DG: Widening The Moat

In “We Went Where They Ain’t”, the Dollar General deep dive published in June 2021, I concluded with the following: “I believe Mr. Market has some doubts about Dollar General’s ability to grow beyond ~25,500 units and / or questions the sustainability of the business and its economics at maturity. I’d argue the market has held some version of this belief for much of the past five years, which is why the stock trades at a pretty large discount to retailers like Costco. Personally, I think that conclusion has been, and continues to be, too pessimistic. For that reason, I will make DG a 5% position tomorrow.”

The company’s Q2 FY22 financial results, which were reported on August 25th, were largely as expected. DG continues to see strength across its bread and butter Consumables business, with sales up 13% YoY. This solid result was offset by ongoing pressure in the Non-Consumable categories (Home, Seasonal, and Apparel), which have faced tough comparisons since the early days of the pandemic, along with current pressures from a difficult macro environment for DG’s core customer. In total, DG’s Q2 sales were +9% YoY, to $9.4 billion, driven by a roughly equal contribution from comps (+4.6% in Q2) and new unit growth. As a result of the company’s strong first half performance, management has updated their FY22 guidance; specifically, they increased the expected revenue growth guide by ~75 basis points (to +11% YoY growth), reflective of a ~100 basis point increase in comps (expected to increase 4.0% - 4.5% in FY22), partially offset by slower than expected unit growth due to ongoing delays in permitting and the receipt of construction materials needed for new stores. Even with the (slight) adjustment lower, DG still expects to add >1,000 net new units in FY22.

When viewed relative to the results at Walmart U.S., we can see that the past few years have been a roller coaster for DG. The two companies, which reported roughly similar same store sales (SSS) growth before the pandemic, began to diverge in early 2020. This was to DG’s benefit at first, but then it reversed (when DG faced tough prior year comps and didn’t meaningfully participate in the broader retail industry tailwind in certain discretionary categories like furniture and TV’s). Now, both companies are starting to (slowly) return to historic comp patterns, with each retailer benefiting in the most recent quarter from their reliance on serving core customer needs in Consumable categories like food & beverage and other essentials (along with the sizable top-line benefit from the pass-through of input cost inflation).

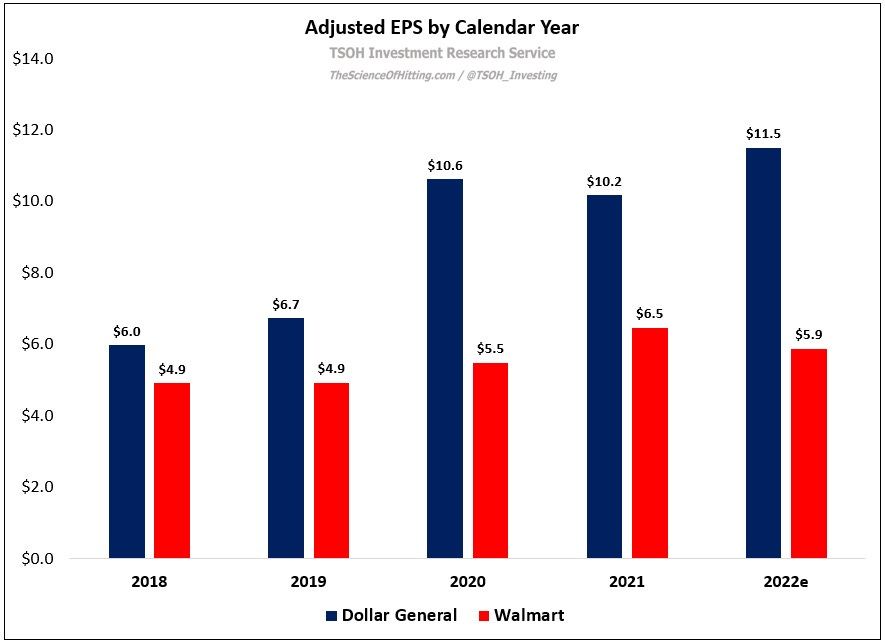

The one notable ongoing difference is DG’s resilience down the P&L; while Walmart is working through excess inventories in some discretionary categories that contributed to its 2021 top line outperformance, DG is largely immune to those pressures. This is most evident when looking at profitability: whereas DG expects 12% - 14% EPS growth in FY22 (with a four point benefit from a 53rd week), Walmart expects EPS to decline 8% - 10% in FY23 (its current fiscal year). And as we zoom out and look across the past three years for a pre-pandemic comparison, the numbers are revealing: in FY22, DG is likely to earn ~$11.5 per share, roughly 70% higher than what it earned in FY19. Walmart, by comparison, is likely to earn ~$5.9 per share in FY23 – roughly 20% higher than its FY20 EPS (ended 01/31/2020).

There are a few reasons for these divergent outcomes, some of which are specific to COVID anomalies / timing (current EBIT margin profiles relative to pre-pandemic) and some of which speak to longer-term trends (outsized unit growth at DG, a larger impact from repurchases, etc.). The broader point I’m trying to make is that DG has a cleaner, and in my opinion better, hand than many of its retail peers. With the benefit of hindsight, I’d argue the results over the past three years are a telling example of why I think that’s the case.

Family Dollar: A Resurging Risk For DG?

As discussed in the deep dive, one of the primary attributes that attracted to me to DG was its real estate strategy (“we went where they ain’t”), which is tightly intertwined with its customer value proposition and business model. That said, DG still faces competition, most notably from big box retailers like Walmart and other small box retailers like Family Dollar (“a turnaround that hasn’t turned”). As it relates to competition from Family Dollar, I think that this comment from Dollar Tree’s Q2 FY22 press release deserves our attention: