DG: Short-Term Stumbles

From “We Went Where They Ain’t”:

“The importance of ‘conveniently located, small-box stores’ cannot be overstated. A major part of Dollar General’s success has been attributable to its small town focus. As noted in the annual report, roughly 75% of DG’s stores are in towns with less than 20,000 people. These are the kind of places where the economics may justify an 8,500 square foot DG box, but not a 180,000 square foot Walmart Supercenter. Finding pockets throughout the country where Dollar General can effectively serve its customers, in those places where big box retailers cannot, has been a key part of the company’s real estate strategy for many years; as David Perdue, the CEO of Dollar General from 2003 to 2007, once put it, ‘We went where they ain’t’.

For the people living in these towns, Dollar General is a great solution for their day-to-day shopping needs - and one that becomes even better over time as initiatives like NCI and DG Fresh, along with store remodels to add coolers for refrigerated and frozen foods, improve DG’s supply chain and merchandising capabilities. Customers can quickly pop in and get what they need at good prices, particularly relative to what they pay at a C-store or a local mom & pop (‘most shoppers stop by a few times a week for a handful of items they need that day’). The business mix reflects this focus on price and convenience: nearly 80% of DG’s sales are attributable to consumables like toilet paper, frozen pizza, toothpaste, and beer (as noted at the 2016 Investor Day, sub-$5 products account for ~75% of DG’s sales, with an average transaction value of ~$11). Dollar General competes - and wins - by delivering a balance of value and convenience to consumers in small town America (‘succeed in small markets with limited shopping alternatives’).”

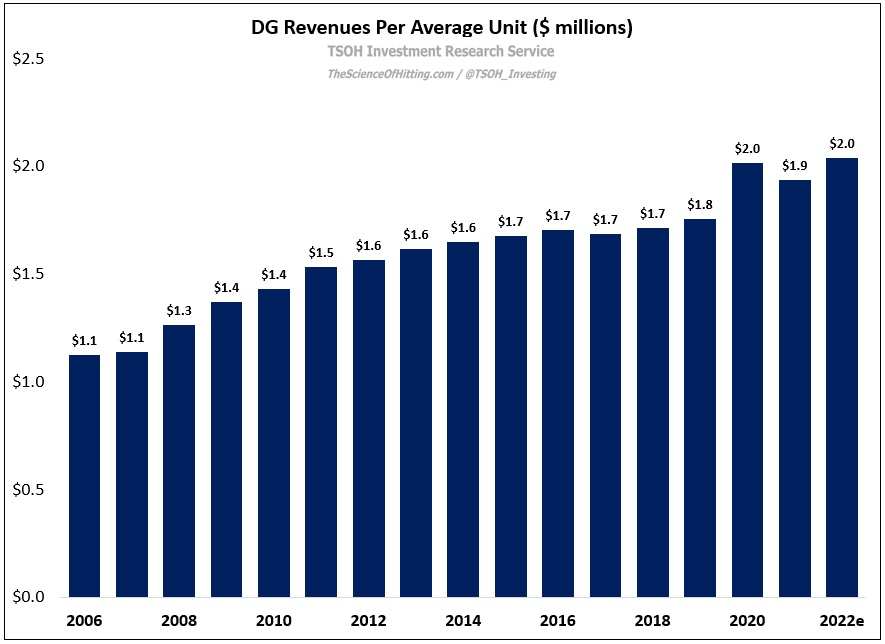

On Thursday, Dollar General reported its Q3 FY22 financial results; while the company is navigating short-term headwinds, most notably as it relates to gross margins, the year to date results offer further evidence that DG is well positioned for the years ahead. Strategic initiatives like NCI and DG Fresh are improving the operating efficiency and customer value proposition in its stores, while also providing white space for continued unit growth (core DG banner and new concepts / geographies). While the FY22 P&L has proven messier than expected a few quarters ago, I think that’s immaterial when viewed through the proper lens; Dollar General continues to hold a strong hand, and I believe it will continue to win its fair share of customer spending.

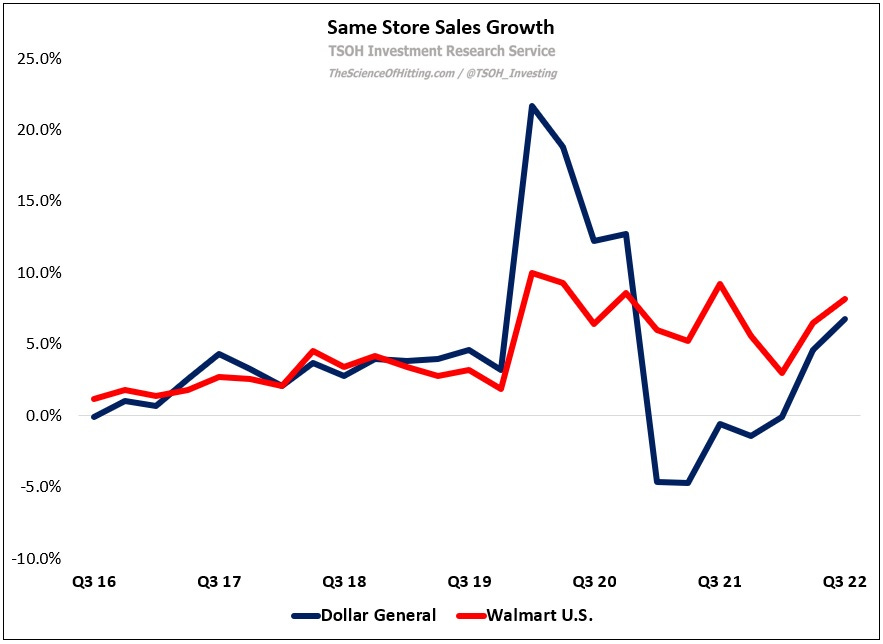

In Q3, Dollar General reported a 7% increase in same store sales, which was largely attributable to a higher average ticket (alongside a “modest” increase in customer traffic, but with fewer items per basket). Much like we’ve seen over the past 12-18 months, this outcome reflected strong growth from Consumables, offset by a decline in the Non-Consumable categories (most notably Apparel, which has reported double digit YoY declines in each of the past six quarters). This outcome, in my mind, is a good reminder of DG’s core value proposition: it’s a rural, small box grocer that earns its keep by offering consumers a compelling balance of value and convenience.

DG’s Consumables revenues were +14% YoY in Q3, in-line with the mid-teens growth that Walmart U.S. reported in food & beverage this quarter; the commentary at both retailers suggests growth was overwhelmingly driven by pricing (inflation), with unit volumes roughly flat YoY. (As you can see below, the comps normalization that I wrote about in Q2 continued this quarter.)

I think the relative results at DG and WMT speak to the importance of the two variables called out above (DG’s convenience and value). In a tough macro environment with significant cost inflation, you can appreciate why Walmart’s everyday low prices resonate with consumers. The fact that DG has been able to roughly keep pace with Walmart’s growth during a period like this is a testament to their unique value proposition; DG doesn’t necessarily have the lowest prices, but their customers also value convenience, which helps to level the playing field (with an average ticket of less than $15, you can understand why someone might be willing to pay another $1 - $2 to avoid ~15 minutes of extra driving / shopping time on their way home from work).