ESPN: “Looking For Strategic Partners”

On Thursday, Disney CEO Bob Iger sat down for a wide-ranging conversation with CNBC’s David Faber. The interview, which followed an announcement on Wednesday that Iger’s contract had been extended through the end of 2026, touched on many of the challenges that the company currently faces.

I’ve written about Disney’s challenges and long-term opportunities on numerous occasions over the past two and a half years, most recently in “A Worrisome Circumstance”. As I wrote then, I believe the long-term foundation for Disney’s direct to consumer (DTC) businesses, especially in the U.S., should be built on a strategy that highly incentives their bundle:

“Scale, when measured solely in terms of the number of paid subscribers across Disney’s various DTC services, wasn’t sufficient; they needed to figure out how to deal with variables like churn and pricing power, which in my mind would be greatly influenced by the level of platform engagement. This was particularly important for the long-term future of ESPN / sports rights, which is why I believed the DTC bundle - and ideally a single service for those subs - provided the clearest path for Disney’s linear to streaming transition. I continue to believe this is the right decision for the long-term health of the business (importantly, and in contrast to some notable legacy media peers, I also believed Disney could effectively execute that strategy).”

Today’s post will focus on sports rights and the ongoing evolution of ESPN. Specifically, I want to focus on this comment by Iger during the interview:

“If you look at today’s media landscape, sports stands very, very tall in terms of its ability to convene millions and millions of people all at once… It lends itself to technology in many ways, in terms of coverage, distribution, and consumption. And our position in that business is very unique. We have a great brand… That said, we’re going to be open minded; not necessarily about spinning ESPN off, but about looking for strategic partners that could help with distribution or content… There’s so much more that can be done with [ESPN’s programming] in terms of the way it’s distributed and consumed… Everything’s on the table… If they come to the table with content value, distribution value, or capital, even if it just helps to de-risk the business to some extent… If they come to the table with value that enables ESPN to transition to its DTC offering, we’re going to be very open minded.”

I want to start by reiterating something I’ve long believed is critical to Disney’s long-term DTC road map: they have to make a clear strategic decision (go wide or go deep). What has become apparent, specifically as a result of some of Iger’s commentary in recent months about ESPN and Hulu, is that they intend to move forward with the all-encompassing DTC playbook that I discussed in May. It has taken longer than I would’ve hoped to get here (the lingering Hulu ownership issues have not helped), but we now have clarity on the U.S. DTC strategy: the goal is multi-product DTC subscribers, and likely an all-in-one bundle over time (starting with Disney+ and Hulu).

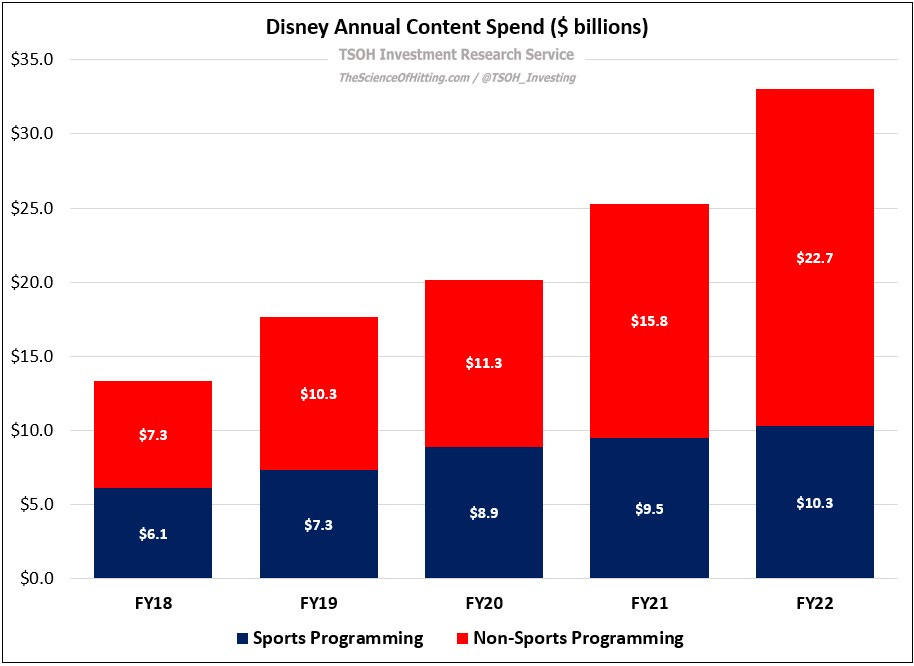

As a reminder, ESPN+ (which ended Q2 FY23 with more than 25 million paid subs) has run rate revenues of nearly $2 billion; by comparison, the U.S. linear sports networks generate roughly $12 billion in annual revenues for Disney. Clearly, the business remains largely exposed to linear; bridging that divide is critical to ESPN’s long-term success. (That ~$14 billion of revenues is relative to global sports rights costs of ~$10 billion in FY22; my guess is that 70% - 80% of that spend is attributable to content in the United States.)

So, with that as the starting point, why is Iger suddenly floating the idea of strategic partnerships at ESPN, and what does that look like in practice?