DG: Flight to Value

Dollar General: Flight to Value

Recent DG Posts: Deep Dive, Q2 FY21, Q3 FY21, Q4 FY21

Following difficult quarters at Walmart and Target, which collectively generate more than half a trillion dollars in annual U.S. retail sales, Mr. Market wasn’t in the mood to take a “wait and see” approach with the rest of the industry.

As a result of cost inflation (COGS and SG&A), supply chain disruption / excess inventories, and the headwinds that surface as a result of business mix shifts, investors concluded that the proper response for the U.S. retailers who had yet to report their early calendar 2022 results was to act now (sell) and ask questions later. But when Dollar General (DG) reported its Q1 results on Thursday, most notably the reiterated FY22 EPS guide, management indicated that DG is somewhat insulated from the pressures that retailers like WMT and TGT are navigating. DG’s points of differentiation, which I first wrote about in June 2021 and which were on display in Q1, underlie my continued belief that this is a high-quality business with a bright future.

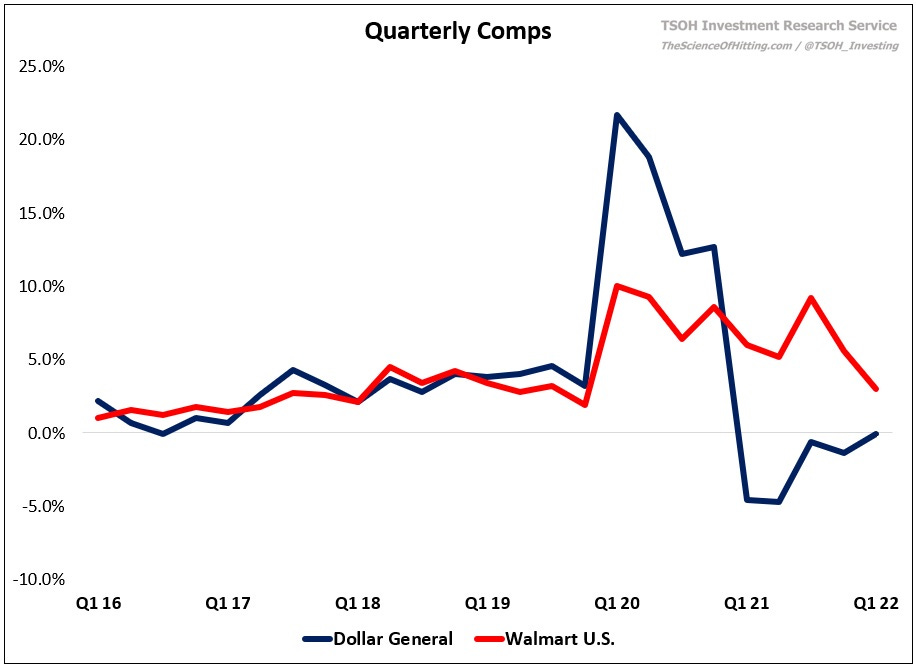

For the quarter, same store sales at DG were roughly flat, with a decline in traffic offset by inflation-driven growth in average ticket. Given what we’ve heard from other retailers, it wasn’t too surprising to learn that comps in seasonal, apparel, and home were all negative in Q1 (collectively -15% YoY), offset by growth in consumables (+5%). To me, this data suggests that the U.S. consumer faces real headwinds as a result of high inflation (another factor, as we’ve seen at companies like Disney and Airbnb, is some shift in consumer spending back towards services / experiences). That conclusion also suggests that DG, with >75% of its revenues from consumables, is better positioned to navigate through this period than some of its peers. (Target’s Q1 FY22 call: “In Apparel, Home and Hardlines, we saw a rapid slowdown in sales trends beginning in March, when we began to [lap] last year's stimulus payments. While we anticipated a post-stimulus slowdown in these categories and we expect the consumer to continue refocusing spend away from goods and into services, we didn't anticipate the magnitude of that shift… this led us to carry too much inventory, particularly in bulky categories, including kitchen appliances, TVs and outdoor furniture.”).

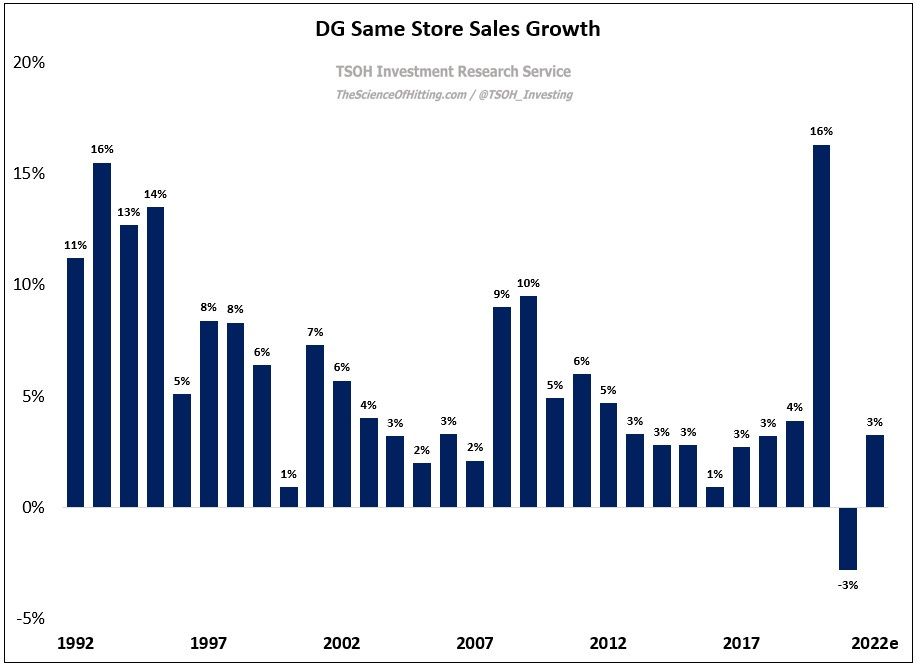

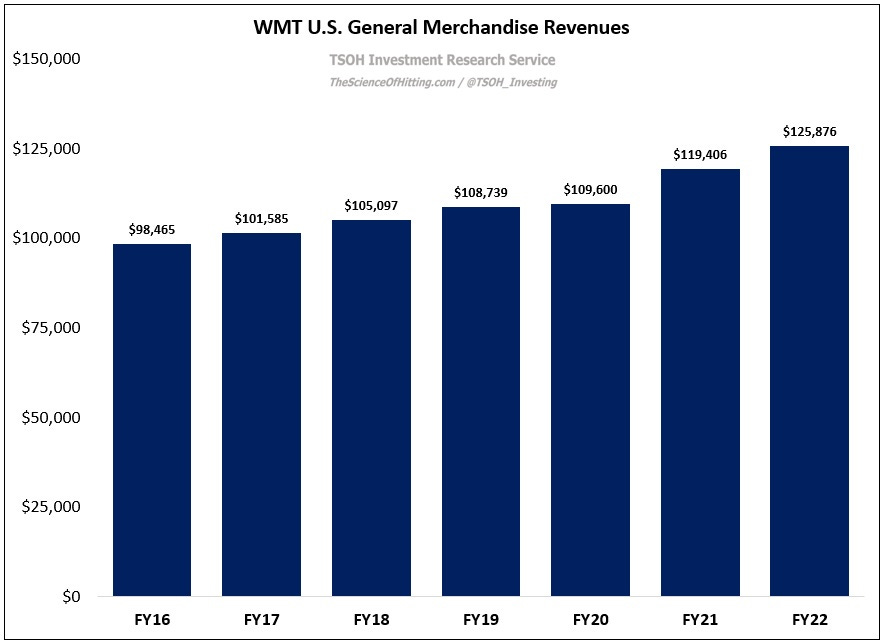

On a trailing three-year (stacked) basis, DG’s comps accelerated sequentially by ~250 basis points (from +14.5% to +17.0%). For FY22, management expects SSS growth of 3.0% - 3.5% (the prior expectation was +2.5% for the year). While I still think it’s an open question whether we’ve fully lapped the pandemic-related benefits (stimulus), I’d note that the cumulative lift at DG from FY20 – FY22e is only in the mid-teens (call it ~750 basis points higher than what you’d expect in a normal environment). To put that number in context (~750 basis points), April 2022 U.S. retail sales were 15% - 20% higher than the pre-pandemic trendline. Said differently, if retail becomes another industry where the pandemic tailwind / pull-forward proves short-lived (AUV reversion), I think DG is less exposed than some other U.S. retailers. (As shown below, Walmart’s U.S. General Merchandise revenues increased by ~$16 billion over the past two years – or about 50% higher than the cumulative dollar growth generated in that category from FY16 – FY20).