Disney 10-K Update

Earlier this week, Disney filed its annual report for FY23. In addition to the analysis shared after the release of the Q4 results (“Improve The Bottom Line”), I think the following charts provide some context for thinking about the current state of affairs at the company (some of the data points that I track for Disney are only included in the annual filing, not in the quarterly releases).

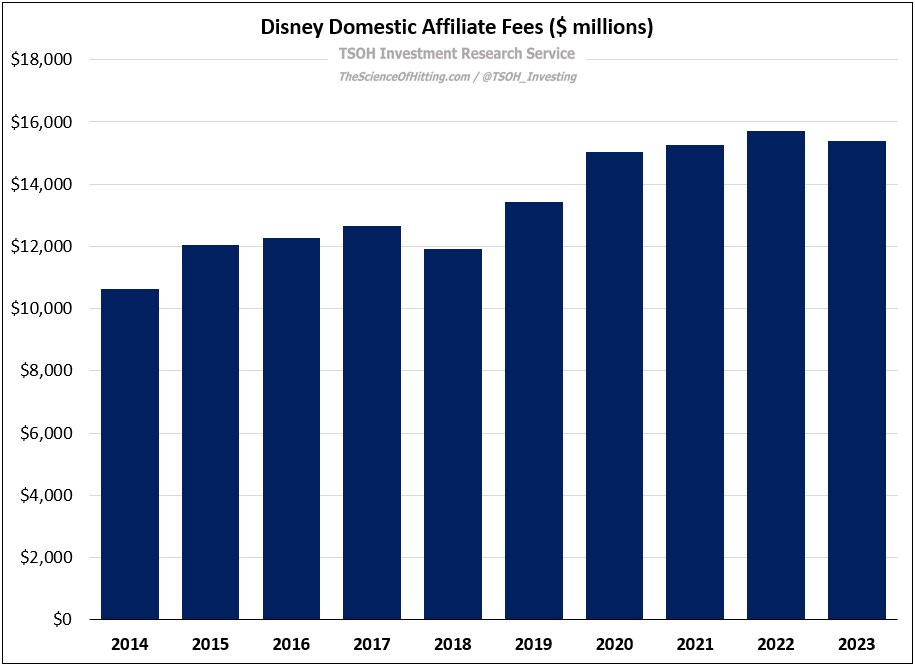

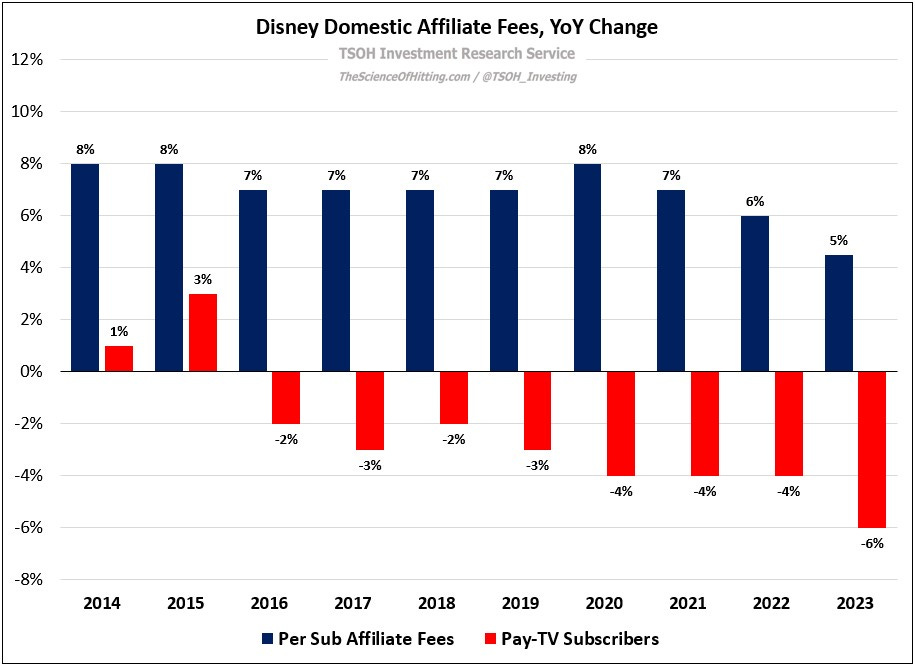

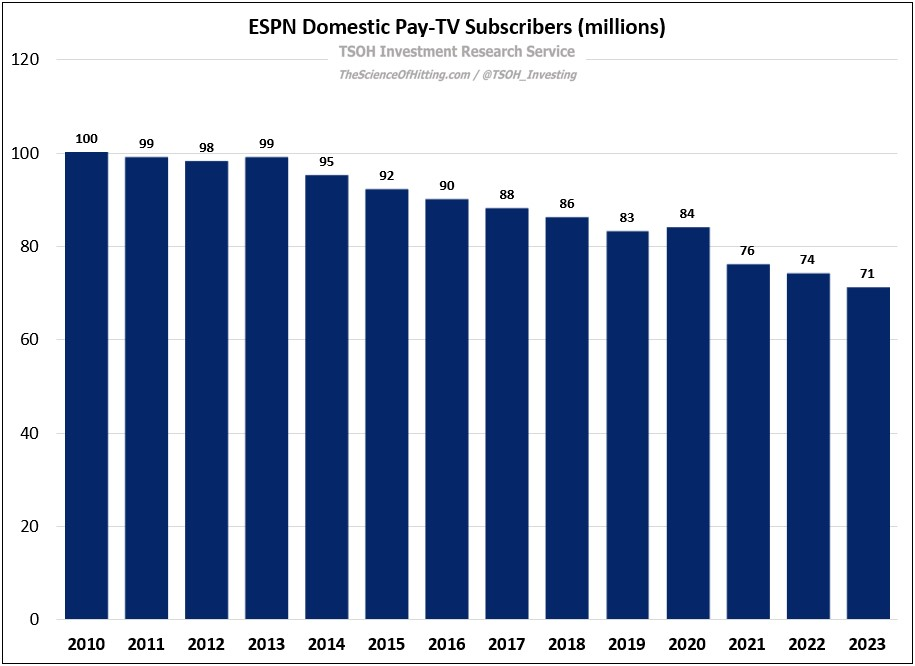

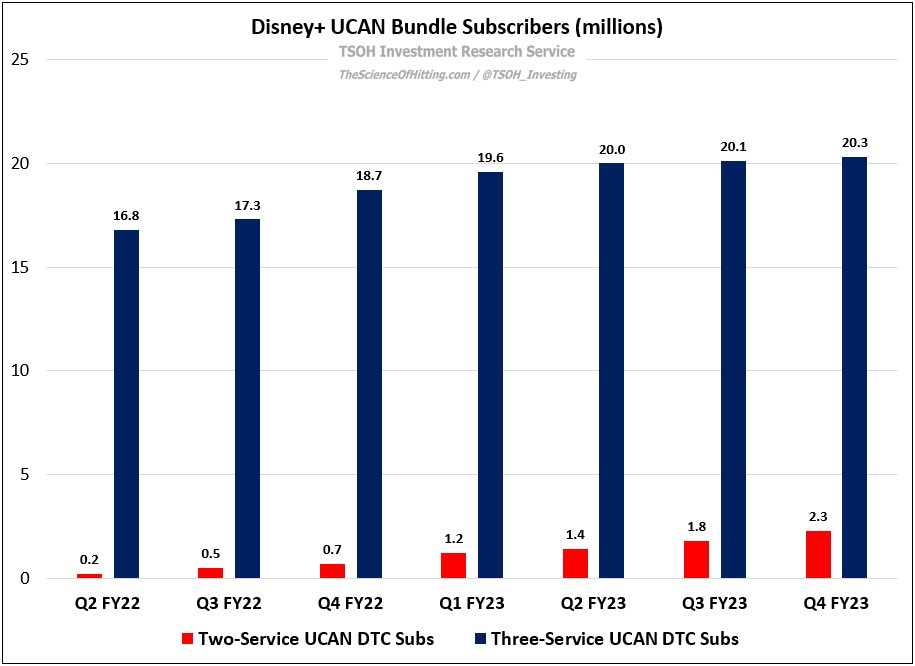

The first four charts are related to Disney’s video businesses. While FY23 domestic affiliate fees of ~$15.4 billion remain just shy of all-time highs, both rates (per sub affiliate fees) and volumes (the number of U.S. pay-TV subs) faced incremental pressure throughout the year. As the decline of U.S. pay-TV accelerates, with a notable example being the ~13 million ESPN linear customers that have left the ecosystem over the past 36 months, the question is how to effectively transition to DTC / streaming for entertainment and live programming. The rising number of bundled (two-service and three-service) UCAN DTC subscribers is encouraging, but there’s still a long way to go.

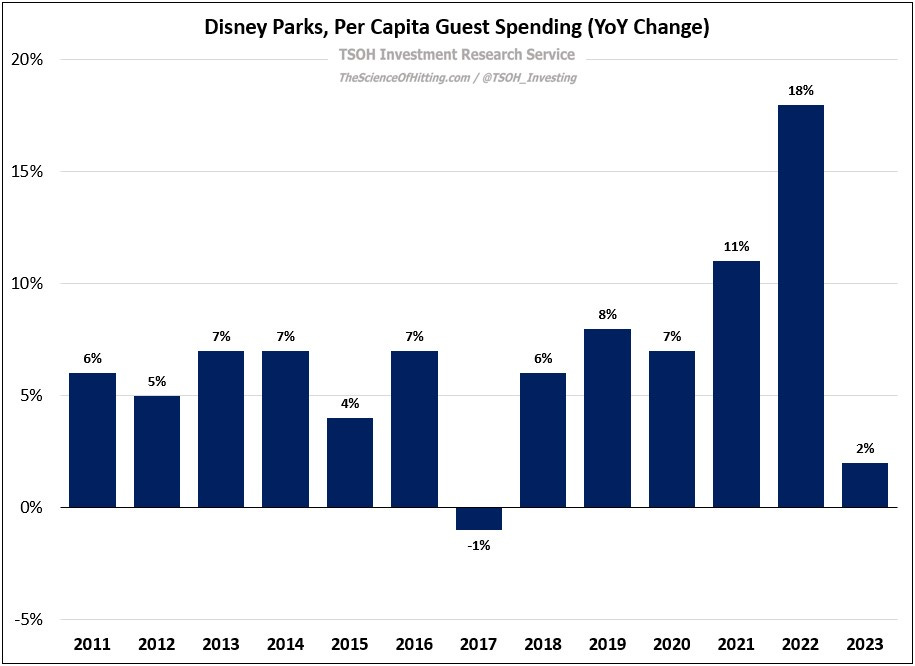

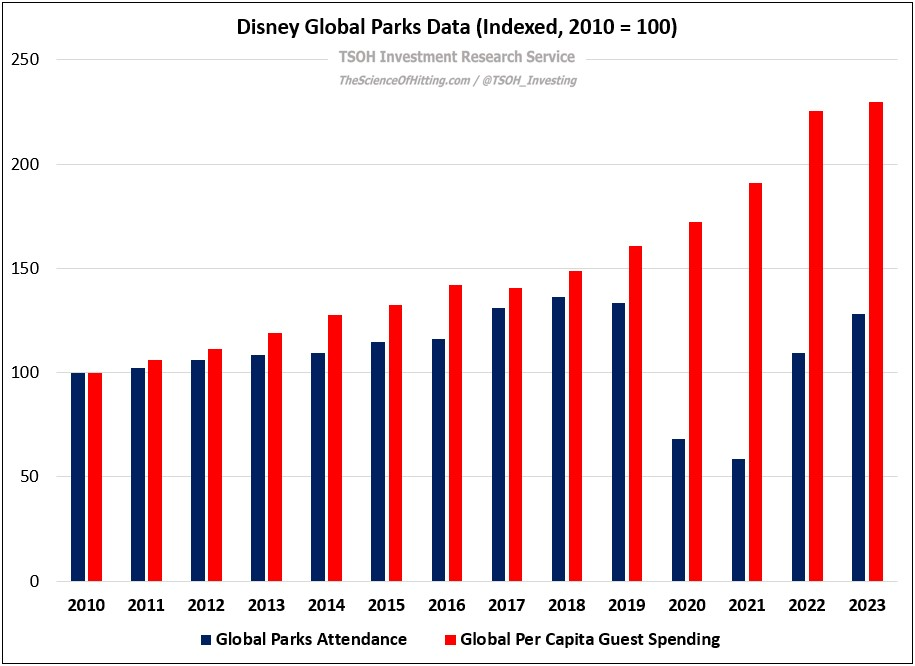

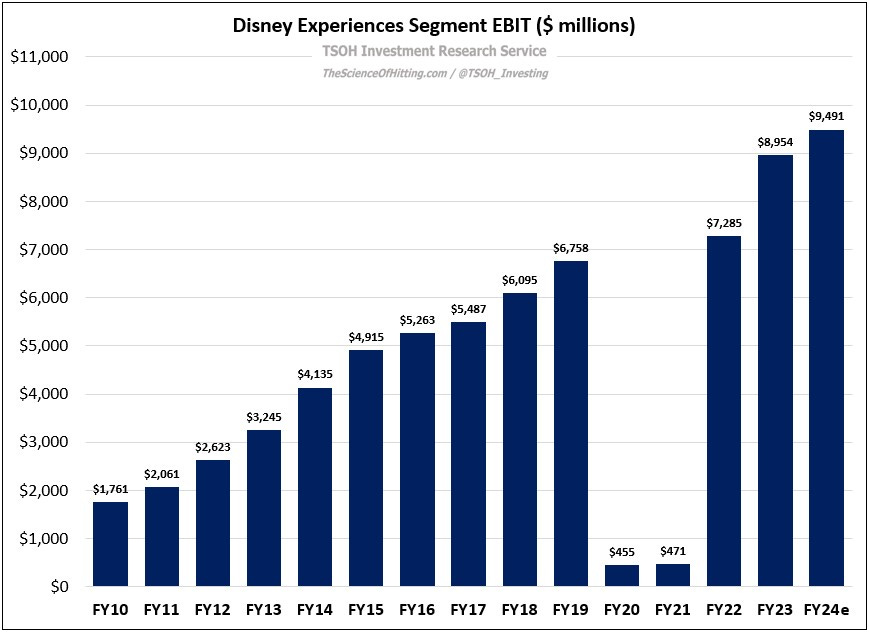

The final three charts are related to the Experiences segment (and for the first two charts, specifically Disney Parks). As you can see, per capita guest spending continued to be a tailwind in FY23, albeit at a lower level from the unsustainable pace that was reported in FY21 and FY22. The Parks business also benefited from an ongoing pandemic-related recovery, with global attendance climbing nearly 20% YoY in FY23 (returning closer to the pre-2020 trend). As discussed in “Turbocharged”, Experiences will continue to play an important financial and strategic role at The Walt Disney Company.

I hope that everybody had an enjoyable holiday weekend!

I’ll be back tomorrow morning with an update on Airbnb.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.