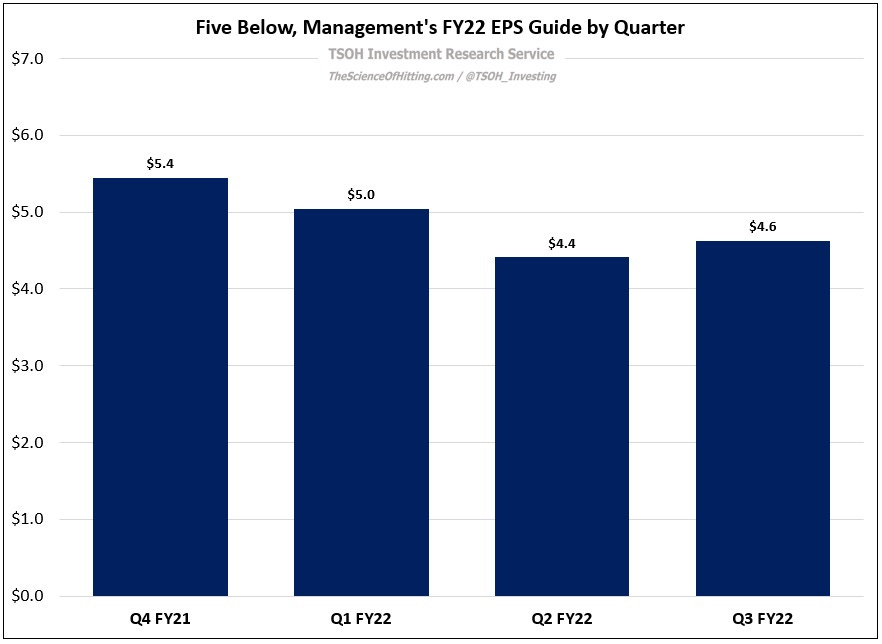

The company’s Q2 results, which were released in late August 2022, provided some supporting evidence for my concerns (in terms of the business results). The company was forced to cut its FY22 guidance for a second time, with an updated EPS range of $4.26 – $4.56 per share (at the midpoint, that was roughly 20% below the FY22 EPS guide originally set in Q4 FY21).

As we looked ahead to Q3, with the results set to be released in late November, I thought it was reasonable to believe that the struggles being experienced at retailers like Target would spill over to Five Below (and if that happened, it would surely require FIVE management to cut FY22 EPS guidance for a third time). Well, it didn’t work out that way. While FIVE faced its fair share of Q3 headwinds, with operating income declining more than 50% YoY, the results were fairly strong in light of the current macro environment and the difficult comparisons (Q3 FY21 comps were +15%).

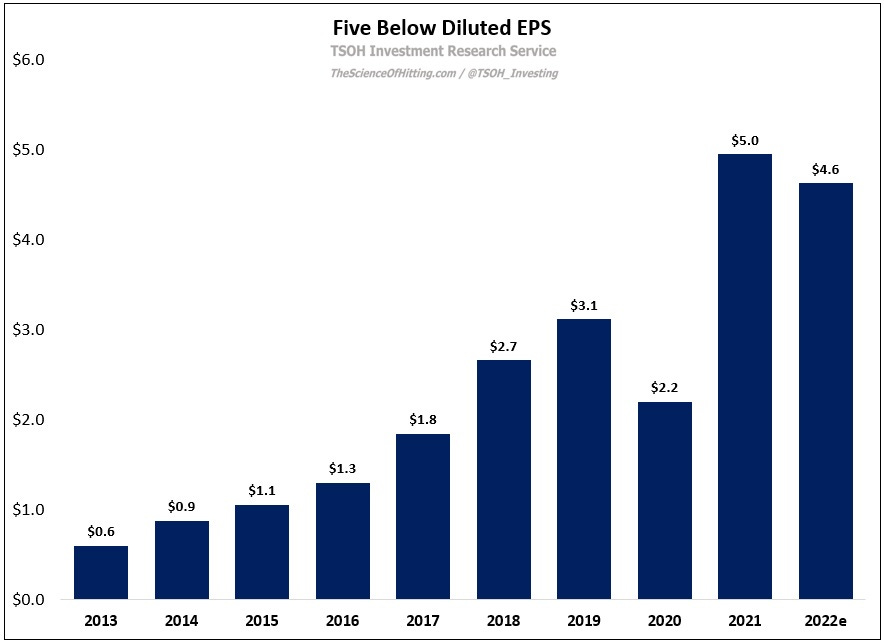

Revenues in Q3 increased 6% YoY to $645 million, with 10% growth in the unit count offsetting a 3% decline in same store sales. For the full year, management’s expectations improved from three months ago: revenues are expected to exceed $3 billion (+7% YoY, with comps down 2% - 3%), with EPS of ~$4.6 per share. As you can see below, this implies a roughly 50% increase versus FY19 EPS (with a trailing five-year EPS CAGR of +20%).

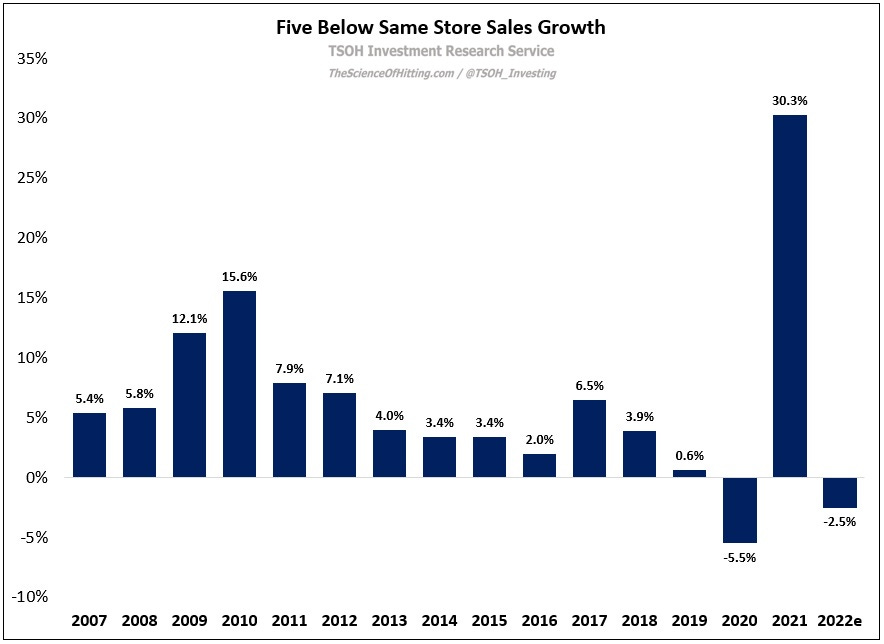

To be perfectly clear, my increased focus on FIVE’s short-term results doesn’t reflect a change to my long-term perspective (investment time horizon). Instead, it speaks to the uniqueness of the current situation, most notably due to the volatile results reported from FY19 – FY22e: determining whether the baseline for future growth was FY22 EPS of ~$5.5 per share or ~$4.0 per share is important; the answer to that question has a significant impact on a reasonable estimate of Five Below’s intrinsic value. Of course, there’s no assurance FY22 will be the finish line either. As you can see below, the results – so far – look pretty darn compelling: after reporting +30% comps in FY21, FIVE’s comps are only expected to decline low-single digits in FY22. For a company that generated 3.0% - 3.5% comps, on average, in the five-year period from FY15 – FY19, it would’ve taken about seven years to see a ~25% comps lift; instead, that has happened in the past 24 months (to be fair, with some extra help on the FY21 comparison from the issues in FY20).

But what does that mean as we look ahead to FY23 and beyond? Returning to the question asked in “Triple Double”, will those per store sales gains prove sustainable? This topic was brought up during the Q&A session on the Q3 conference call, and management’s commentary was noteworthy.