"We Take A Long-Term View"

Charter's December 2022 Investor Day

The focus of today’s post is Charter’s recent Investor Day event - but before we talk about where the company intends to go in the years ahead, let’s take a step back and review how they got to where they currently find themselves.

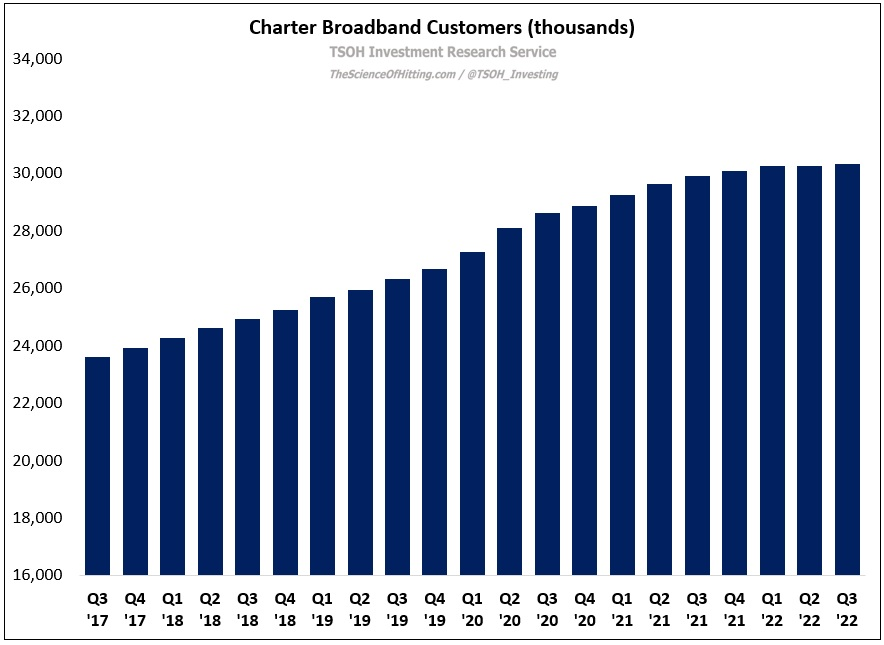

As you can see below, Charter ended Q3 FY22 with ~30.3 million broadband customers, a trailing five-year CAGR of ~5% due to a combination of home passings growth and an increased penetration rate (up from ~48% to ~55%).

Over that five-year period, monthly revenues per residential Internet customer increased by ~4% per annum, from ~$53.3 per month in Q3 FY17 to ~$65.6 per month in Q3 FY22. As a result, residential Internet revenues in Q3 FY22 were ~$5.6 billion – up nearly 60% compared to the ~$3.6 billion reported in Q3 FY17 (~9% CAGR). During this period, there was a balanced and consistent growth algorithm for the core business (broadband). In addition, Charter returned more than $60 billion to its shareholders, with a roughly 45% reduction in the diluted share count since the start of 2017. Long story short, Mr. Market liked this setup - and priced the equity accordingly.

That now feels like a bygone era.

In addition to significant external impacts (COVID hangover, reduced mover churn, etc.), Charter faces heightened competitive threats from fixed wireless (FWA) and fiber. As opposed to the >1 million annual broadband net adds reported on average over the past five years, the question now is whether Charter can grow at all. (And when the narrative flipped, the levered equity model once applauded by Mr. Market quickly became a big question mark.)

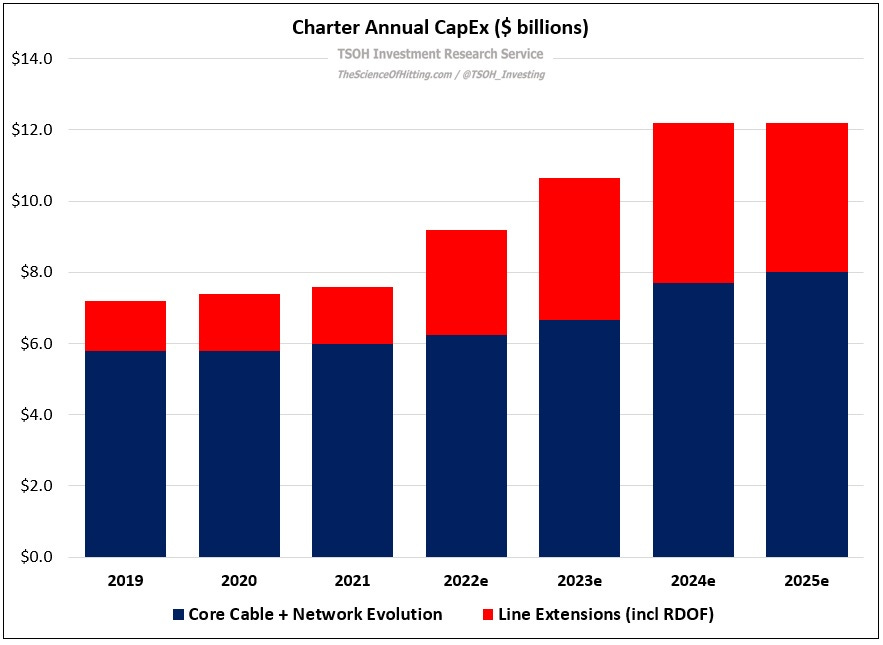

That brings us to Charter’s December 2022 Investor Day. The biggest announcement at the event was the plan for the next step in its long-term network evolution: over the next three years (by YE2025), Charter plans on investing ~$5.5 billion, or ~$100 per home passed, to ensure it can deliver 5:1 Gbps speeds to >85% of its footprint. As shown below, this plan assumes a material step-up from the CapEx spend reported in recent years, for both core CapEx / network evolution and line extensions (the latter includes RDOF, which I’ll discuss in a moment). This will result in a meaningful headwind to FCF, with a corresponding impact on repurchases.

In today’s write-up, my goal is to weave in discussions from the Investor Day to address three key questions for the Charter investment thesis: (1) What is the long-term growth strategy for this business? (2) Can Charter navigate competitive threats from FWA and fiber? (3) What are reasonable financial expectations for this business as we look out over the next five years?

Charter’s Connectivity Strategy

At the end of October 2022, Charter introduced a new offering called Spectrum One. As I discussed in “Back On Offense”, it’s a bundled product (broadband and wireless) that perfectly encapsulates Charter’s strategic vision: deliver high-quality connectivity services at attractive prices to a large number of customers (the >50 million households in its footprint).

In terms of telling a story, the convergence playbook has come at a convenient time for the company (when net broadband growth has stalled to previously unseen levels). While I don’t think that investors should completely gloss over that fact, I also believe that it is somewhat coincidental: as I discussed in “Cable’s Wireless Moment”, the decision to pursue this business has been years in the making. I think management sees a compelling opportunity with Spectrum One and is right to press on the gas. (“I wouldn’t be surprised if both pursue a more aggressive pricing strategy, even if it’s a short-term hit to wireless profitability; they should be laser focused on increasing the number of bundled connectivity households / accounts.”)

But despite the significant growth reported in the wireless business over the past few years, less than three million customers currently use Charter’s broadband and wireless services (~5% of homes passed). The opportunity is to push that to multiples of its current size over the next decade.

The question is how to get there; what needs to be changed / improved to make that vision a reality? The answer presents one of the complications I have with this investment. One of my main takeaways from Investor Day is that management holds a somewhat conflicting view of its current position: on the one hand, they argue they offer best-in-class standalone offerings (in terms of service quality) on broadband and wireless - not to mention the additional value / savings offered through Spectrum One; on the other hand, they are preparing for significant incremental CapEx outlays over the next three years to further improve the core asset base. My sense is that the market is unconvinced that they’re truly playing offense; said differently, is this incremental investment maintenance CapEx or growth CapEx?

In terms of the business results, the key test will be whether Charter can reaccelerate broadband growth while quickly expanding the wireless base. I think that’s a likely outcome (one that will be helped by the incremental network investments outlined at Investor Day); that said, if the broadband business remains stuck in the mud, it would suggest my thesis is flawed.

Converging Competition

I’ve spilled enough ink on the competitive threat presented by fixed wireless, so let’s spend some time on fiber. A good place to start this discussion is with the FCC’s “Measuring Broadband America” report (published in December 2021), which included the following data for DSL, cable, and fiber offerings.