Waving The White Flag

DG, DLTR, and "Strategic Alternatives"

From “Dollar General: The Road To Recovery” (March 2024):

“My views on Family Dollar are unchanged: there have been numerous attempts to revive the banner over the past 5-10 years, but success has proven elusive… The inherent difficulties of a retail turnaround, along with the incentives for stakeholders like Dreiling and Mantle Ridge, suggest a more likely answer is one that will focus on minimizing any further damage.”

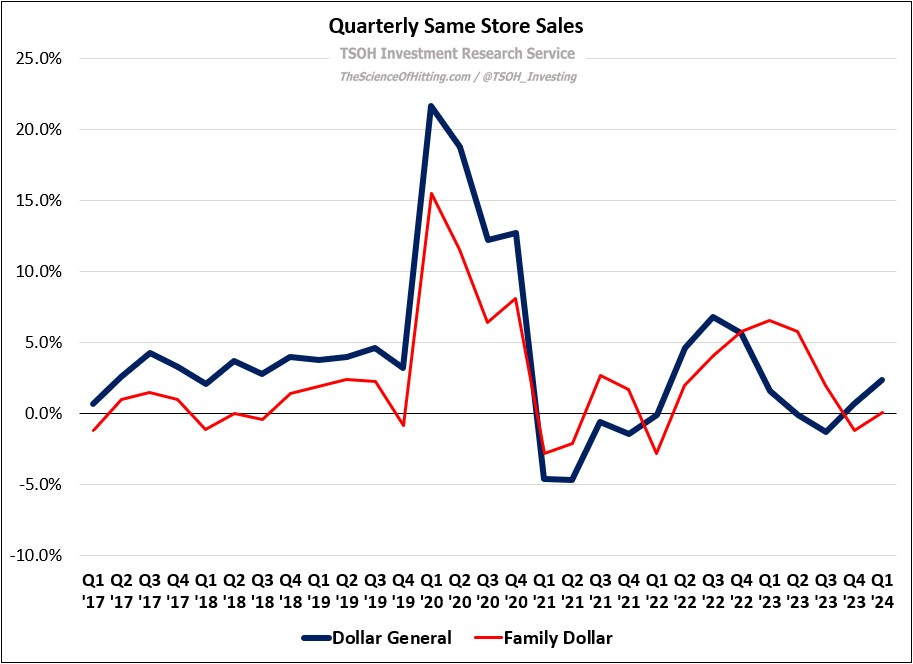

On June 5th, in conjunction with the release of its Q1 FY24 results, Dollar Tree announced that further strategic actions are being considered at Family Dollar. As a reminder, we are only six months removed from the “Portfolio Optimization Review”, which concluded with the decision to shutter >10% of FDO’s stores. The pace of these developments, along with management’s recent commentary, signals they are finally ready to wave the white flag on Family Dollar. ( “The decision to explore strategic alternatives includes evaluating how each banner might appeal to different sets of owners.”)

The specifics of how that will occur are unclear at this time. What we can confidently say is that it will not fetch a price tag anywhere close to the ~$8.5 billion paid in 2015. Even if they end up receiving pennies on the dollar, I still think that there is a strong argument for this decision. I’m biased as a Dollar General shareholder, but I’d also say that this is an encouraging move from the perspective of someone who remains open to owning Dollar Tree. That speaks to the difficulty of the task at hand for Family Dollar, as well as the interesting long-term opportunities at the namesake banner as they run the Dollarama playbook. In short, I think this is a positive long-term development for owners of DG and DLTR. (Note that FDO’s quarterly comps exclude the impact from the more than 500 stores that were closed during Q1 FY24.)