"Compete With Anyone"

An update on Comcast

From: “Peacock: From DTC To DOA?” (May 2021): “I don’t think [Comcast] management is serious about making the tough decisions that are necessary for any shot at real success in the global DTC business… That said, as time passes, the odds of a big strategic change - particularly at NBCU - seems to be declining. Simply put, there’s a lack of urgency from management.”

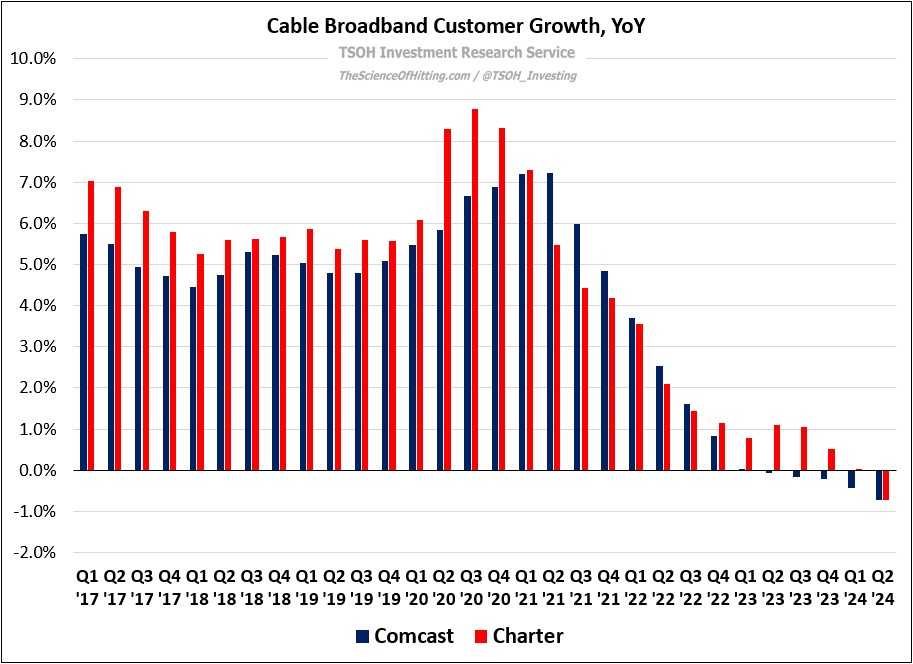

We’re in the middle of a difficult period for the leading Cable companies, exacerbated by the expiration of certain government broadband subsidies (particularly for Charter). Comcast and Charter reported their Q2 FY24 results last week, and each saw their broadband customer base decline by 0.7% YoY – the first time they’ve each reported YoY broadband volume declines.

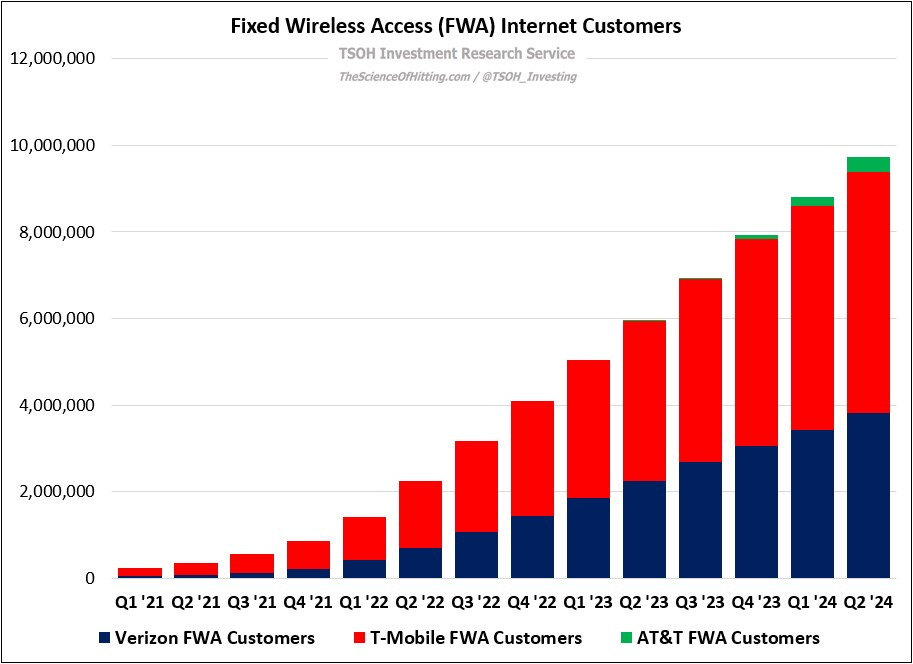

I won’t rehash the causes of that outcome - a frequent topic of discussion at TSOH for Comcast and Charter / Liberty Broadband - other than to note that the fixed wireless (FWA) businesses at T-Mobile, Verizon, and AT&T will collectively surpass ten million customers in Q3 FY24, a figure that is inclusive of >900,000 sequential net adds per quarter, on average, over the past two years. Naturally, Cable investors are keen to learn when this will slow, with particular focus on how T-Mobile and Verizon will think about this business as they approach their original FWA volume targets (Charter CEO Chris Winfrey: “It isn't a question of if, it's just a question of when.”)

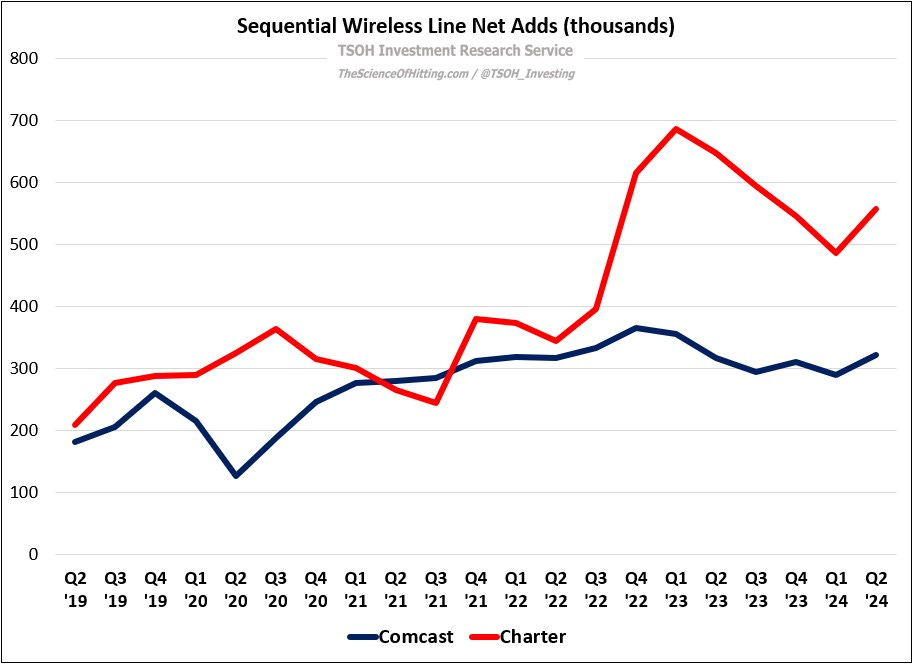

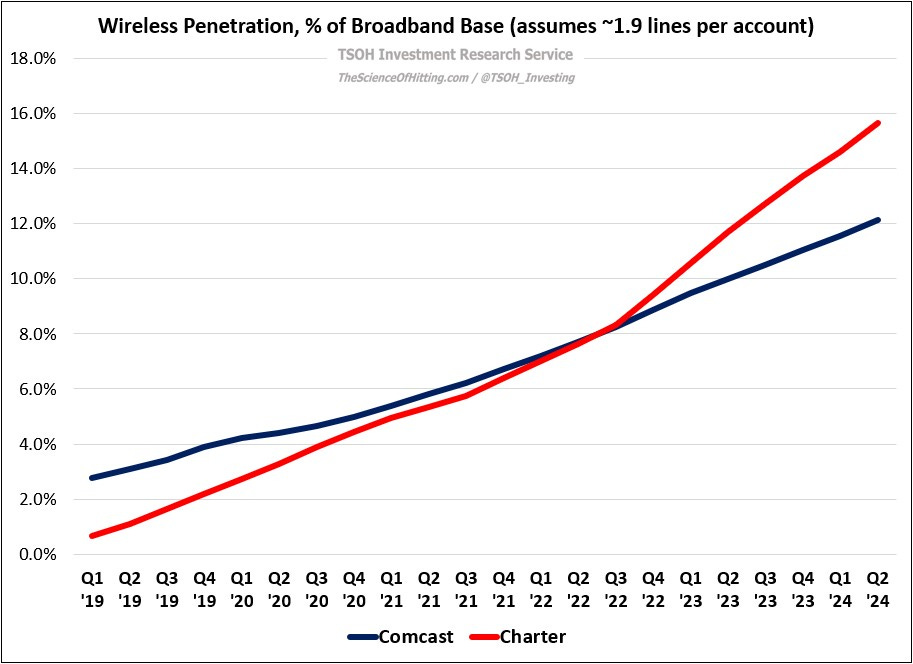

The other side of connectivity for the Cable companies is wireless. The trends in this part of the business remain consistent to prior quarters, with Charter taking a more aggressive posture to wireless line net adds / connectivity bundles than Comcast. Given what each of these companies have said about the economics of their MVNO with Verizon, Charter’s approach continues to strike me as the logical thing to do. Said differently, I remain baffled why Comcast continues to lag Charter on this metric by such a wide margin. As you can see below, this has led to a growing gap between the two on wireless penetration (as a percentage of their broadband customer base).