DG: "No Noise, No Distractions"

From “We Went Where They Ain’t”: “For the people living in these towns, DG is a great solution for their day-to-day shopping needs - and one that becomes better over time as initiatives like NCI and DG Fresh, along with store remodels to add coolers for refrigerated and frozen foods, improve DG’s supply chain and merchandising capabilities… DG competes - and wins - by delivering a balance of value and convenience to small town America.”

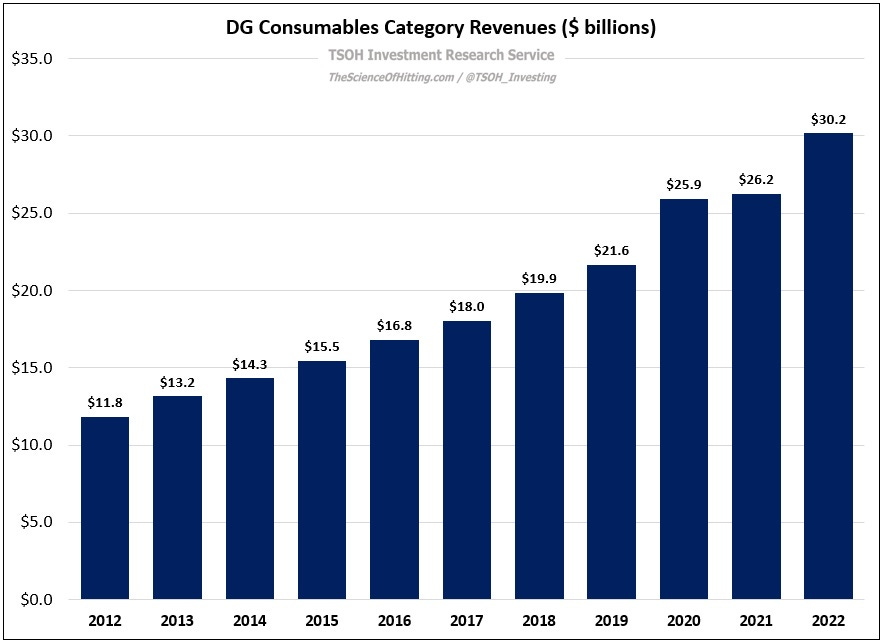

As discussed in that deep dive, I believe the best way to think about DG is as a (primarily) rural grocery store. The majority of its revenues are attributable to the Consumables category, which includes day-to-day consumer needs like frozen foods, beer, toiletries, and cleaning supplies. The combination of three factors - what they sell, how they sell it (convenience plus everyday low prices), and who they sell it to – underpins DG’s sustainable competitive advantages (to be clear, that alone isn’t sufficient; it’s supported by ongoing investments to continually improve the model). As shown below, DG’s Consumables category has been its primary driver: at $30.2 billion in FY22, category revenues have grown ~10% annualized over the past decade.

On the other hand (as I’ve discussed previously), DG’s experience in the Non-Consumable categories (seasonal, home, and apparel) has been quite volatile since the onset of the pandemic. Long story short, DG experienced significant tailwinds in these categories during the early days of the pandemic (helped by U.S. government stimulus payments), but the ensuing periods have been choppy. Overall, the outcome has been satisfactory: in 2022, revenues from the Non-Consumable categories totaled $7.7 billion – 26% higher than the $6.1 billion generated in FY19 (pre-pandemic levels).

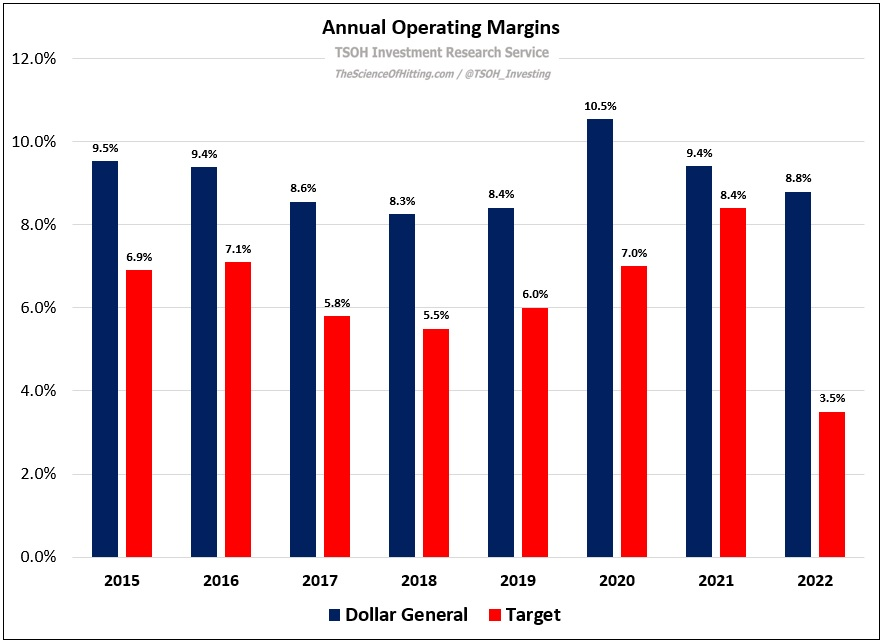

The relative size of the two segments speaks to the core focus of DG’s business – a key factor that influenced my decision to invest in the company back in June 2021. While some notable large U.S. retailers, like Target, are navigating a tumultuous environment as we emerge from the pandemic, DG is much less exposed to these pressures (that said, they are not immune).

As it relates to the question of normalized unit volumes, margins, and profitability, this is an important consideration that can greatly influence the long-term value of these enterprises (said differently, I think it explains why TGT’s stock has been much more volatile than DG’s in the past few years).

2022, 2023, and Beyond

By some measures, 2022 looked like a typical year for DG: comps increased 4% and revenues increased 11%, both of which are roughly in-line with reasonable long-term growth expectations for the business. Where it diverged from expectations was on profitability and free cash flow: diluted EPS only increased 5% YoY to $10.7 per share (with growth entirely due to the combined impact of repurchases and a 53rd week), with FCF generation of just $424 million (to put that in context, FCF over the previous three years averaged ~$2.0 billion). Those outcomes were due to three primary factors: margin headwinds, inventory pressures, and outsized capital expenditures.